Being assessed for a home loan can sometimes feel a bit like a police interrogation – all that the paper-based third degree is missing is a swinging overhead lamp in a small, dingy room!

But banks want to know absolutely everything possible about your expenses to ensure that you’re in a position to service your mortgage.

For some would-be property buyers, there can be a temptation to fib about what you spend each month on rent, bills, credit cards and lifestyle expenses. But lenders can and will catch you out.

And if you accidentally underestimate, you might do yourself a disservice by misrepresenting your position.

So, why is it important to be accurate about your living expenses? And how do banks calculate it? Let’s take a look.

What they look at

Some lenders will take your estimate of your living expenses and, provided it seems realistic and on par with people in your circumstances, that will be enough.

Banks use two different measures to see if what you’ve said you spend stacks up.

One is called the Household Expenditure Method, which is based on the cost of 600 different goods and services in the Australian Bureau of Statistics’ Household Expenditure Survey.

The second, which is less and less widely used, is the Henderson Poverty Index.

It’s a calculation of the household expenses of a family of two adults and two children but can be adapted to suit different household structures.

But increasingly, banks will ask you for evidence of your household expenditure.

They might want to see six or more months’ worth of bank statements. They might ask for receipts for your utilities and rent.

And I’m seeing more and more query items on savings and credit account statements that want to know more about.

What you should consider

Your living expenses are an indication of what sort of person you are financially.

Imagine that you were going to lend a huge chunk of money to a total stranger. What would you look at? What things might bother you?

If they were swiping their card at a casino every other night or spending a small fortune on online shopping, would that bother you?

If they regularly went over their credit card limit or racked up huge mobile phone data bills every month, would you give pause?

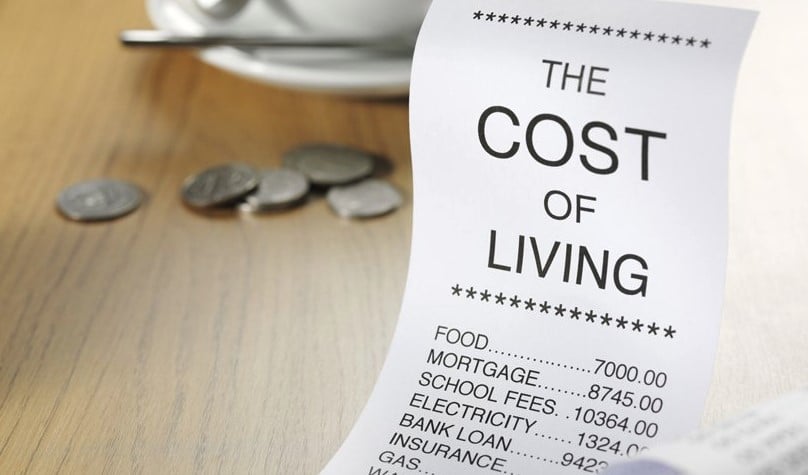

Your living expenses include reasonable costs, like your rent, power, water and gas bills, groceries, childcare, healthcare and insurances, expenses for your children, essential clothing and transport.

It also includes discretionary or non-essential items, like alcohol, tobacco, entertainment, travel, shopping and the like.

Banks want to be safe

Mortgage lenders are required by law to ensure they do business with people who are reasonably able to pay their home loan repayments.

This sounds like a given, but it’s up to the bank to be confident that what you spend now – and will spend in the future – isn’t going to jeopardise your ability to be a responsible borrower.

The banking royal commission shone a light on some undesirable practices by some lenders and put pressure on the industry as a whole to lift its socks up.

And that’s a good thing for everyone – good borrowers are a good thing for everyone.

Mortgage defaults and repossessions have ripple effects across property markets.

Too many of them can have dire consequences, as we saw in the United States in the Global Financial Crisis. So, it’s important that banks lend responsibly, and it’s important you hold up your end of the bargain.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.- Timing the Market vs. Time in the Market - July 15, 2024

- On Market vs. Off Market Listings: What’s The Difference - June 17, 2024

- Impact of Victoria’s Land Tax Hike on Property Investors - June 3, 2024