Victoria could be on the cusp of a mass exodus of property investors after the State Government whacked them with yet another hefty tax hike – the latest in a long line of revenue-raising measures aimed at landlords. It’s one of the greatest Australian heists and the Labor party didn’t even need a weapon.

This one, an overhaul of land tax, could be the straw that broke the camel’s back, with agents in other parts of the country, like Perth, Adelaide and southeast Queensland, reporting an influx of people who are fleeing the state, especially with the recent strong markets in each of those areas.

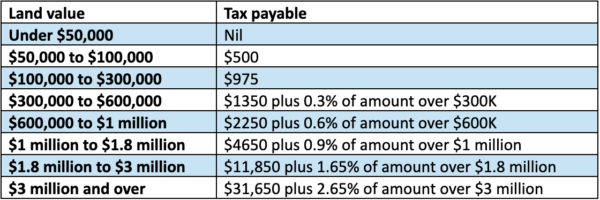

The sweeping changes see the tax-free threshold for land gutted from $300,000 previously to just $50,000. In addition, the government has increased the rate of tax payable and introduced yearly fees.

This is how the land tax situation now looks in Victoria.

Source: Victorian Government

The government expects to suck about $4.7 billion from landlords over the next four years by requiring them each to pay $1300 more a year on average.

For those with land worth just north of $1 million, which is a fair chunk of Melbourne’s detached dwelling stock, that extra amount jumps to about $1700 annually.

Plus, the drastic reduction to the tax-free threshold means 380,000 more landowners will be slugged with tax than before.

So, all up, it’s quite the cash cow for a government, crippled from a growing debt from their COVID mismanagement.

Not the first whack

Non-investors might look at the raw numbers and wonder what landlords are complaining about. A few hundred or a few thousand bucks here and there doesn’t seem earth-shattering.

This isn’t the first time that long-term landlords have copped a tax hike. Plus, rising property prices have pushed many into higher tax rates, called ‘bracket creep’. Back in 2016, the Victorian Government collected about $1 billion in land tax. This year, it’ll be in the vicinity of $6 billion – a mammoth difference in a relatively short space of time.

And remember, before Covid and the run of interest rate hikes, average annual rent price growth was fairly modest. So, those big extra expenses incurred by investors have outpaced income.

For many, other holding costs like council rates have also skyrocketed over the past decade. A slew of rental reforms have also created additional expenses related to compliance. Foreign investors pay some of the highest taxes in the country. Plus, there are half a dozen other ‘levies’ and special fees imposed on those who put their cash into real estate.

Now, on top of higher stamp duty from rising property prices and tens of thousands of dollars more paid in interest, comes this latest whack.

To put it into perspective, look at what happens in much of the rest of the country.

If you own land worth about $500,000 in New South Wales, Queensland or South Australia, you don’t pay any tax. In Western Australia, you’d get a bill for about $800.

Now, in Victoria, you’ll be stung to the tune of about $1900. That’s a stark difference.

You also have many families with “legacy” property’s owned by parents or grandparents and used by the family for holidays, now also falling under the land tax threshold with the “empty house” rule applying that sees another 1% of the capital improved value of the property, further added to your land tax bill.

Investors weighing up options

In recent reporting in the Australian Financial Review, one property manager alone lost 52 investor clients in the wake of the land tax changes, describing it as the “final nail in the coffin” for many, on the back of significantly higher interest rates, council rate hikes, sweeping tenancy reform and no progress on reforming stamp duty.

Victorians already pay more stamp duty on property purchases than any other Australian state.

When is enough enough?

And pundits have been warning for more than a year now that punitive reforms implemented by the government, plus the threat of more fees and taxes, was having a negative impact on investment levels in the state. That’s not a helpful scenario in the midst of a rental supply crisis.

The latest data from the Australian Bureau of Statistics shows about 31 per cent of new mortgages in Victoria went to investors in the backend of 2023, which was well below the national average of 36 per cent and miles away from the 40 per cent share in New South Wales.

After the land tax changes, accounting body CPA Australia declared Victoria the least attractive state for property investors.

And it warned that landlords will either pass on the cost to tenants in the form of rent increases or sell up and exit the market. Many would-be investors will steer clear and look elsewhere. All three of those scenarios spell bad news for struggling tenants.

A survey by industry group Property Investment Professionals of Australia last year found 25 per cent of investors in Victoria had sold one or more properties in the previous 12 months. Most attributed the decision to concern about rising taxes and other costs.

It might be safe to assume that more will follow them out the door in the year to come.

What should you do and what are some of our investors doing?

Any decision you make about your investments should be guided by careful consideration of your personal circumstances and your goals.

Some will pass on the cost. Some will evaluate whether the future returns of their asset justify all these increased costs. For a proportion of those, they’ll sell up and take their money elsewhere.

Geographic diversity in a property portfolio is a worthy consideration and there are some interesting things happening around the country.

This seems to be the single biggest impact on our Victorian investors. Yes, they still want to invest, they just don’t want to pay the absurd land tax impost thrust upon them, so many are divesting their Victorian assets and redeploying the capital in other states.

It’s a lot to weigh up. Speak with us about your situation and what your options might be moving forward.

Knowledge Hub Updates

Join 12,400 readers who already receive it.

- Timing the Market vs. Time in the Market - July 15, 2024

- On Market vs. Off Market Listings: What’s The Difference - June 17, 2024

- Impact of Victoria’s Land Tax Hike on Property Investors - June 3, 2024