Who would have believed it?

2021 is going to be a great year property, but if I had told you that six months ago or eight months ago you wouldn’t have believed me, would you?

Now I know some people think I’m an eternal optimistic, but I believe I’m realistic – especially now that I have the perspective of almost 50 years of investment experience.

Before I give you the reasons why I’m confident 2021 will be a great year for our housing markets, I want to make it clear that I recognise that even though we are out of the recession we are not out of the woods and there still is a lot of pain to be felt in certain industries and we definitely have headwinds both locally and overseas that will slow down our progress.

But let’s look at the evidence of why I think property values will be considerably higher at the end of 2021 than they are now.

1. The property market is too big to fail

During the challenging period of 2020 it was very clear that neither the government, the RBA nor the banks want property to fail.

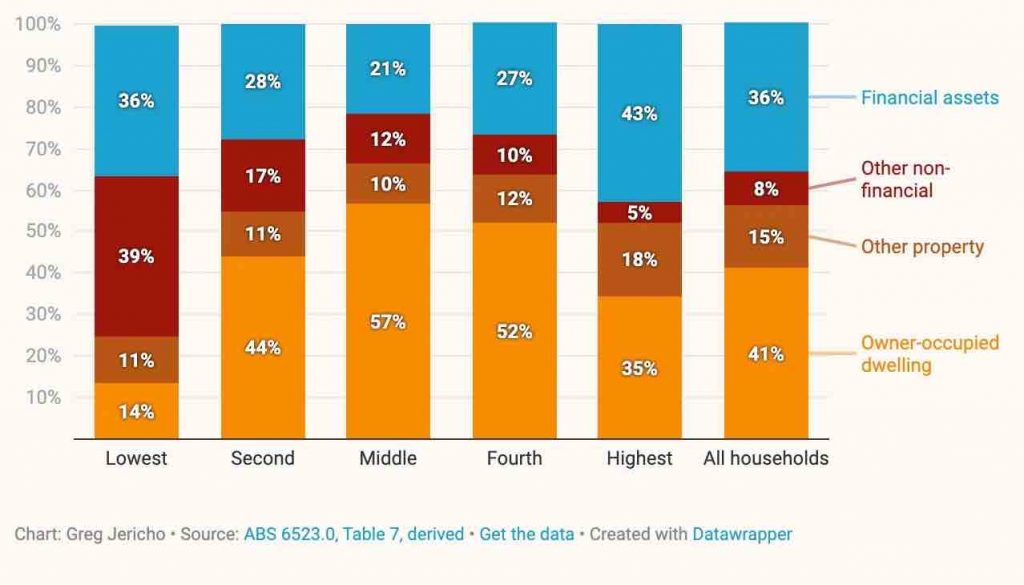

With more than half of household assets tied up in property and the family home makes up nearly 60% of the assets of median-wealth households, governments will always work to keep the market buoyant in a downturn.

We saw this after the 90’s recession and during the GFC when first home buyer grants for construction created a boom, and again now with the government homebuilder scheme and other grants creating a first home buyers’ boom.

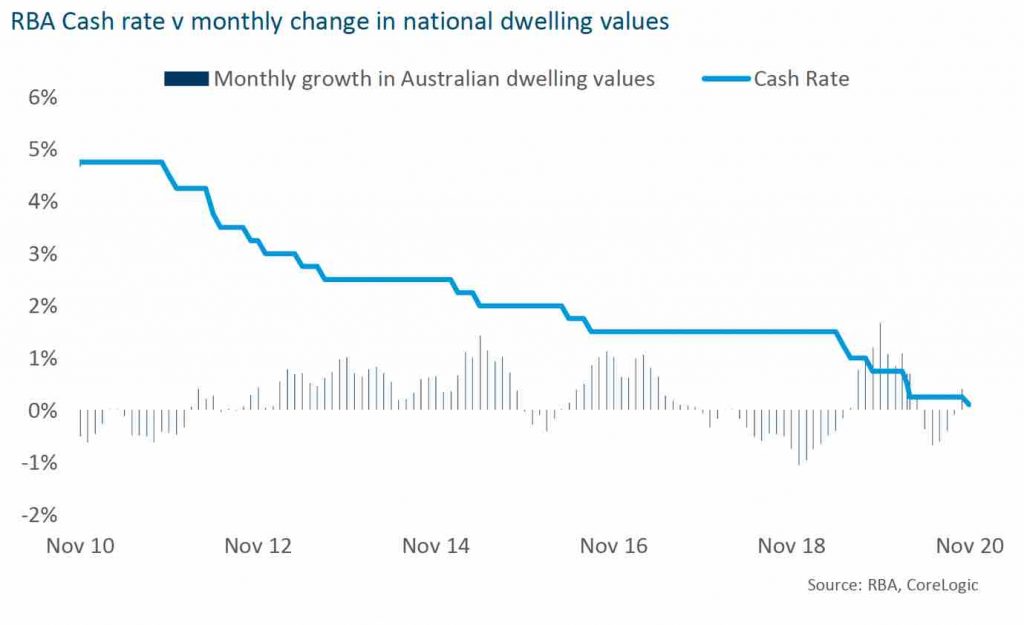

2. Historically low interest rates

Interest rates have been slashed by the Reserve Bank as it tried to grease the wheels of industry, create jobs and support our economic recovery.

These historically low interest rates mean people can borrow more, especially now that homeowners can get fixed-rate deals as low as 1.99 per cent per annum.

Similarly, property investors can hold onto their assets more easily than ever with the differential between income and outgoings being so low.

Of course in March 2021, when bank lending restrictions are loosened, investors and home owners will be able to borrow considerably more than they can today – in fact this may increase some people’s borrowing capacity by up to 20% – the results will give the property markets another significant boost.

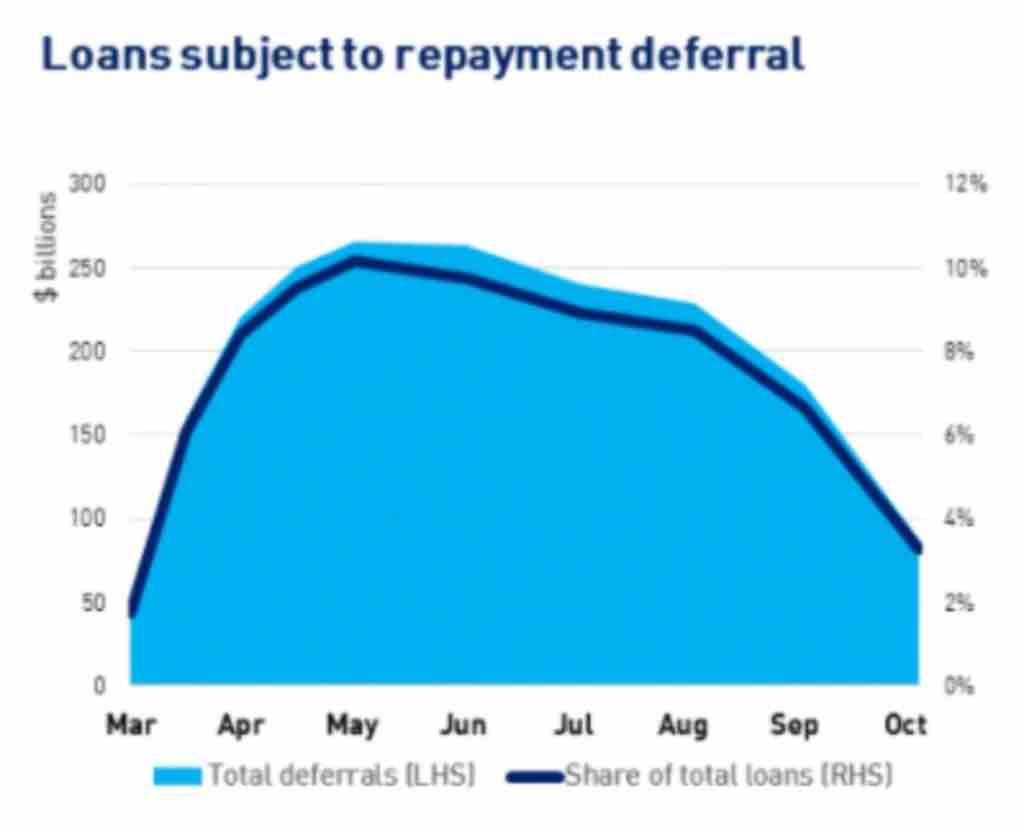

3. Mortgage holidays are under control

There’s no doubt that the economic fallout of coronavirus had many people concerned about their financial future.

You may remember earlier in the year the term ‘mortgage stress’ was bandied about in the media.

Some of the usual suspects were touting headlines that suggested up to one in five Australian households, a massive 20 percent, were in some sort of mortgage stress.

Nothing was further from the truth, with many Aussies kept in work with Jobkeeper payments and other stimulus measures.

At the same time the banks were willing to work with borrowers and provided favourable terms until they were able to return to paying their loan again.

The following chart shows loans subject to repayment deferrals have fallen significantly as our economy has picked up.

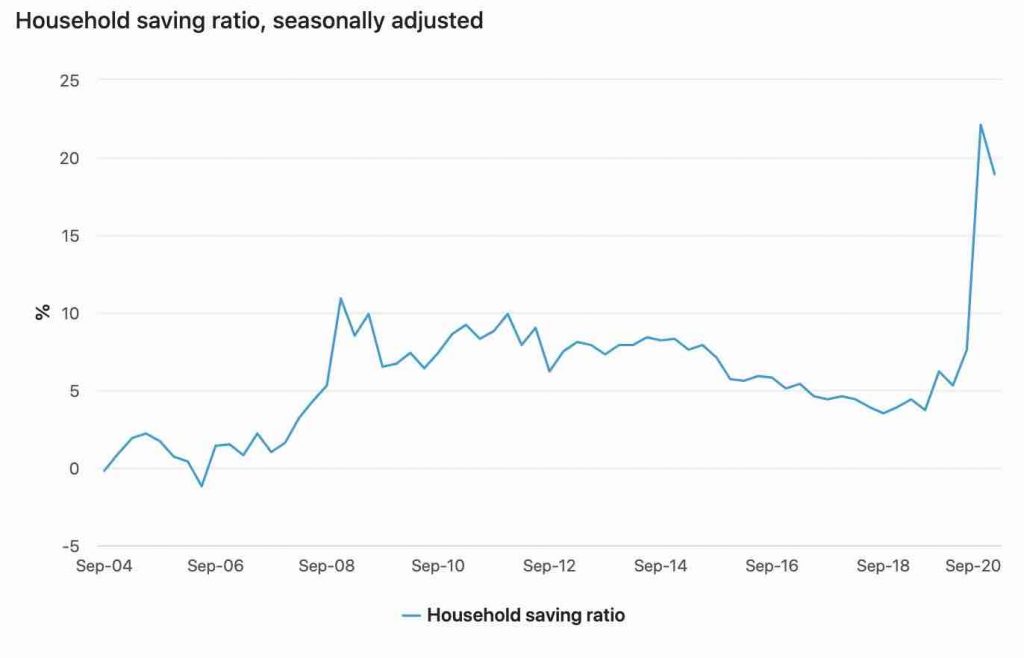

4. Household savings are strong

Although unemployment rose and wages growth is low, many workers who kept their jobs have rising disposable incomes thanks to the tax cuts in the recent federal budget.

At the same time many Australian households have stashed their cash, saving money by not being able to travel overseas or dine out as much.

Households have saved almost $119 billion over the past year, part of which could flow into property, pushing up prices.

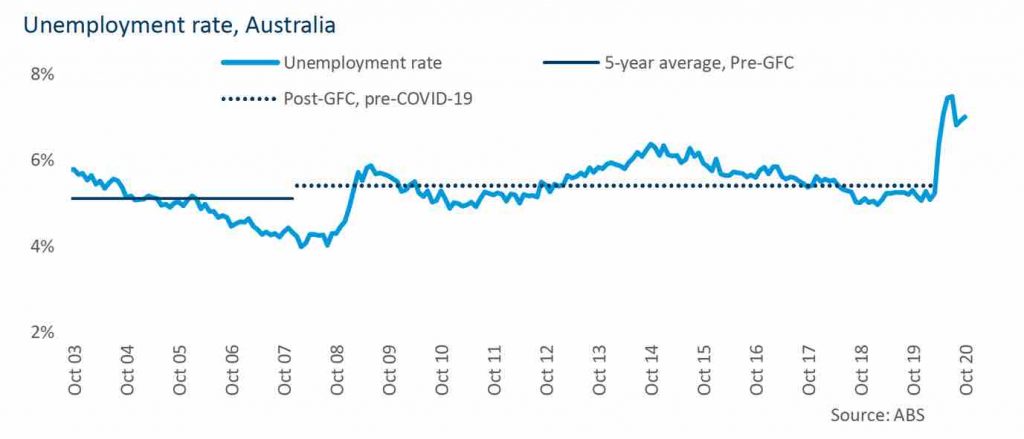

5. Jobs are being created

The various government incentives kept many businesses open and many Australians in work meaning unemployment didn’t reach the double digit figures that were initially forecast.

At the same time many jobs have been created and Australians are feeling more confident in the financial futures.

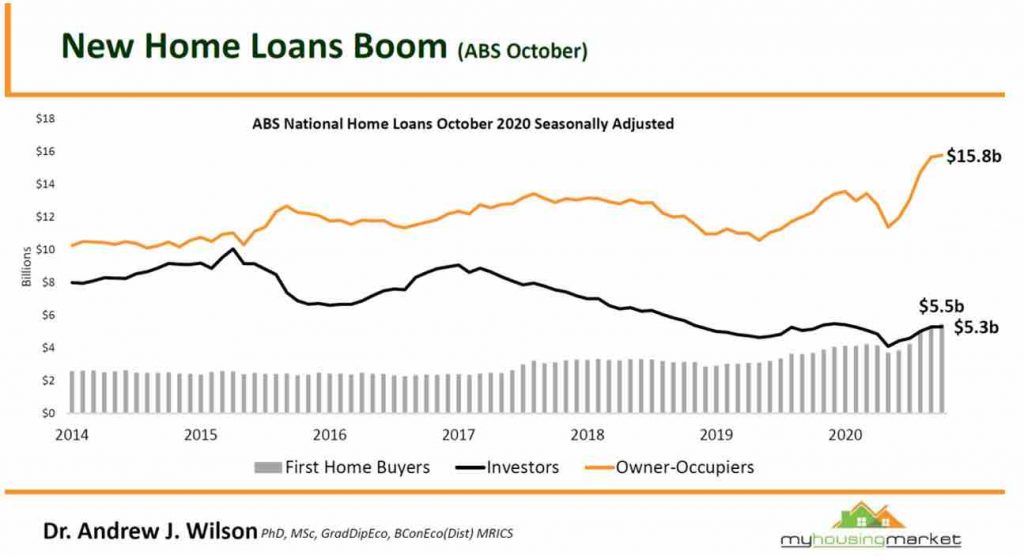

6. Lending for residential property has soared

The amount of money lent to buy homes or refinance existing properties has been rising, reaching a record high in October.

This is the first time that first home buyer loans have been higher than investor loans.

And that’s not because investors are not keen to get on the market, it’s just that the banks are giving them a hard time when assessing their borrowing capacity.

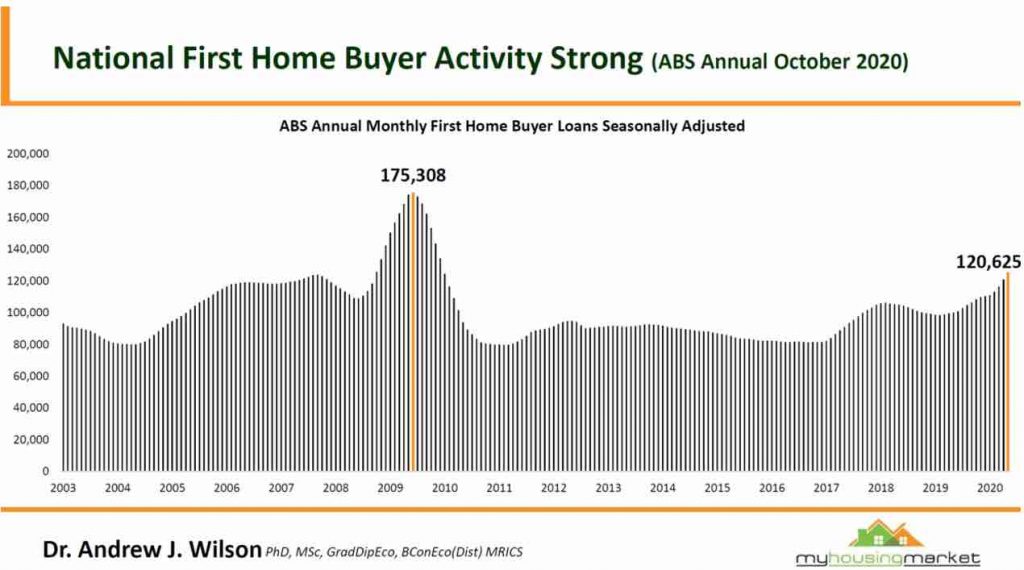

7. First Home buyers are back

First home buyers have been rushing into the market this year taking advantage of the various State and Federal government grants.

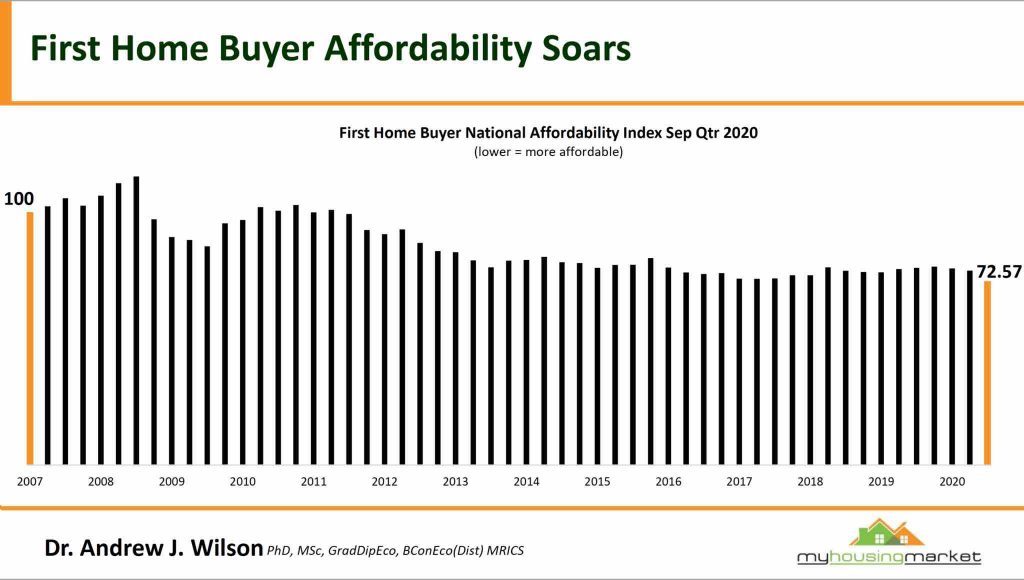

Following chart from Dr Andrew Wilson shows that first time home buyer affordability is it historic highs (more easily affordable).

Note that the lower the affordability index in the chart below the more affordable properties are, and with interest rates being at record lows and house prices remaining flat over the last couple of years, first home buyers are in a prime position to take advantage of the market, and then of course there are all the government incentives to make it even more attractive for them.

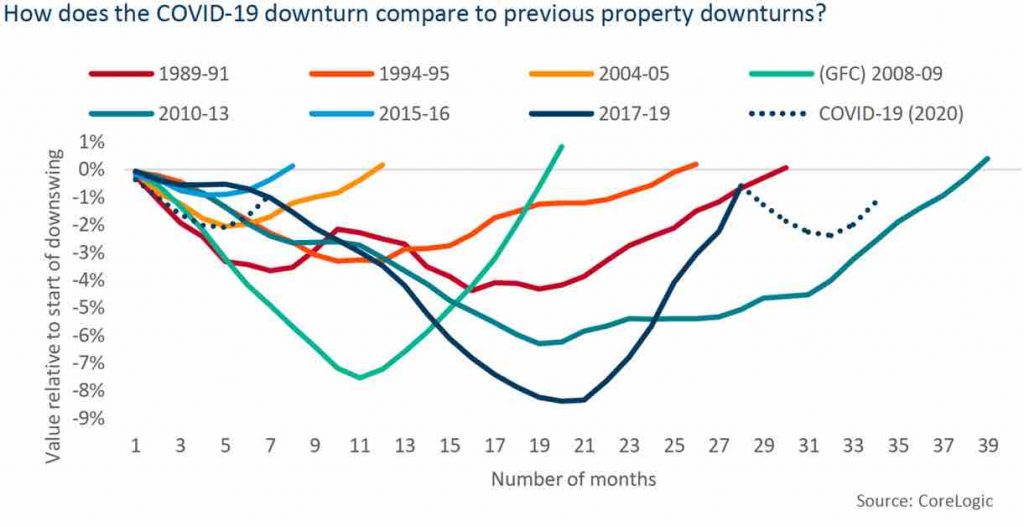

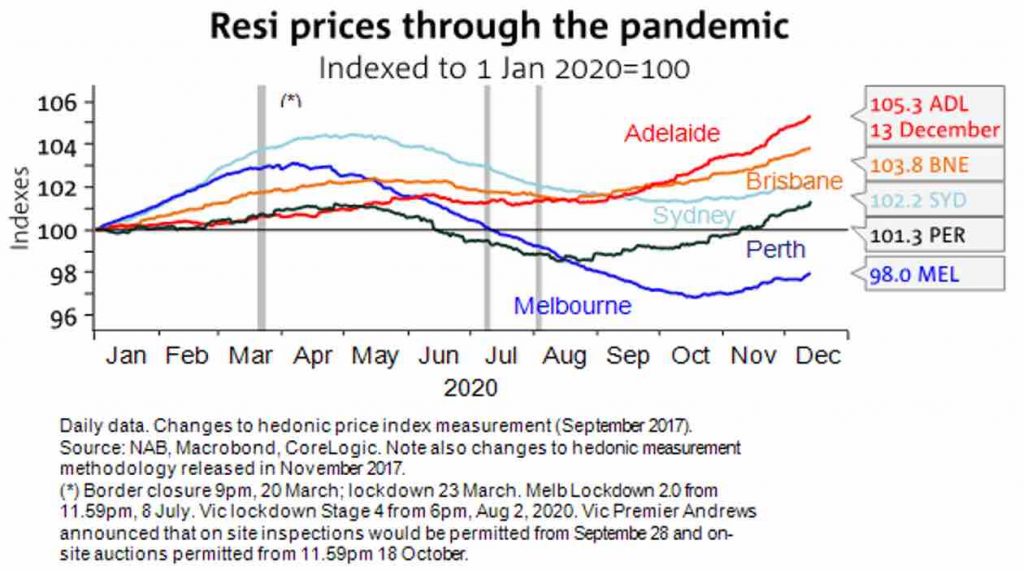

8. The property downturn was short lived

The capital city residential property markets are finishing the year strongly and this property downturn was much shorter and less intense than many predicted.

Prices across the five capital cities are rising again.

Info Source: 8 Charts explaining why we’re in for a great time in property in 2021

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.

- 8 Charts explaining why we’re in for a great time in property in 2021 - January 5, 2021

- New data shows COVID-19’s impact on Australians’ personal finances, including debt and insurance - December 21, 2020

- 4 key reasons why the property pessimists are changing their minds - October 12, 2020