New data shows COVID-19’s impact on Australians’ personal finances, including debt and insurance

As Reserve Bank Governor Philip Lowe warns that Australia’s recovery from recession will be “uneven” and “bumpy”, new data from Roy Morgan shows the financial impact COVID-19 has had on Australians and also shows how people who have suffered negative changes to their employment during the COVID-19 pandemic have fared far worse than others.

Almost 6 million Australians (28%) have had their employment negatively impacted by COVID-19 and 51% of them made resulting changes to their personal finances, as did many whose employment was not impacted directly.

Throughout September and October, more than 7,000 Australians were surveyed about changes they had experienced in their employment since March and about the impact on their payments of mortgage, rent, insurance, utility bills, credit cards and personal loans.

Well over one-quarter (28%) of respondents reported experiencing one or more of the following negative employment changes: I had my work hours reduced; I was stood down for a period; I was not offered any work; I had my pay reduced for the same number of work hours; I was made redundant; My business slowed or stopped completely.

This represents 5.9 million Australians.

Of those who have experienced negative employment changes due to COVID-19, more than half (51.0%) reported reducing housing and insurance payments or utility bills, cutting back on debt repayment, and/or making early-release withdrawals from their superannuation.

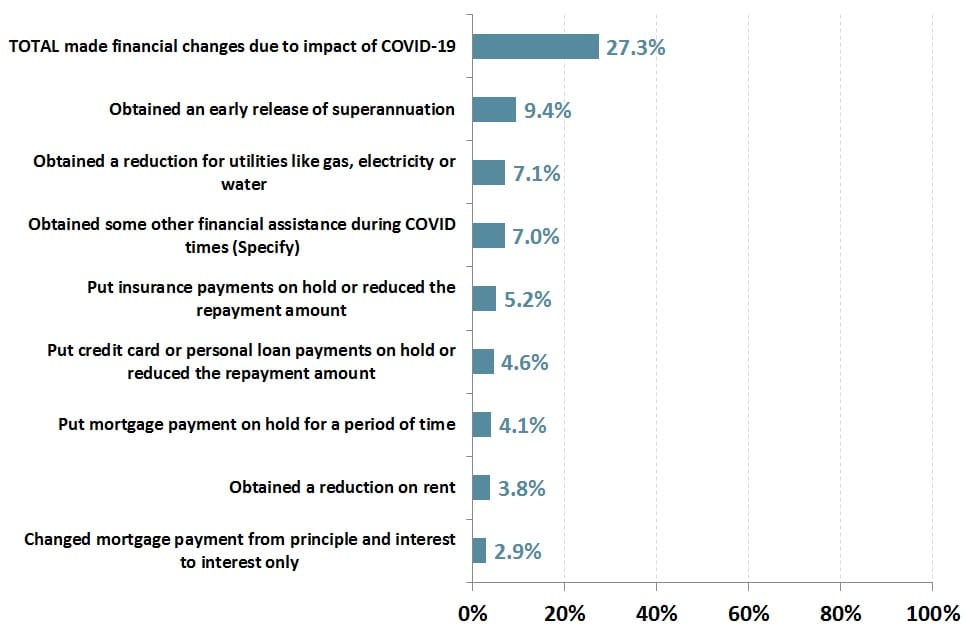

In all, 27.3% of all Australians, including those who did not experience employment changes, made such changes to their finances due to the impact of COVID-19.

Early Super withdrawal wasn’t the only step taken

The single largest financial change was early access to superannuation.

Early release of superannuation was permitted from April 20, 2020 for account-holders “adversely financially affected by COVID-19″ according to specific Australian Taxation Office criteria.

Those with sufficient funds were allowed to apply for a lump sum of up to $10,000 up to June 30 and, if they still met the criteria, the same again in the current financial year.

The option was taken up by almost 10% of all Australians, and by 18.5% of those who experienced negative employment changes due to COVID-19.

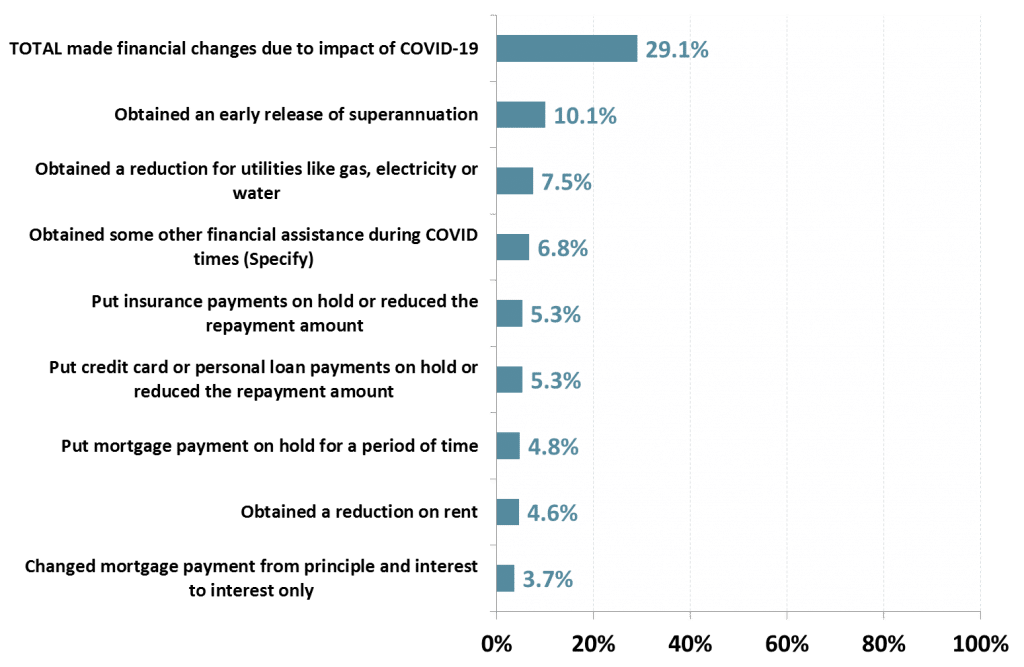

In addition, among those who experienced negative employment changes due to COVID-19, 12.9% obtained a reduction on their utility bills (gas, electricity or water); 10.8% put their insurance on hold for a period or reduced payments; 10.3% put credit card or loan repayments on hold, or reduced the repayment amount; 10% put their mortgage on hold for a period; 9.2% obtained a reduction on their rent; and 6.3% changed their mortgage repayments from principal and interest to interest only.

Roy Morgan CEO, Michele Levine, says:

“The release of September GDP figures showed Australia has technically emerged from recession, but as Treasurer John Frydenberg has acknowledged, our economic recovery has a long way to go.

“While it’s encouraging to see 183,000 fewer people either unemployed or under-employed in November compared to October, Roy Morgan’s accurate unemployment measure shows we still have 2.96 million Australians either unemployed or under-employed — an increase of more than 800,000 since before the pandemic — and government economic stimuli is now being progressively withdrawn.

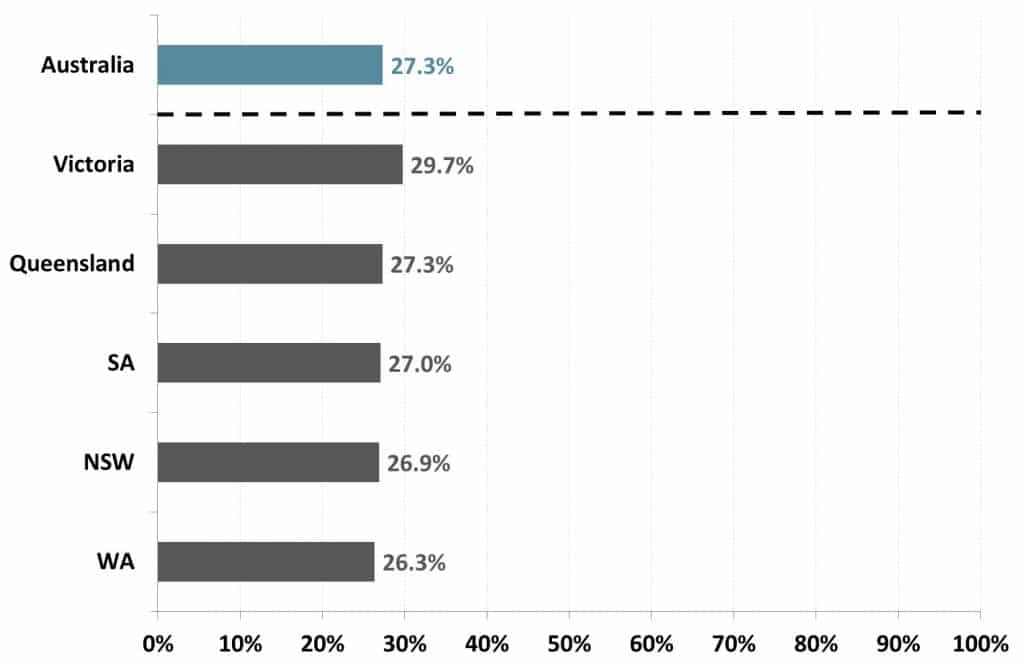

“Looking at the results based on where respondents live shows that COVID-19 has had a bigger impact on people living in Australia’s capital cities than in country areas. This is in part due to the higher impact of the lockdowns on cities but is also likely to be in part due to the greater awareness among people living in the cities of the arrangements that can be made with banks and other service providers to reduce financial hardship.

“These results of this new survey show the financial impact of COVID-19 on individuals including those who had to stop or reduce mortgage and other debt repayment. For many the tide has turned, with banks reporting that more than 70% of those who took up a mortgage pause have resumed payments.

“However, the full impact of COVID-19 on Australians and the economy at large will only be possible to properly assess when the extensive Government support is over and the special arrangements made by service providers come to an end in during 2021.”

% of Australians who have made financial changes due to the impact of COVID-19

% of Australians who have had a negative employment change who have made financial changes due to impact of COVID-19

City dwellers were more likely to make changes than those in country areas

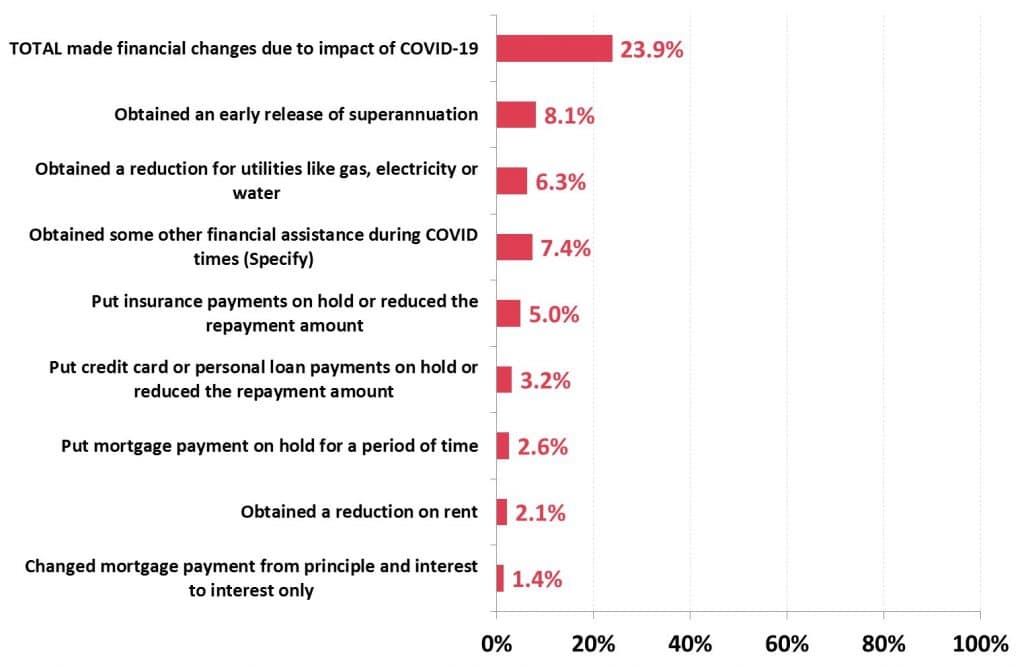

Looking at the data by location, we can see that 29.1% of Australians living in capital cities have made changes to their personal finances due to the impact of COVID-19, compared to 23.9% of people in country areas.

On a state basis Victoria, which had the longest lockdown, had the highest proportion of respondents making changes to their personal finances (29.7%), followed by Queensland (27.3%), South Australia (27.0%), New South Wales (26.5%) and Western Australia (26.3%).

% of Australians who have made financial changes due to the impact of COVID-19 – By State

% of Australians in Capital Cities who have made financial changes due to COVID-19

% of Australians in Country Areas who have made financial changes due to COVID-19

Info Source: New data shows COVID-19’s impact on Australians’ personal finances, including debt and insurance[/vc_column_text][/vc_column][/vc_row]