Why 2020 is a great time to buy

We’re only a few weeks into the first month of the year and it appears that property markets are already to starting to hum with activity.

While last year was one of market ups and downs, as well as changing lending goalposts for would-be mortgage-holders, this year appears to be one of more stable overall conditions.

Markets strengthening

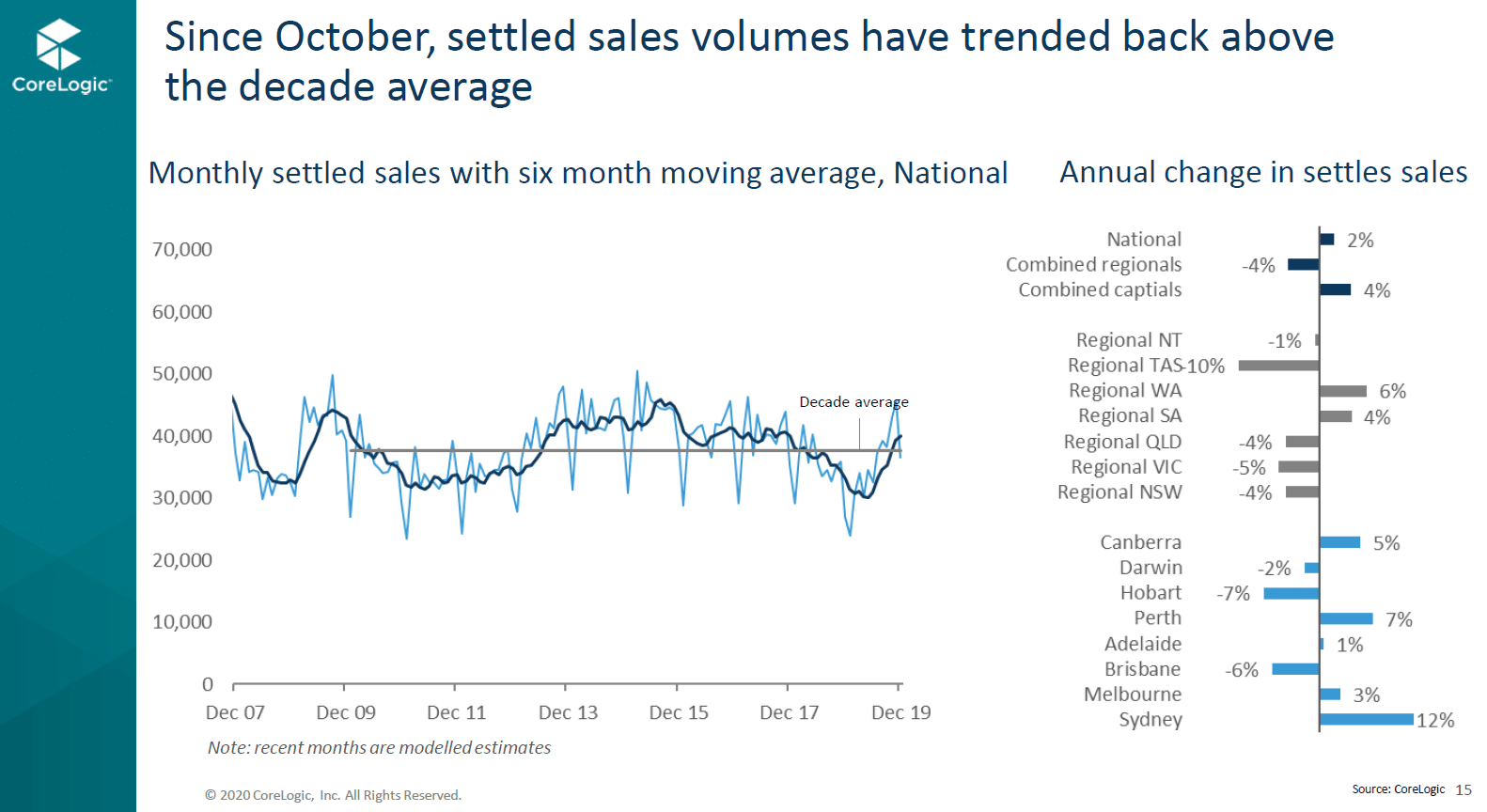

In fact, the market started to improve during the last quarter of last year with more buyers active and property prices starting to strengthen.

According to the latest figures from the Australian Bureau of Statistics, the number of home loans for owner-occupiers increased by 10 per cent in the 12 months to November last year.

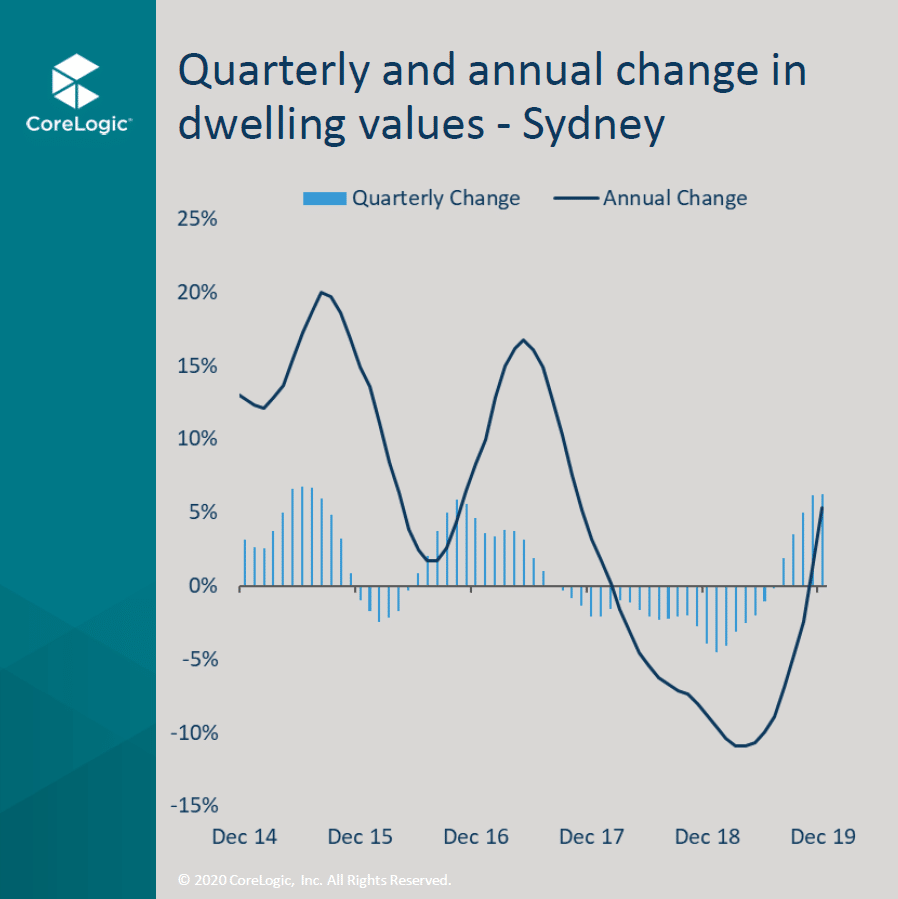

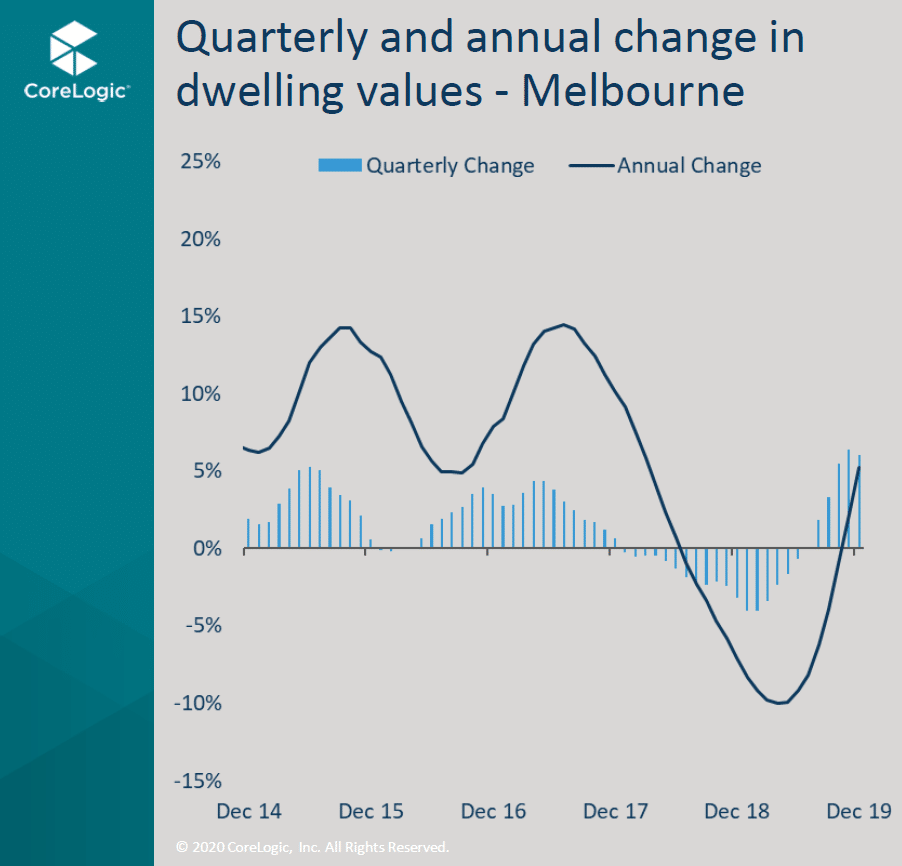

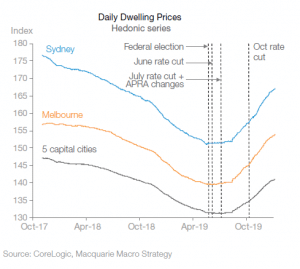

And CoreLogic data showed that Sydney and Melbourne dwelling values rebounded in the second half of the year to each record annual price growth of 5.3 per cent.

Other capitals, such as Brisbane, Canberra and Adelaide saw their markets improve over the last quarter of last year as well.

Hobart has also continued its multi-years of dwelling value growth, finishing last year with price growth of 3.9 per cent.

These results are welcome news after a few years of fairly average market conditions in most major locations.

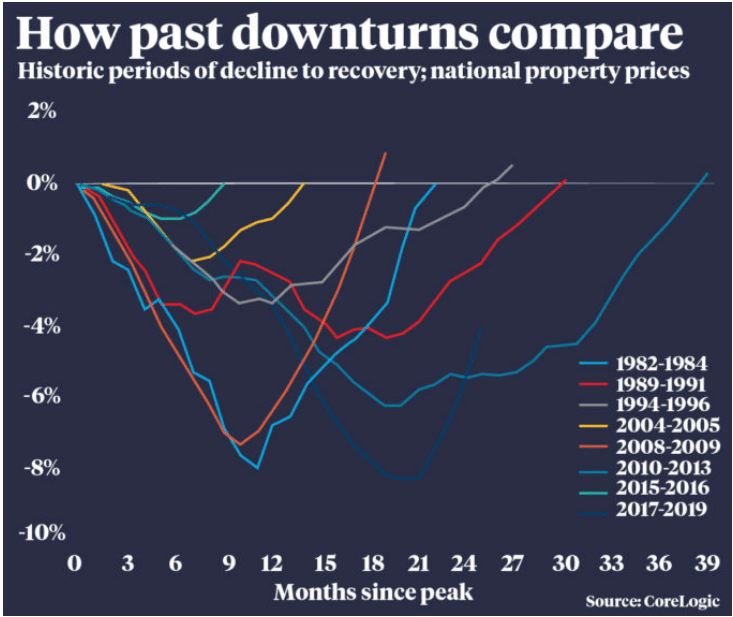

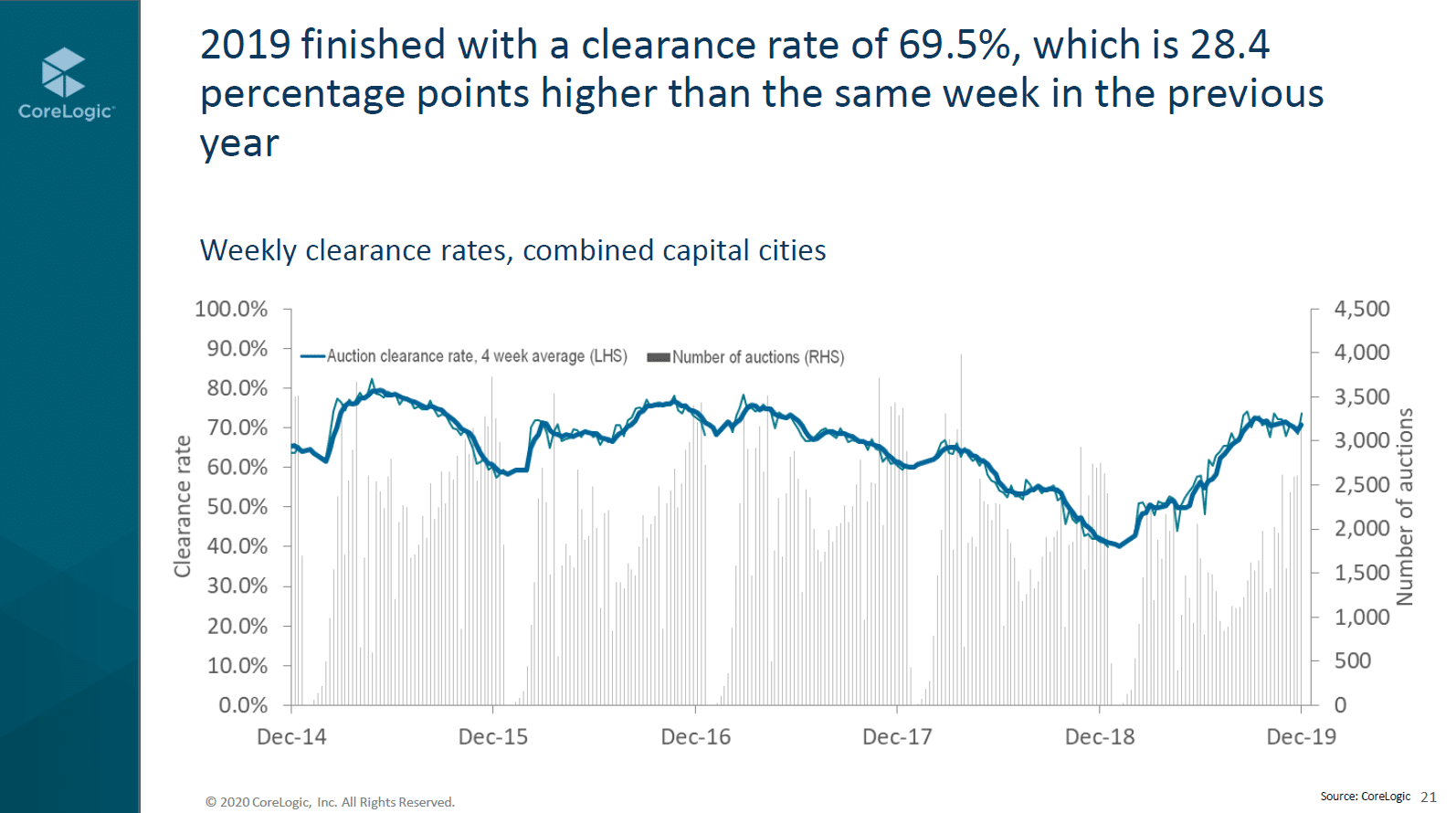

In fact, as the table below shows, the most recent decline has been a longer and slower one, which was lead predominantly by the regulators trying to avoid over-heated property markets in Sydney and Melbourne – fueled largely by investors – to now showing a positive rebound based on low interest rates, easing regulatory intervention and negative gearing being off the table after the Coalitions election win in May 2019.

Of course, there was always going to be a point in time when market conditions, not necessarily at the same time, started to improve because that is the nature of real estate.

And that’s why savvy homebuyers and investors are making their move now before prices start to increase even further.

Super-low rates

One of the reasons why markets have rebounded is because of our historically low interest rate environment.

Now super-low rates don’t ignite markets in isolation, however, the combination of lower property prices in Sydney and Melbourne in particular have clearly ignited those markets.

On top of that, the winding back of unnecessarily difficult lending criteria has helped homebuyers and investors in every location qualify for finance more easily.

A few years ago, when the laborious APRA restrictions were in play, many potential borrowers struggled to meet the unrealistic benchmarks that had been set.

It stands to reason that when you prevent a large percentage of the population from qualifying for loans that demand, and prices, will fall through the floor, which is what happened in our two major cities.

Not only that, prices had reached a point that were unaffordable to the majority so they simply couldn’t afford to buy into those locations.

Fast forward to this year, though, and the situation is much different.

Lenders are open for business and buyers are ready and able to purchase.

And most analysts expect 1 more rate cut to the official interest rates taking them to 0.50%. Of course, we can only hope that our lenders will pass on the full 0.25% but that will need to be seen before we believe it.

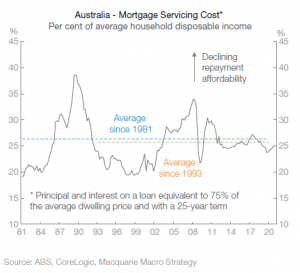

And consumers have heeded the debt message by taking advantage of the low rates to maintain their loan repayments at previous levels and fast repaying their mortgages, thereby assisting repayment affordability back to below long term averages.

A number of property market researchers have already forecast solid capital growth in most of our major cities this year.

Unfortunately, it appears that Perth and Darwin are likely to continue to struggle.

Over the past few years, I’ve written tens of thousands of words about property markets, because they are always doing something that’s worthy of analysis.

This year, though, it appears that it is the best time to buy for a long while – with the positive combination of low interest rates, increased buyer demand as well as relaxed lending criteria set to supercharge our property markets.

Smart homebuyers and investors have already bought a ticket, because they don’t want to miss the boat.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.

- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026