What is a good credit score?

Some of the most common questions I get asked from clients relate to their Equifax score, or their credit rating.

Equifax is Australia’s largest credit reporting agency and allocates you with a number that is essentially a summary of your financial history.

It’s a way of measuring your history when it comes to engaging with lenders, credit card companies and utilities providers.

It’s used in a variety of financial situations to give a prospective lender an idea of your quality as a borrower. And it’s absolutely critical in the decision-making process.

How the score works

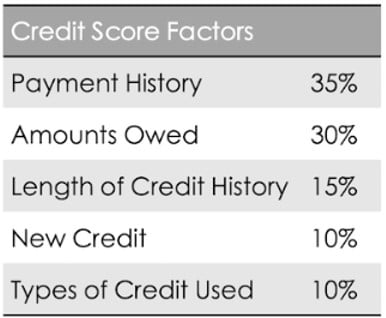

The Equifax score will be a number between zero and 1200. It’s calculated with data on your credit report and is based on a number of factors.

For starters, any issues you’ve had in the past with defaults, serious breaches of credit contracts, overdue debts and debt collection referrals will impact your score.

But other things can also have a negative effect.

If you make a number of enquiries for credit, this could be a red flag and impact your score accordingly. That is, if you’re constantly applying for credit cards – even if you don’t take up the offers – this will be recorded in your file.

Sometimes, those enquiries are innocent. I had a client once who loved to shop around for frequent flyer deals on credit cards, getting a new one and transferring balances whenever there was an incredible deal. But too many enquiries can hurt your score and make lenders nervous.

What’s a good score?

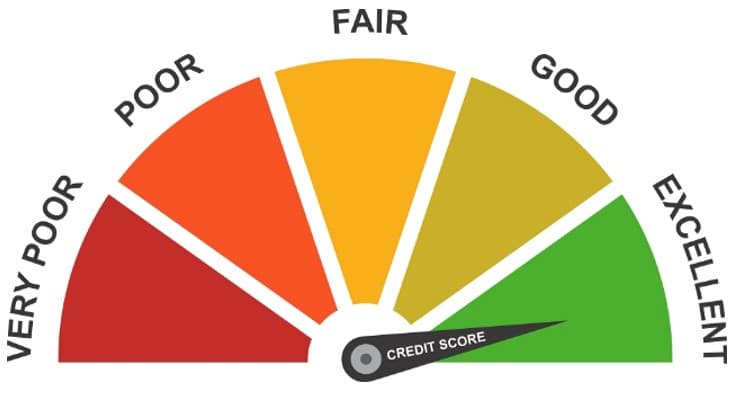

The higher your Equifax or credit score, the more likely you are to be considered a good candidate to lenders. A score of zero to 500 is below average and tells a lender that you’re at high risk of experiencing an adverse credit event in the next 12 months. A score of between 500 and 620 is average, between 620 and 725 is good, between 725 and 832 is very good and above that is excellent.

High credit scores show you have demonstrated responsible credit behaviour in the past, which may make prospective lenders and creditors more confident when evaluating your request for credit.

Generally speaking, a score of about 650 upwards is considered good to most lenders. Below that and you might face some challenges.

Different lenders have different criteria, and the type of credit you’re seeking also determines what type of score will be necessary. For example, a power company looking at your credit score will obviously have a different comfort level to a bank considering your mortgage application.

How can you improve a score?

There are some basic things you can do to begin improving your credit score.

The obvious one is to always make payments on time and avoid incurring any penalties, late notices or referrals to collection agencies.

Another easy one to limit the number of credit enquiries you make, from credit cards to store interest-free loan deals or other types of charge cards. The less you’re sniffing around for credit, the better your score will get.

If your score is especially low, order a copy of your credit report and find out what high-risk listings are contained in it. These could be credit cards with exceptionally high limits, defaults and serious infringements.

Defaults usually remain a black mark for several years. But if there’s an error or a misunderstanding, you can apply to have it corrected.

If you have multiple loans and credit cards that are dragging down your score, you can consider consolidating them into one loan with a low or introductory interest rate to get on top of debt.

And if you have any overdue debts, prioritise paying them off as quickly as possible.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.