The problem with property-cycle panic

Cast your mind back just seven short years ago to 2012.

It was the year the world was meant to end, according to some readings of the Mayan calendar. It was when a South Korean pop star had us doing the Gangnam Style dance, Greece almost went broke and property markets started to boom in Sydney and Melbourne.

All of those things made big news, but the start of a hot new real estate cycle in our two biggest cities gained a lot of local attention. And, of course, they’re back in the headlines now.

Property market collapse! Prices plummet amid bust fears! Downturn set to continue!

Those are just a few recent dire headlines. And while markets are soft and some of the news is concerning, I’m going to discuss why you shouldn’t worry about the current downward cycle.

Cycles are normal

Property markets have been in the exact same position they’re in now on countless times in the past. It’s normal.

In the midst of it, property investors worry. The constant barrage of negative stories in the media keep them up at night. They watch the monthly data roll in showing another retreat and find themselves panicking.

And remember these “news services” always tend to try and prosper on headline grabbing, whether it’s factual or not doesn’t tend to matter, it’s just trying to grab your attention or draw you to their publication, that’s all.

Don’t panic. This is an absolutely normal part of a property cycle. It’s why the concept of the property clock is so compelling.

Around six o’clock is the start of a new cycle when prices are flat and slow. Not a lot happens for a couple of ‘hours’ as markets consolidate and prices begin to edge up.

Around eight o’clock we see momentum catch. The market has a steady rise underway, driven by first homebuyers lured by low prices and investors after a bargain, and there are hints that things are picking up.

Passing through nine o’clock and toward 10 o’clock, a boom period begins. There’s strong general market activity and those who’ve done well already are keen to upgrade to bigger and better homes. Investors are confident. Developers get active. Demand is high and supply is low.

It’s around 11 o’clock we see the first signs of jitters. Supply is booming and starting to outpace supply. Investors are nervous that things are getting too hot. First homebuyers have been priced out. There’s too much competition for upgraders. Perhaps the government introduces new regulations to slow growth or banks get nervous and impose harsher lending restrictions.

As the clock hits 12 o’clock, it’s a price peak with every minute beyond this triggering the start of a ‘reset’. Prices start to come down. When speculative property owners see this, they panic and sell. It’s kind of like the share market on a bad day. For the next three hours, it seems pretty dire.

Between four and five the frenzy begins to settle somewhat. It’s like pulling up the Titanic when it was running at full speed. Most participants know a slowdown is underway but momentum is tough to fight.

As it passes beyond 5 on through to 6 o’clock a whole new 12-hour period is on the horizon. Things will calm and tempers will settle. A new cycle of growth is set to begin.

Sound familiar?

Let’s look at Sydney, for example

The city on everyone’s lips over the past 18 months years has been Sydney. The market correction there has been steep, and doomsayers point to it as an example of the end of property booms.

Of course, it’s not. Sydney has gone through the exact same downturn cycle – usually around two years in length – every decade or so.

That’s the typical length of a housing cycle – seven to ten years, depending on conditions and location. And the ‘time’ is currently at about four-thirty by my reckoning.

AMP Capital and its chief economist Shane Oliver, one of the country’s most respected figures in the analysis space, thinks the top to bottom decline in Sydney will be between 20 and 25 per cent.

And boy, does that sound like a lot. But here’s some much-needed perspective.

Since 2012, when the boom began – nine o’clock on the cycle after a period of stability – until the correction begin in 2017 – 12 o’clock – the market in Sydney grew by a staggering 77 per cent. That’s a huge growth in a five-year span of time.

In the 18 months since the drop-off occurred, Sydney has lost about 14 per cent overall – so more than half of the way through the full downturn that Oliver has predicted. And that takes things back to late 2015 levels. By his forecast, when the correction has finished, and the recovery phase begins, prices will be back at mid to late-2014 levels.

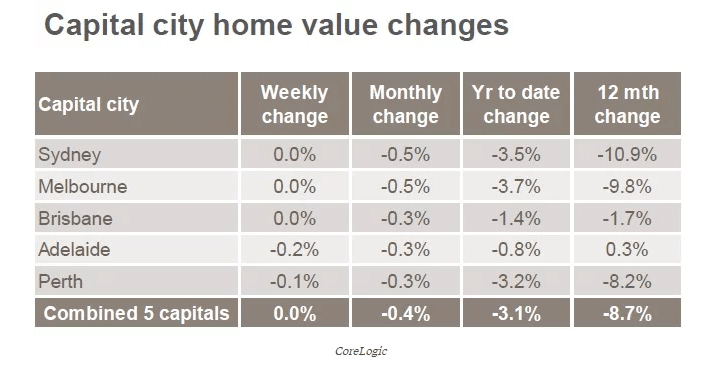

But as this recent Corelogic data suggests, the market changes may be slowing and stabilising as we speak. And remember this too, forecasts are just that – when was the last time you trusted your local weather forecast?

Well, property forecasters are just the same, making commentary on some data and statistics that seem to point to their logic that a market will or fall because that’s their thoughts. Property markets don’t listen to property forecasters though!

Or, put simply, they will still be 50 per cent higher than when the boom phase began in 2012.

So, in an eight-year cycle, which includes two- and a-bit years of downturn and a full five of growth, investors who got in at the start will still be up 50 per cent.

That’s an exceptional return in a relatively short period of time.

In Melbourne, it’s a similar story – albeit with slightly smaller figures – and investors there too will be well ahead.

So, don’t panic

Cycles are normal. A part of that normal cycle is a correction when things get too hot, too fast. But recoveries always take place and always lead in to a period of growth. You just have to be patient.

What I mean by this, is we know there is a cycle, correct? But what we never know is the timings of the peaks and troughs (Gee, investing would be easy if we did wouldn’t it?) and how long the rises, falls or even stability will last for. This is always the hardest thing.

But, Property investment is a long-term game. You should buy with a view to holding for more than seven years. If you bought in 2012 or earlier, you are still in possession of an incredibly well-performing asset from a capital gains perspective. Tack on top of that the tax concessions if it’s negatively geared or the steady stream of income if it’s positive, and you’re in a good place for sure.

But if you’re not feeling very cheery right now, there are still things you can do to relieve the tension of the final few hours on the clock.

A regular review of your property portfolio’s finances is essential. If you bought in 2012 and you’re still ahead, you could be throwing money out the window by remaining on those bank interest rates from seven years ago as we recently wrote about in our story of the deadly sins of interest rate creep.

Banks have slashed rates in that time. Even over the past few years, rates have chopped and changed at almost every financial institution. And in the past few months alone, as banks try to drum up business in the wake of the royal commission, they’re discounting once again to bring new customers through the door.

As qualified and experienced finance brokers, we can look at the state of your loans and find you a better deal. It might just put a smile on your face while the correction finishes, ahead of the recovery kicking off again.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.