Is now the best to buy property since the GFC?

The funny thing about every market downturn is that when we’re in it, it’s often hard to see the forest for the trees.

We think what’s happening is unique and worse than ever before.

But cast your minds back to 2008 and 2009, when the Global Financial Crisis swept across the western world and left carnage in its wake.

Housing markets tumbled. Share markets crashed. Banks in many countries shut up shop.

Even in Australia, where the economy avoided recession, real estate flat-lined for some time.

But, as it has always done, the correction eventually led to a recovery and prices grew once more thanks to housing markets being underpinned by solid growth drivers.

Yet, back then, as the recovery began, few thought it was a good time to buy.

Many are stuck in the same blindness now, but I think this cycle presents a better opportunity than in the post-GFC period.

And if you buy smart, employ the services of an independent and qualified financial adviser, and strike while the iron is hot, you could set yourself up for good long-term growth in your property investment portfolio.

Worse on paper, not in reality

You might’ve read a newspaper headline in the past few months about the decline in house prices since mid-2017 being worse than during the GFC.

It’s true. In early 2009, when the full impact of the GFC reached our shores, property prices had slid by a concerning 4.5 per cent across the five major capital cities over the course of a year.

Last year, the five-city median value fell 5.1 per cent. On an apples for apples comparison, that’s pretty compelling. But in reality, it’s actually a different scenario.

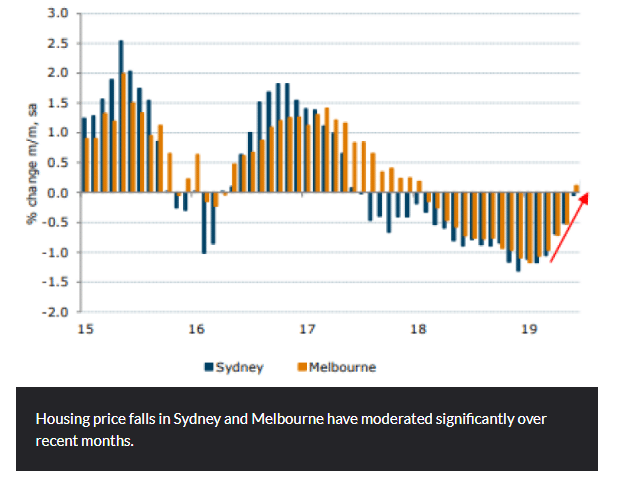

For one, the bulk of that five-city increase is thanks to price falls in Sydney and Melbourne, which had just experienced a long and sustained boom in prices that saw medians absolutely soar.

The falls there were steep, but – and it’s a massive but – the reduction has taken the Sydney and Melbourne medians back to early 2016 levels.

Since the boom began, investors in the two cities have shared in about 50 per cent increases in prices.

In Brisbane, median prices during this period of softness have been relatively stable, with the exception of the oversupplied unit market in the CBD and middle ring.

In Adelaide, Darwin and Hobart, the market has grown. Canberra saw only a modest decline.

So, in the GFC, the declines were spread across many markets.

In this scenario, though, they’re concentrated really on two major cities that had seen exponential growth and were probably due for a correction.

Grey skies are going to clear up

The cause of the property market downturn we’ve just seen was totally different to the financial chaos of the GFC.

It was largely due to a lack of affordability, a crackdown by financial regulators, jitters in the local and global economies and an exodus of foreign buyers combining to create the perfect storm.

What’s changed? Affordability has improved, efforts are being made to help first-timers, there’s intervention at a national level to stimulate the economy and the financial regulator has eased its outlook.

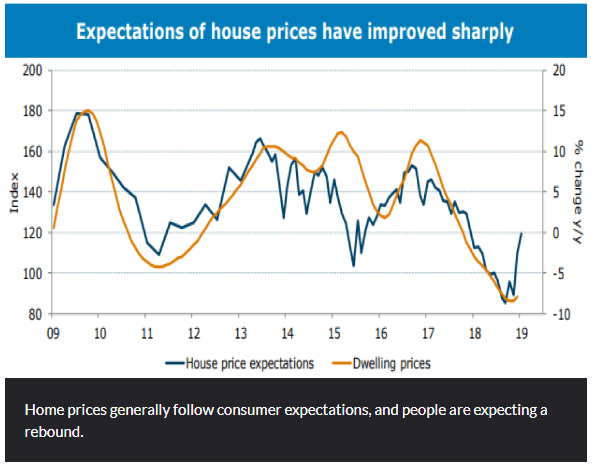

A growing chorus of property market experts and economists agree that the worst looks to be over and a bottoming out is imminent, which will lead to a slow and steady recovery.

Last month, Tim Lawless, the head of research at property data house CoreLogic, said the outlook for markets is much more positive now than it has been.

In fact, the rate of decline has slowed and there are some reasons for optimism.

For one, the softer market since mid-2017 means a number of projects have been put on hold. This means the amount of new stock coming to the market is going to be low for quite some time.

When demand comes back in a big way, supply won’t be able to keep up. This will ultimately push up prices once more.

On top of that, the population continues to grow at a significant pace and, broadly speaking, the economies in our two biggest capitals, Sydney and Melbourne, are solid.

So, more demand, less supply and good long-term fundamentals. There’s reason to be optimistic once more.

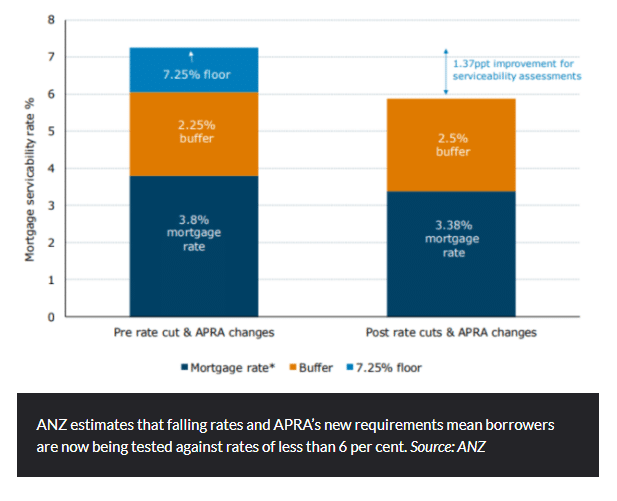

Shane Oliver, chief economist at AMP, has also revised his outlook in recent months, saying the recovery is being sped up by the Reserve Bank rate cut, government policy supporting first homebuyers and changes to lending rules.

Will lending be getting easier?

Unlike in the wake of the GFC, when lenders across the world were in the doldrums after a crisis unlike anything seen since the Great Depression, the mood now is considerably different.

For one, banks aren’t at risk of difficulties like they faced post-GFC. In fact, the climate is very good – although it could be better.

The housing downturn, coupled with a crackdown by the financial regulator, means they’ve not had as many mortgage customers as they’d like – but that’s all going to change.

Lending requirements are being discussed with the view to these being eased to encourage more people into the housing market.

At the same time, banks are being very competitive in order to win business, offering a whole host of good deals and a certain level of flexibility.

Interest rates are also at record lows and economists believe we could see more rate cuts by the end of the year. So, not only are mortgages cheaper, but it’s getting easy to secure one without all of the hoops we’ve seen lately.

So, in summary…

This downturn began for different reasons to the one led by the GFC, which means the recovery will be more easily stimulated, – plus experts are already saying that there are positive signs on the horizon.

The drivers for demand – population growth the big one – remain in place while the pipeline of supply is dry.

The financial regulator is easing the tough conditions and banks are being more competitive to get your business. At the same time, the RBA has dropped rates to record low levels and could go further by the end of the year.

The government is working to stimulate the economy. The uncertainty of the election campaign, now over, should help things settle down a little. It is also focusing on helping first homebuyers get into a property. And, despite those double-digit drops in Sydney and Melbourne, median prices there have retreated by a couple of years but remain well up since the boom began.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026