Don’t be complacent with interest rate cuts

So July has marked the 2nd round of interest rate cuts and as veteran economist Dr Don Stammer once said “RBA rate cuts are like Mormons – they come around in pairs.”

I have struggled to see why we needed to wait to have 2x interest rate cuts across 2 months when it was clear that these were needed in June and greater stimulus required, then why didn’t Reserve bank board just cut by 0.50% then?

It continues to show a lack of leadership from our policy makers being late to the party (again) and then not being willing to do what’s required, when it’s required!

Until last month, the RBA had been waiting to see what happens next for nearly three years – the cash rate was reduced to 1.5 per cent in August 2016. The great uncertainty now is whether cutting the rate to just 1 per cent will actually achieve much.

There are several ways of looking at the impact of lower interest rates and some debate about their effectiveness at such low levels.

A quick example of fun with numbers: I can tell you that with rates so low, shaving another quarter or half a percent really doesn’t matter much – or I can tell you that the cash rate has been slashed by a third, by far the biggest percentage fall ever in two months, and therefore the percentage reductions that should flow to borrowers will be considerable.

Both ways of looking at it are legitimate, but it’s where textbook economics meets behavioural economics that the outcome becomes tricky.

What have the banks done?

Across the board, our major (and minor) lenders have passed on between 0.43% and 0.45% of the 2x 0.25% cuts. For some investors paying interest only, these cuts have been up to 0.65% which is very welcome relief indeed.

After all, it’s been our investors that have suffered the brunt of interest rate rises in order to curb their influence on the market(s), whether rightly or wrongly, but this has resulted in pure profit taking by the lenders.

There are savings on offer

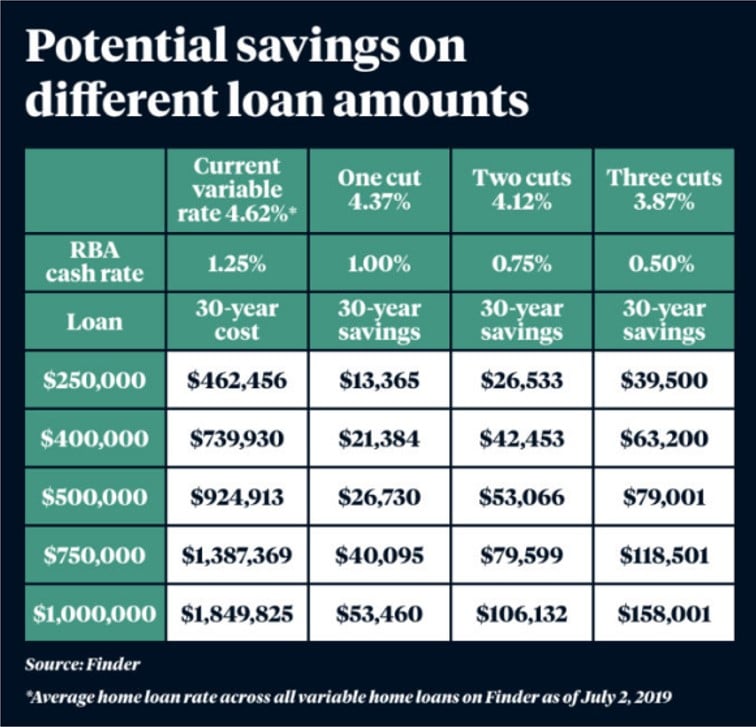

Without question, you will be paying less on your home loan than you were at the start of the year just as this table shows you.

But I caution you, don’t be complacent

Argh yes, Australia’s and Australians greatest curse – complacency!

Yes, the majority of people will simply accept that their bank is dropping rates and will refuse to seek out and see if they are actually getting the best interest rate available.

And guess what, as I’ve written many many times before, I will almost certainly back that they are not.

Sure, their rates have gone down, and this is good, but is it the best for you in your circumstances???

So is finance still available?

A great question.

The RBA rate cut might make life a little easier for home owners. But it will mean little to first-home buyers struggling to get a loan.

The Australian Prudential Regulation Agency (APRA) has been imposing lending restrictions on banks since 2014; the Australian Securities and Investments Commission (ASIC) is now pushing banks to dig deeper into borrowers’ expenses; and on Monday the federal government expanded its comprehensive credit reporting regime to include all eligible bank accounts. We have written about the impacts of Open banking and what this could mean for you.

That means that, while house prices have dropped significantly since their 2017 peak, many first-home buyers are now missing out on loans they would likely be able to repay. And that’s hurting the economy.

University of New South Wales real estate research fellow Nigel Stapledon has said that APRA had gone too far in its restrictions on bank lending, which he said had hit low-income households the hardest.

“They are a blunt instrument and they’re not necessarily equitable, because the most at-risk households are low-income ones,” Dr Stapledon said.

“It’s caused banks to tighten up too much… and that’s having adverse impacts on the housing market.”

APRA’s quantitative controls and the fallout from the banking royal commission had led to such tight lending standards that borrowers who could comfortably afford a loan were now being denied, Dr Stapledon said.

The prudential regulator eased restrictions on interest-only loans in December and announced in May it would soon ease its mortgage serviceability requirements. But Dr Stapledon said it was still a lot harder to get a loan now than it has ever been.

Asked if APRA’s restrictions had improved affordability, Dr Stapledon said high levels of supply meant the housing boom would likely have ended without APRA’s intervention.

“I think it’s been a mistake,” the former Westpac chief economist and Treasury official said of the controls. “Who did they help?”

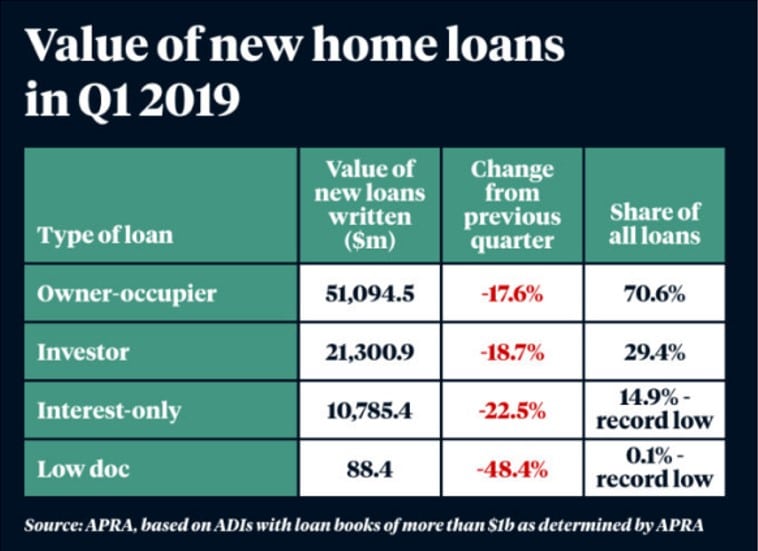

Dr Stapledon’s comments come just a few weeks after APRA revealed the value of new housing loans approved in the March 2019 quarter was down 16.5 per cent year on year.

All this said, the banks are still open for business as we recently wrote about and if you meet their criteria, you can still expect to obtain finance. My only suggestion is be ready to jump through a few more hoops than you may have had to in the past.

So what should we do

OK, so the 1st thing is “don’t be complacent”.

It’s a great time to shop around and seek a better deal.

With around 60% of all mortgages currently being introduced by mortgage brokers due to the current complexity in the lending landscape, it is a really good to seek a review and see if you can obtain a better deal.

Seek advice as there are numerous ways to get a better deal, sometimes it’s as simple as asking and other times it requires a full refinance from one lender to another because your existing lender has also become complacent with your business.

Want to know how to increase your chances of securing a loan

It’s pretty simple and most of it is common sense, but the trouble with doing the simple things well, is that it’s not that common.

Here’s my top tips to being able to avail of a loan in this environment:

-

- Be able to prove your ability to repay the loan – Yes, this relates to your income and all income sources

- Check and improve your credit rating

- Remove unnecessary financial commitments – if you don’t need or use that credit card, or the limit is way more than you need, get rid of it or reduce it to what you do need

- Have a strong savings history – complements point 1 and your ability to repay

- Show you have a ‘safety net’ – most businesses in Australia operate with an overdraft to assist with their cash flow needs. Investing is no different, you want to and need to have a safety net as things can, and will, go wrong

- Don’t apply with too many lenders at once

- Maintain stable employment

- Disclose all information to the lender – it still staggers me how many people say “I didn’t think they’d need to know that”. Lenders have access to more data and analytics than ever before so you are only fooling yourself with any non-disclosure.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.

- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026