An interest rate cut will do little to help – so what would help?

We keep hearing about a supposed interest rate cut that is “coming” as is it is going to miraculously fix all our spending problems and put much more money in everyone’s back pockets.

Oh dear, if you really think this is the case, you are sadly mistaken!

Don’t get me wrong, to pay less on your mortgage – whether it’s a home or investment loan – would be nice, but the banks have been slowly and steadily increasing rates anyway.

That means that any rate cut will really only give back what the banks have taken from us under the guise of “higher funding pressures”’ over recent years.

Now, the banking royal commission was meant to call out banks’ bad behaviour, but in the end did very little apart from potentially handing the power back to them – after a few weak slaps on the wrists.

While I don’t think this was the intention, somehow, this is what seems to be happening.

Don’t get me wrong: We need our banks to be strong, which why they have been the envy of the economic world.

But we also need competition, and this is what second- and third-tier lenders as well as our non-banks provide, which is why we must fight to ensure that this competition remains in force and even prospers.

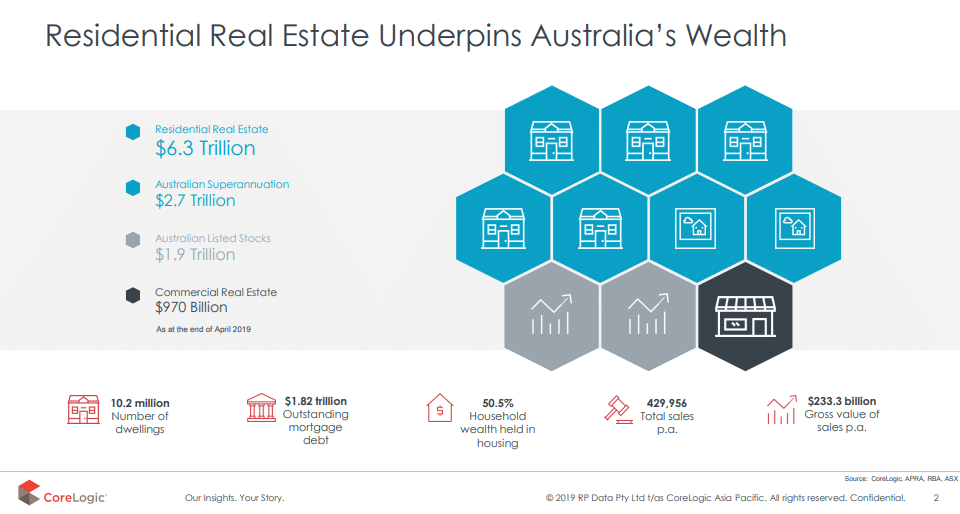

The Wealth Effect

What is the “Wealth Effect” I hear you ask?

Well, it is how people feel about their overall wealth, which directly correlates into their willingness to spend.

However, with house prices in Sydney and Melbourne, which are our two biggest cities, coming off 13.9 per cent and 10.9 per cent respectively from their highs, people simply aren’t feeling as wealthy as they once were, and therefore are less willing to spend.

Say, you bought a house in Sydney in mid-2017 for about $1 million – close to the then-median house price – that same home today has a market value of around $860,000, if you assume the 13.9 per cent fall, which means you are, theoretically, $139,000 worse off.

That’s enough to take the shine off anyone’s financial fortitude.

Job security and certainty

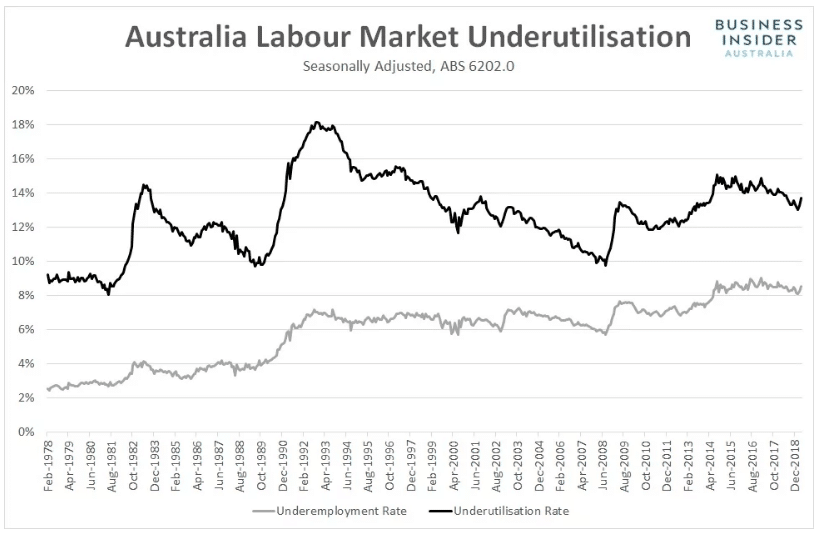

We keep hearing about our low unemployment rate but is that the real story?

No, it’s not. You see, we are currently experiencing a lack of full employment, which means that we have many people who are working, but they’re either part-time or casual so they’re not at their full capacity. It’s employment underutilisation that is hurting our economy and has been steadily rising now for years.

Some might be working 30 hours a week when they really want full time hours of 38 per week, plus many people are working two or three part-time jobs just to make ends meet.

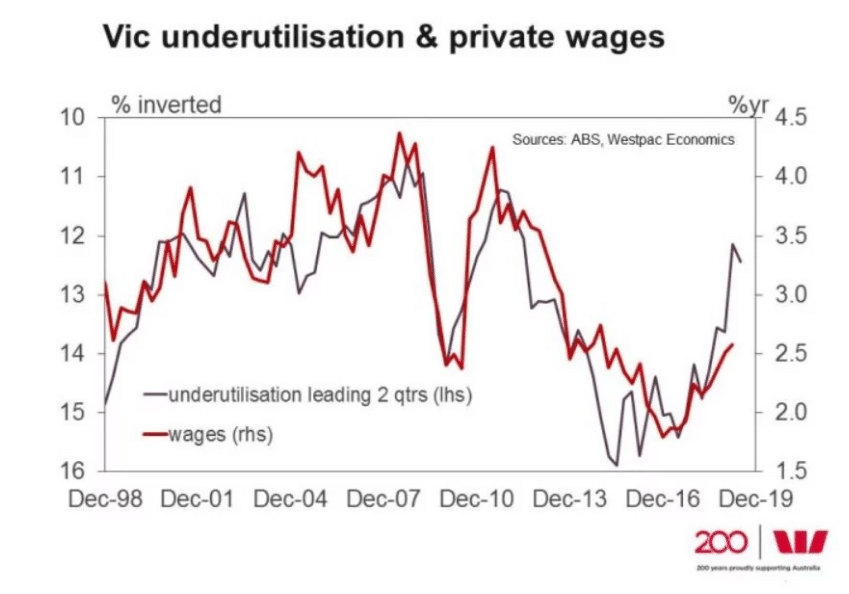

The only state that is bucking the trend at present is Victoria, and guess what, they have massive government spending and investment in infrastructure and are providing workers full time jobs. Then, and only then, can wage growth come and this is what’s happening in Victoria.

I asked the staff at my office a rhetorical question recently: “If I guaranteed your job for the next five years, with pay rises, would you feel more comfortable in going out and spending on whatever items you want or need whether it be a car, holiday, household items or the like?”

Guess what? I got a categorical “yes” in reply!

And that’s the thing, people need confidence in this environment.

It really is as simple as that.

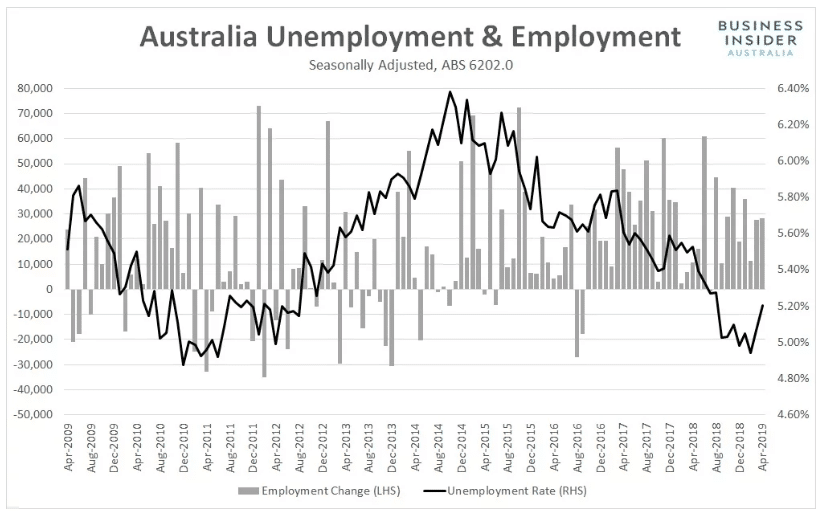

Unemployment

Unemployment is rising for the 1st time in a long time and coupled with underutilisation, this is a real concern for our economy.

We are starting to see a rise after a long period of falls. In Australia, if you want a job, you can get one but now we are seeing a rise in the participation rates, with more people wanting enter or re-enter the workforce, which is also why the unemployment rate is rising.

Consumer Spending and Consumption the key

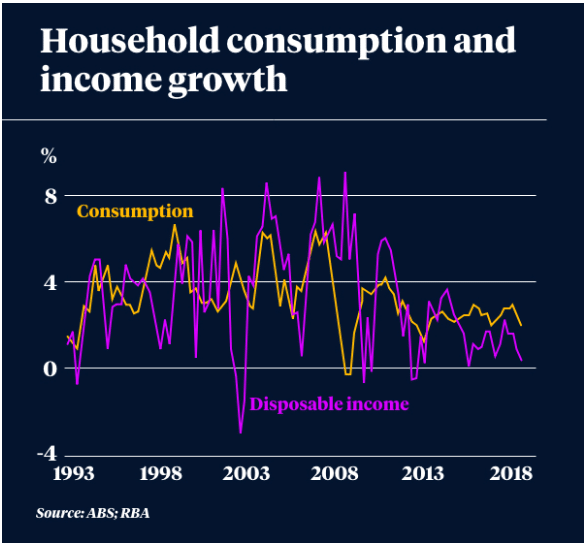

We have long been in an incredible low interest rate and low inflation environment and this hasn’t prompted consumers to spend.

Wages growth has been mostly benign for the past few years, with some data even showing it is failing to keep up with inflation, which technically means people are earning less for the same jobs!

Of course, none of this inspires households to go out and spend money, which is what our economy needs to get moving again.

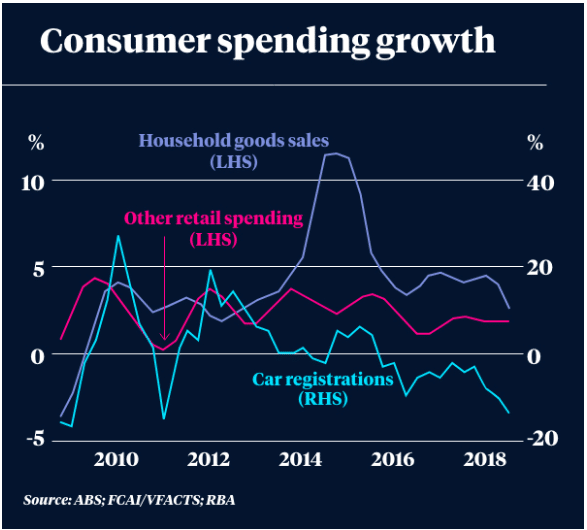

One of the reasons for the decline in spending on household goods, in particular, is the slower property market as there are fewer buyers wanting to fit out their new properties with the latest mod cons.

However, there is stimulus on the horizon with billions of dollars of tax rebates on the way in July, which will technically be the equivalent of a 0.5 per cent rate by the RBA anyway.

Consumer spending simply cannot rise if wages aren’t rising and peoples net wealth is falling, it’s just common sense that people will be conservative when they aren’t making money and more bullish when they are.

If you’re job was under threat, you hadn’t had a payrise in years, the boss wants to reduce your hours and then every month in the media you are being told that you are losing money on your home, are you really going to go out for dinner, buy that new TV or book a holiday? Of course not, it just defies logic to do so.

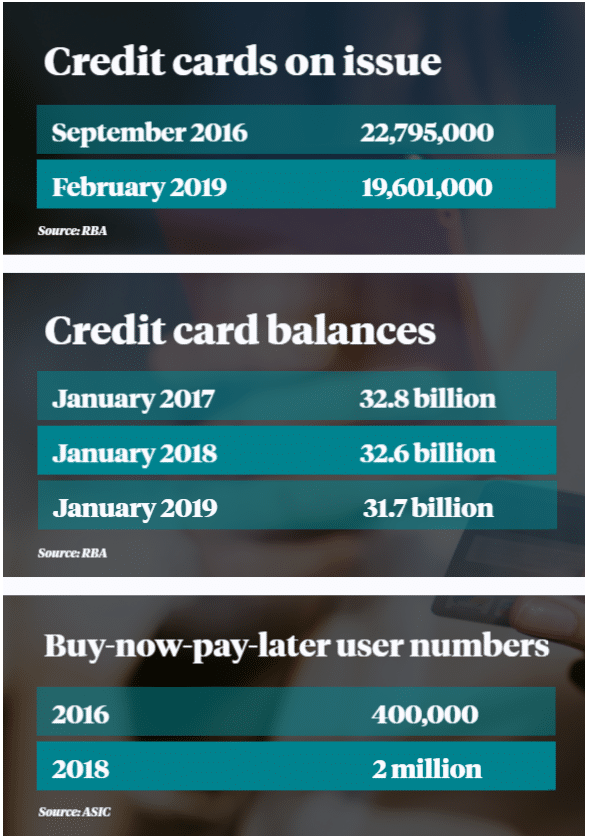

Credit cards and personal debt are under control?

It is pleasing to see the overall reduction in credit cards on issue and also that credit card debt is starting to reduce.

This is vital and, educationally, I think in the past year or two, people are understanding how a credit card can reduce their borrowing potential.

But has this come at the expense of the “buy now pay later” (or BNPL) craze that has taken effect?

The BNPL movement has an even scarier role to play with people entering into, or buying, products they simply cannot afford.

Whatever happened to “saving” for the goods or services you wanted to purchase?

Alas, this seems to be long forgotten in the modern world.

Here’s what really needs to happen

So, even though the Reserve Bank seems primed to cut rates, possibly even in June, it doesn’t have enough gas left in the tank to kickstart the economy.

To shift the economy out of first gear and into third, and hopefully fourth or fifth at some stage, there needs to be a multi-faceted economic stimulus approach.

1. Government stimulus

Clearly, the Federal Government has the major role to play when it comes to firing up the economy.

It needs to provide income tax relief, which is already on the agenda thankfully, as are tax rebates from the start of the new financial year.

It also should provide other stimulus measures to encourage people to spend, perhaps similar to what was in play during the GFC. And don’t give people cash like the last disaster. Give people a prepaid debit card with funds on it that can only be used at registered local retailers. That’s right, not online and not to the pokies or Dan Murphy’s but to our local retailers to support them and to support jobs.

Taxes generally need to be reduced but especially so for businesses, such as payroll tax, which would enable companies to grow and employ more staff, thus reducing the under-employment quotient.

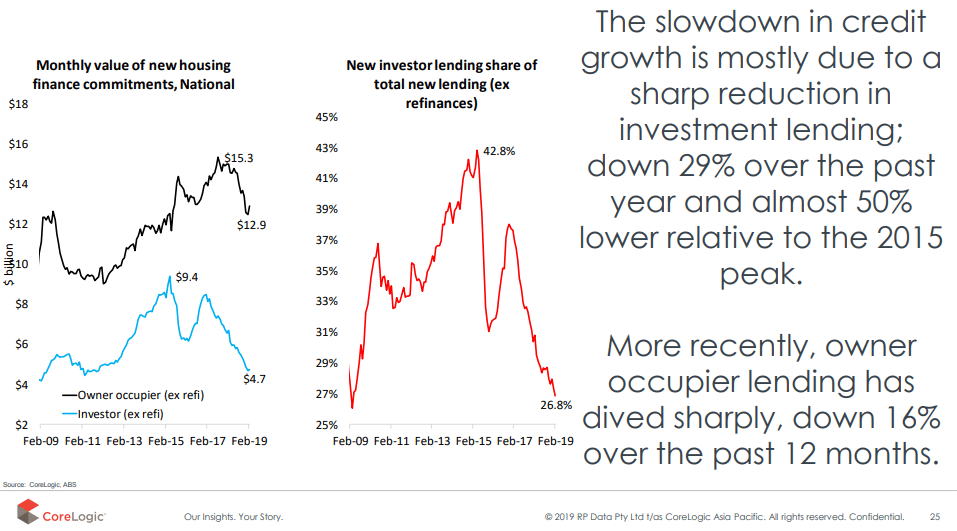

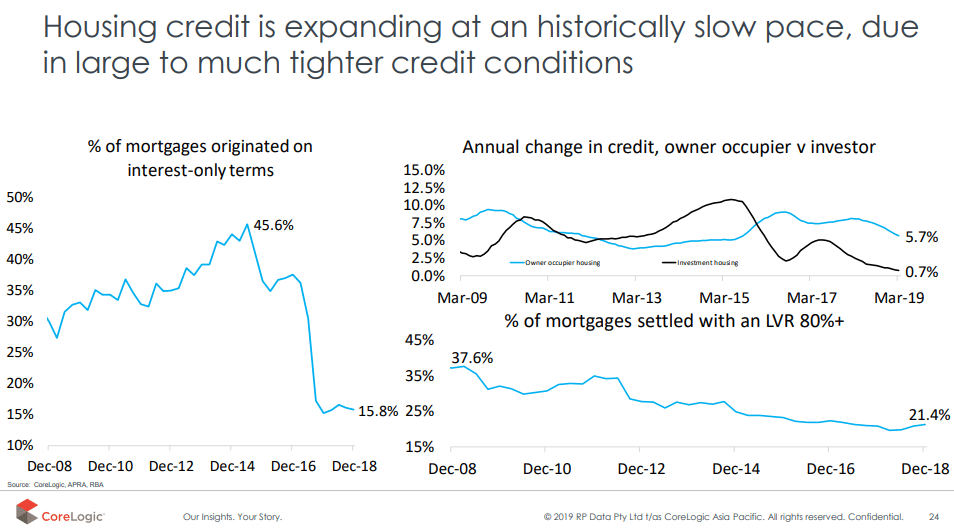

2. Lending standards eased

One of the best, and easiest ways if you ask me, to restart the economy is the regulatory easing of some of the current lending standards.

Don’t get me wrong, a lot of the measures have been credible and important in maintaining a sound market, but the servicing rates need to be addressed and reviewed.

I wrote recently about whether APRA had gone too far and I think they now have. Furthermore, no one knows what their agenda is or end goal they want to achieve. I believe in a fair and balanced market but APRA and our regulators have now taken this away.

And couple this with some of our banks and lenders crazy interpretations of these rules and you have many people scratching their heads and wondering how they ever were able to borrow in the 1st place?

Tell me, when do you think that we’ll have interest rates of 7.25 to 7.5 per cent again?

Not anytime soon, but this is still the servicing rates applied to your loan application and it negatively impacts your ability to borrow.

In the case of a home loan application, this can be up to double what it will cost you in actual mortgage repayments every month.

3. Open the purse strings

The next thing that needs to be happen is that banks need to free up credit again and make sound lending decisions.

It has become almost like the Spanish Inquisition for some potential borrowers these days, which is just plain insulting as well as being bad business practice.

These interpretations of the rules and the lenders “pulling” up on lending needs to stop. We need a balanced market and this is when “sound” borrowing practices are followed. I think we can agree that the old rules won’t, and shouldn’t, be applied but a balance has to be found and found quickly or otherwise, finding and raising the Titanic might be easier than trying re-start consumer confidence.

4. Employers needs incentives to employ and pay well

Employers also need to put full-time workers on and pay them appropriately – with the proper government stimulus to do so.

A great dividing factor for small business is the impositions of things such as Payroll tax and the like. Why should a business pay more tax to simply put more employees on? This just does not make sense and is counter-intuitive to the whole full time employment and wage growth argument.

And the incentive to write off items up to $20,000 in depreciation is great, but it still encourages people to make a big spend, which they won’t do if they are unsure about business conditions, yet all the discussions are on employment and wages.

So here’s a tip, why not keep the above in place because there is some stimulus I’m sure for this, but for busineses not using this, or using it to it’s fullest, why not offer an incentive to rebate either taxes paid or wages for taking on or increasing staff wages?

Do you think that could promote growth?

It also would incentivise businesses to pay well to retain staff and that in turn builds staff loyalty!

5. And finally, can we just be a little grateful for what we have here in Australia

Most importantly, everyone needs to understand and embrace the wonderful country that we live in and get on with living your lives – you only get one shot at it so make the most of every day.

As I recently wrote about the property cycle panic these things are quite normal.

We do live in the lucky country and for that we should all be truly thankful!

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.

- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026