So is it doom or opportunity for our housing markets

I was recently asked this question about our housing markets given the hysterical commentary that has been provided around the state of the housing markets in Australia, it’s a good question and the answer is really dependent upon whether you are already invested and when did you invest or whether you are, in fact, looking to enter the markets.

As the ANZ chief executive Shayne Elliott predicts the pace of home loan growth will slow by roughly half to an all-time low, as an “extraordinary” boom in mortgage debt over the past three decades comes to an end.

As the ANZ chief executive Shayne Elliott predicts the pace of home loan growth will slow by roughly half to an all-time low, as an “extraordinary” boom in mortgage debt over the past three decades comes to an end.

Mr Elliott also underlined the tighter credit conditions facing customers, saying the maximum amount banks would lend an average household for a mortgage had fallen by about $110,000 or 20 per cent in the last three years.

“We’ve had 30 years where home lending has grown, for most of that, double-digit every year, and more recently at 5-6 per cent. That’s an extraordinary market growth over a period of time, and we’ve all become used to it, we just don’t think that’s sustainable. We think that that will be much more subdued,” Mr Elliott said on a call with journalists.

“The reasons are house prices are already high, households already carry reasonable levels of debt, so it’s hard for people to borrow even more. And remember what fuelled a lot of the ability of people to borrow has been lower interest rates,” he said.

“All of those things kind of conspire to say the outlook will be softer.”

“All of those things kind of conspire to say the outlook will be softer.”

In an illustration of tighter lending practices, Mr Elliott said an average Australian household with an income of $110,000 could theoretically borrow up to about $550,000 three years ago, but this maximum had now fallen to $440,000 for the same household.

“The reason for that is all of the myriad of changes that banks and regulators have made around borrowing capacity,” he said.

Reserve Bank of Australia figures on Wednesday also showed housing credit growth dipped to a five-year low of 5.2 per cent in September, with lending to housing investors was at a near standstill. Housing credit growth has not fallen below 4.4 per cent a year, which it hit in 2013, in the 40-year history of the RBA statistics.

So what’s the knock on effect?

Well, finance has and always underpin the opportunity to buy residential housing and if across the board, everyone has $100,000 or so less in borrowings (and this is further exacerbated by those with far greater borrowings already) then it has to have an impact.

And it is!

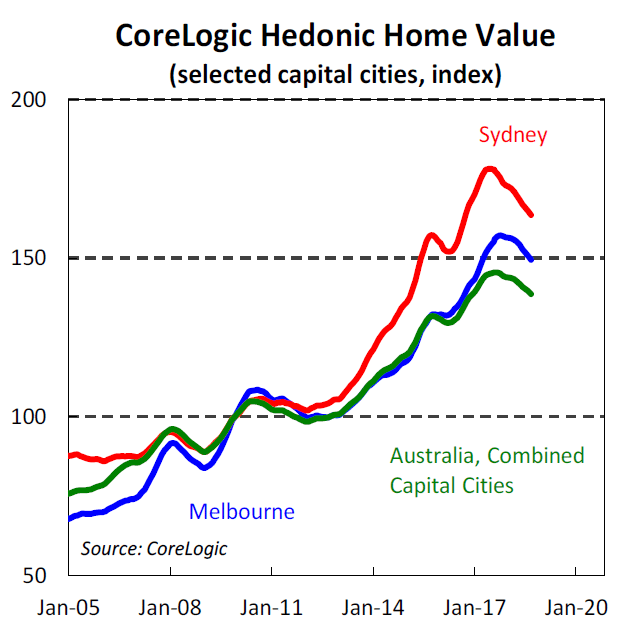

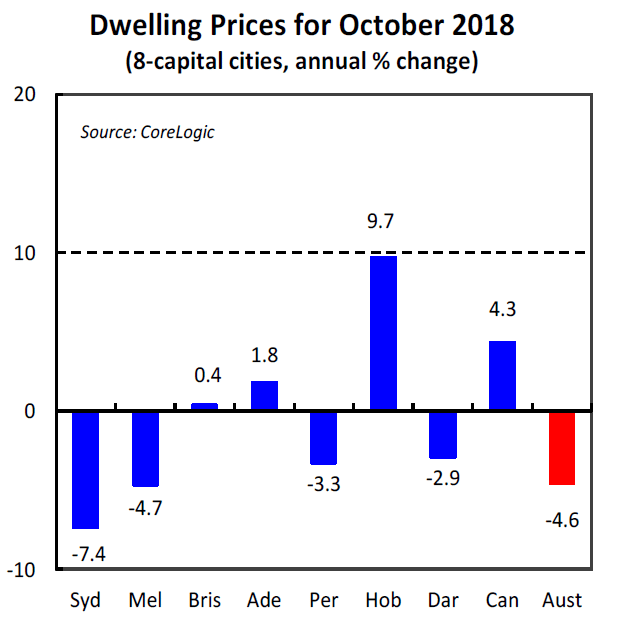

As the latest data just released from Core Logic show, the ability to get (or not get) finance is having a direct impact on our housing markets.

The trend is clear but whilst we can focus on the retraction, what about the growth recorded over the 6 years prior? I don’t hear too many commentators saying that they wouldn’t accept 70% growth and give back, let’s say 5-10%.

So those that are already invested have enjoyed strong capital growth already and now, as with every cycle, we are having a breather.

Remember, property is a long term play

Sure, some of us are saying a price retraction but don’t panic and values have always gone up and down in every cycle.

Sure, some of us are saying a price retraction but don’t panic and values have always gone up and down in every cycle.

We recently wrote about the differences in bank values.

Property is too expensive to trade with the high buying and selling costs and any of these changes only really matter if you are selling or liquidating, otherwise “hang on” and enjoy the journey.

Great opportunity for home upgraders

When markets do normalise — Yes normalise, it’s a better word than correct — it normally provides those people in the market looking to upgrade their family home or residence as the entry level to the dearer property is lower.

Now I hear you say but so is the sale cost of your existing place and this is true. But if you are say looking to upgrade from a $500,000 property to say a $1 million dollar property and both have come off 5%, then whilst you have lost $25,000 from your sale price, you more than pick this up on the purchase with this property worth $50,000 less. That’s like a $25,000 bonus!

And remember also, you pay stamp duty and other buying costs on the purchase figure, so if this is lower, then there is an obvious associated benefit.

The force of the 1st home buyers

As recent market statistics have shown, in a very short period of time, first time buyers have re-entered the market with a bang with stats showing these buyers now represent 18% of the market versus only 13% 6 months ago as we recently wrote about.

So whilst it is more difficult for investors at present, our younger generation are cashing in and enjoying the opportunity to buy good property at a slightly lower value and without the competition of the investors.

We are clearly seeing an uptick in this activity in enquiry and many 1st time buyers now actively looking to get involved in the market for the first time.

But 1st time buyers still need to be wary and make sure they have done their due diligence, got a pre-approval in place and are ready to take the “leap of faith”.

I often get asked “is now a good time to buy” and the reality is, and has always been, that the right time to buy is when it is right for you. No, not trying to time the market but invest as your home or investment, when you can and not trying to trick yourself into thinking that you are getting a bargain.

As the great investment mogul — Warren Buffet — always says “Be fearful when others are greedy and greedy when others are fearful”.

It seems our 1st time buyers are heeding Mr Buffet’s advice.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.

- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026