Forecasting for our housing markets

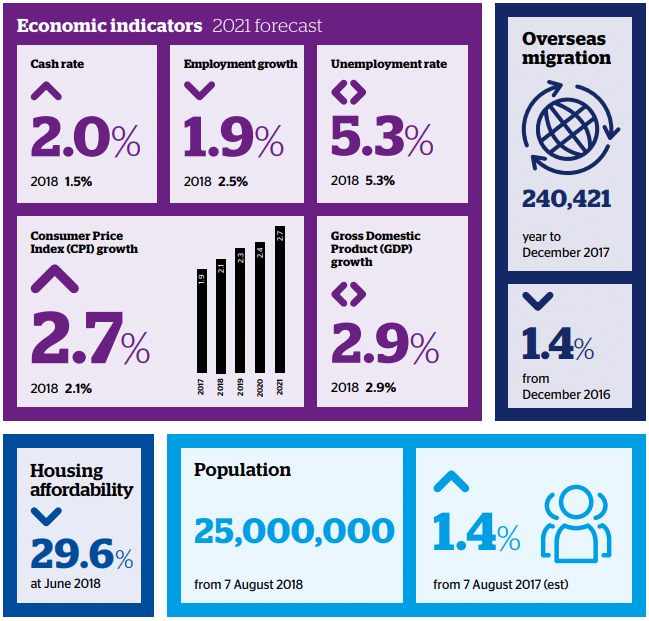

The annual QBE Australian Housing Outlook for 2018-2021 has just been released and have shown some very interesting statistical data that should enable us to look at and invest with confidence in the coming year.

It’s always interesting to look at statistical evidence and data just to see where our leading economists and experts see our current markets and also the future. So a lot of the information that follows is their analysis and commentary around how Australia looks today and “may” look in 2021. Again, remember, as with any forecasts, it is just people’s opinion, formed with data, on where we may be. No one has a crystal ball and no one definitely knows but this is some food for thoughts with comments on each of the major markets.

And, where in the space of 1 year FOMO (Fear OF Missing Out) has quickly been replaced by FOBE (Fear Of Buying Early), hopefully some of this information will reassure everyone, that we are in quite a normal market so please don’t listen to all the sensationalistic journalists trying to sell a story and let’s focus and good long term growth prospects with some balance in our conversations.

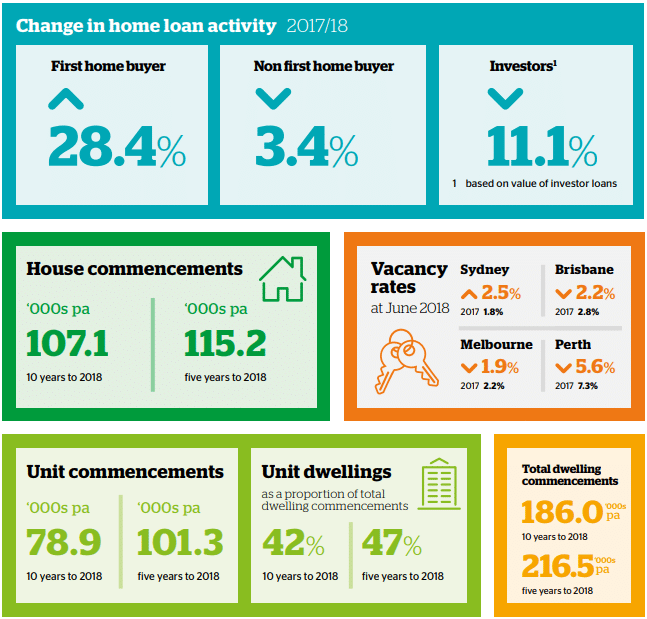

But let’s first have a look at what’s happened over the 2017/2018 year. There is a clear move away from investors based on all the regulatory interventions that have been imposed upon our investors. But whilst they have seen a decline in their buying, it is clear to see that our first home buyers are back with a vengeance.

1st time buyers are no longer having to compete with investors – largely due to regulatory restraints imposed – and therefore are having more success in purchasing at present. We are seeing a clear change in this as well.

But don’t discount our investors.

The markets are just normalising and investor grade clients are still able to access borrowings, just as they did before, however there is just less of them. Between the regulators and peoples exuberance, potentially at their detriment, access to funds that may have previously been available, are now more difficult to access.

Again, as I said, this is quite a normal part of every cycle, with most cycles in property previously having been slowed (or halted) by the access to funds/finance and this time is really no different. It’s just that our regulators are being pro-active in trying to stop a “shock” event by slowing the market in a balanced way.

Let’s look at the markets:-

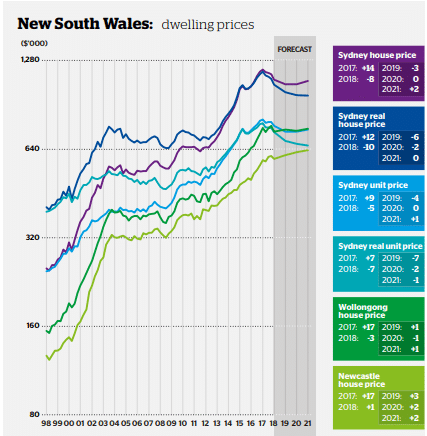

Sydney — NSW

Sydney house market Limited supply, a low interest rate environment and robust investor demand led to strong price growth in Sydney over the five years to June 2017.

Market conditions

The median house price peaked at $1,194,800 over this period, growing by a cumulative 84% (or roughly 13.0% per annum). However, supply is now rising. Annual dwelling completions in New South Wales (NSW) over the two years to June 2018 were 113% higher than the 10 year average between 2006 and 2016, and the NSW dwelling shortage has begun to fall sharply through 2017/18. In Sydney, vacancy rates have increased to 2.5% as at the June 2018 quarter, up from 1.8% 12 months earlier.

The increase in vacancy rates has been most significant in the middle ring suburbs where the vacancy rate increased to 2.8% in the June quarter – the highest level since September 2012. This comes as the middle ring suburbs have experienced the greatest increase in new apartment supply through this cycle.

The increase in vacancy rates has been most significant in the middle ring suburbs where the vacancy rate increased to 2.8% in the June quarter – the highest level since September 2012. This comes as the middle ring suburbs have experienced the greatest increase in new apartment supply through this cycle.

An uptick in dwelling completions and slowing population growth have reduced upward pressure on prices. Together with tightened credit conditions, house prices declined in 2017/18 for the first time in six years. The Greater Sydney median house price at June 2018 was $1,103,500, representing a 7.6% decline on a year earlier.

After seeing the strongest price growth in the 12 months prior, the inner and middle ring suburbs of Sydney have seen the largest fall in prices over 2017/18 (falling by 8.1% and 10.6% respectively).

Outer Sydney saw a more moderate decline of 2.8% over the same period, which was likely supported by its relative affordability appealing to first home buyers.

Outlook

Record dwelling completions are expected in 2018/19 with a strong pipeline of apartment construction likely to keep total completions elevated. Softness in the apartment market will have flow on effects for housing by both keeping potential buyers in rental for longer, as well as encouraging potential buyers to opt for an affordable apartment over a house.

The combination of increasing numbers of apartments coming online, weaker underlying demand, an out-of-cycle interest rate rise in August 2018 and weaker investor activity is expected to cause a further fall in the median house price of 3% over 2018/19. Prices are expected to bottom out over 2019/20, around 11% below the market peak in 2016/17. The impact of slowing supply is likely to cause the market to tighten over the following year, with forecast 2% growth to take the median house price to $1,090,000 by June 2021.

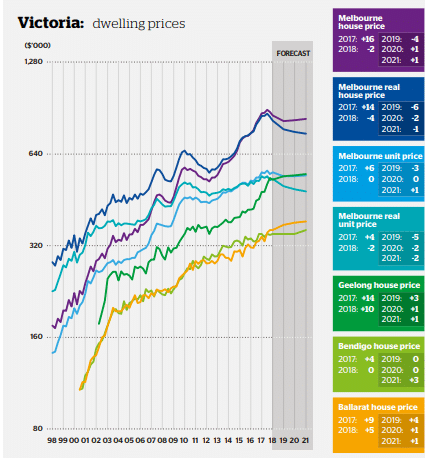

Melbourne — Victoria

Melbourne house market

Melbourne house prices increased by 69% over the five-and-a-half years to December 2017, although prices have recently started to retreat. Strong population growth, a dwelling deficiency and falling interest rates have been key drivers of this upturn, with solid economic conditions and employment growth maintaining a positive purchaser sentiment.

Buyer activity

Buyer activity

House prices increased at a much stronger rate than the unit market, which has been affected by oversupply. Since the start of the year, with upgrader and downsizer activity starting to taper, and a decline in investor activity coming through, the median house price declined by 4.3% over the six months to June 2018.

Investors were a significant component of the upturn, encouraged by tight vacancy rates and low interest rates. Prices increased across the metropolitan region, with the strongest growth rates recorded in the inner and middle ring suburbs over the five-and-a-half years to December 2017.

Initially, the inner and middle ring suburbs performed better than the outer ring suburbs, but since the beginning of 2015/16, median house prices have increased most in the outer ring suburbs.

Melbourne has benefitted from strong growth in first home buyer activity due to increased stamp duty concessions from 1 July 2017. Although house prices have been declining since the start of 2018 across the metropolitan area, the more affordable outer suburbs have maintained their prices since the start of the year, with very minor declines recorded.

The biggest falls, which have caused the decline in metropolitan median house prices, have come from the inner and middle ring suburbs. There was a 24% decline in prices in Inner ring Melbourne.

The biggest falls, which have caused the decline in metropolitan median house prices, have come from the inner and middle ring suburbs. There was a 24% decline in prices in Inner ring Melbourne.

This was the result of mainly lower value houses transacting particularly in City of Melbourne and City of Stonnington, and highlighting the difficulty in selling higher value houses in the current market.

While first home buyer activity is strong, non-first home buyer loans have reduced slightly since the end of 2017 and investor demand has been steadily trending downwards as credit conditions continue to tighten.

Outlook

Weaker investor demand and the easing in non-first home buyer demand appears to be having an influence on the Melbourne market. With affordability already strained in Melbourne, the recent out-of-cycle increase in interest rates is also likely to have some impact on demand. By the June quarter in 2019, the median house price is expected to fall to $820,000, which is around 8.4% lower than the December 2017 quarter median.

Population growth is expected to slow over the next three years. This will suppress construction activity and contribute to restrained price growth. Once the stock deficiency starts to rise from 2020/21, house prices are also expected to start rising. Economic growth is also forecast to accelerate as further new dwelling activity is triggered and business investment begins to improve after being subdued. Continuing affordability challenges means that any upturn is likely to be modest, and by the end of 2020/21, the median house price is expected to remain lower than the median price as at June 2018.

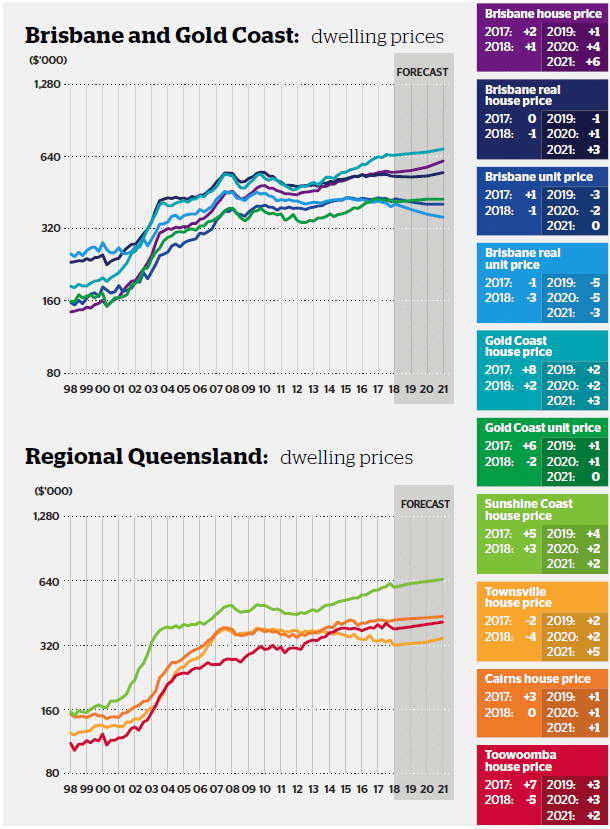

Brisbane — Queensland

Brisbane house market

Brisbane house market

The Brisbane market has been relatively subdued in comparison to the other major east coast capital cities. Brisbane remains affordable in comparison to Sydney and Melbourne, which is likely to continue to support buyer demand.

Median house prices

Over the four years to June 2016, median house price growth in Brisbane averaged 5% per annum, while through 2016/17 and 2017/18, price growth eased to just 1% per annum. Rising supply appears to be having a dampening effect on prices in the city.

In aggregate, the Brisbane market is in oversupply although this is largely expected to be concentrated in the unit sector, with the detached housing market close to balance or in slight undersupply. Across metropolitan Brisbane, vacancy rates vary and are significantly higher in Inner Brisbane and lower in Outer Brisbane, which suggests that the housing market is tightening while the unit market is in oversupply.

However, vacancy rates across Greater Brisbane have trended downwards, which may suggest higher migration flows are occurring and/or more attractive rents are enticing people into the rental market. House price growth has been positive (2.9%) in the more affordable Outer suburbs of Brisbane over the year to June 2018, with a modest decline of 0.8% occurring in Middle Brisbane, and a greater 2.9% decline in the higher-priced Inner Brisbane.

However, vacancy rates across Greater Brisbane have trended downwards, which may suggest higher migration flows are occurring and/or more attractive rents are enticing people into the rental market. House price growth has been positive (2.9%) in the more affordable Outer suburbs of Brisbane over the year to June 2018, with a modest decline of 0.8% occurring in Middle Brisbane, and a greater 2.9% decline in the higher-priced Inner Brisbane.

Population growth in Queensland has been strengthening, with a reduction in net overseas migration being offset by stronger net inflows from other states. Migrants from overseas have a higher propensity to reside in inner city units, while those from interstate are more likely to support demand in the detached housing market in Brisbane’s suburbs.

New dwelling completions in Queensland have increased markedly in recent years, with average completions in the four years to June 2018 up by 37% compared to the previous four-year period. Although supply has increased primarily for units, there has also been some increase in house completions.

Outlook

The local economy looks to be improving with the impact of declining resource sector investment beginning to subside, and a number of industries, such as the tourism and education sectors, receiving a boost from a lower Australian dollar.

Notably, affordability remains significantly more attractive than in Sydney and Melbourne. Nevertheless, a rapid acceleration in prices is not expected until the oversupply in apartments is absorbed. Competitive unit rents and prices due to the oversupply may encourage some potential first home buyers to remain as renters, or alternatively preference an apartment purchase over a house. The Brisbane median house price is expected to see cumulative growth of around 11% over the next three years, reaching $615,000 by June 2021. The strongest price growth is expected to occur at the end of this period, once the oversupply in the unit market is absorbed.

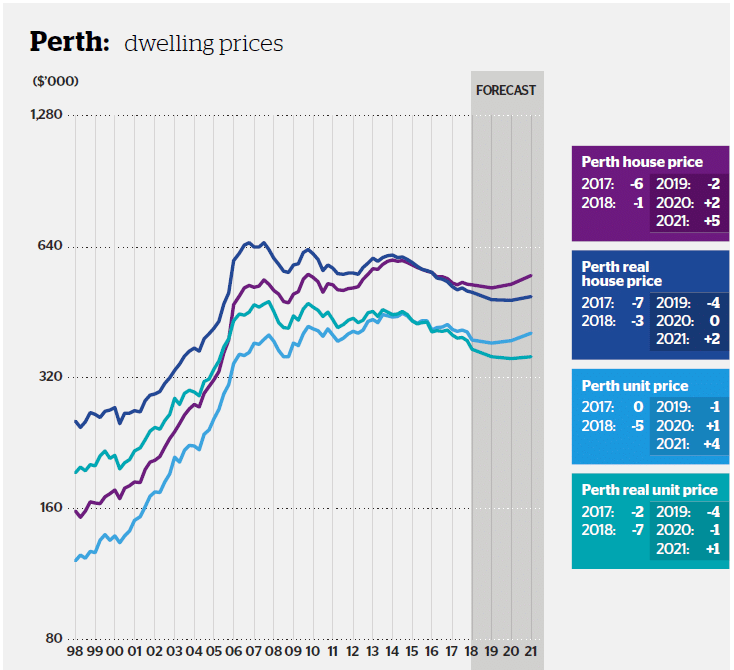

Perth — Western Australia

Perth house market — Median house prices

The decline in house prices in Perth over the past four years began to slow in 2017/18 as the collapse in resource sector investment bottomed out, and signs of population growth recovery began to emerge.

Perth’s median house price has fallen by a cumulative 12% since peaking in the June2014 quarter.

Demand and supply

Demand and supply

After the slump in mining investment, the unemployment rate in Perth peaked at 7.5% in March 2017. However, by June 2018, the unemployment rate had improved to 5.7%, assisted by many transient mining industry workers returning to their country or state of origin. Small improvements in both overseas and interstate migration occurred in 2017/18, flowing through to increasing population growth.

Still, the deterioration in population growth occurred just as new dwelling completions were increasing. A significant surplus of stock emerged in 2016, and the market has remained oversupplied since then.

Rents in Perth are now 19% below the June 2014 peak. This appears to be attracting tenants, with Perth’s vacancy rate of 5.6% in June 2018 being down from a peak of 7.3% 12 months earlier.

Outlook

Although the outlook for the state economy has become more positive, the dwelling surplus in Perth looks set to remain in place for some time, and it appears that the market is beginning to retreat again. After the decline in owner occupier lending flatted out in the six months to December 2017, there has been a 12% year-on-year decline in the first seven months of 2018. A further 2% decline in the median house price is forecast over 2018/19, before modest price growth begins to re-emerge in 2019/20 and 2020/21. By June 2021, the median house price is expected to reach $550,000 (5% higher than June 2018 levels).

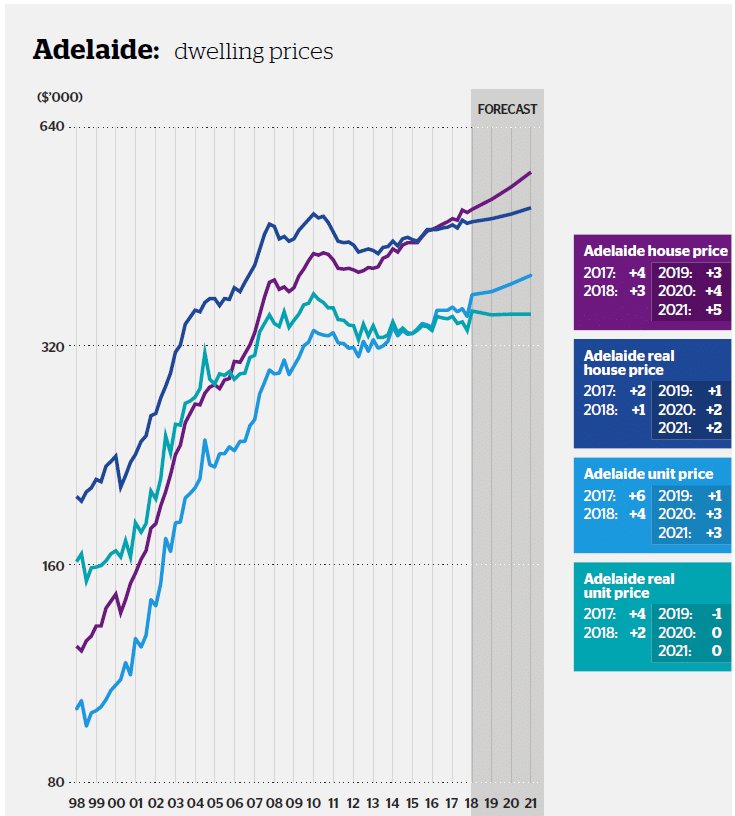

Adelaide — South Australia

Adelaide house market

In Adelaide over the past few years there has been consistent moderate house price growth. This has been underpinned by low interest rates and relatively positive affordability compared to other capital cities, despite the difficult economic conditions. Adelaide’s median house price grew an average of 3.8% per annum over the five years to June 2018.

South Australia is currently facing a period of challenging economic conditions. The key manufacturing industry is suffering from low cost overseas competitors, while the automobile manufacturing industry shut down in 2017 which also impacted local suppliers. In addition, public investment has fallen back after a number of major engineering construction projects have been completed.

South Australia is currently facing a period of challenging economic conditions. The key manufacturing industry is suffering from low cost overseas competitors, while the automobile manufacturing industry shut down in 2017 which also impacted local suppliers. In addition, public investment has fallen back after a number of major engineering construction projects have been completed.

The price rises have been despite an 11% decline in investor activity in 2017/18 – its lowest level in more than four years. Total owner occupier loans in 2017/18 were only 3% below the previous year, with growth in first home buyers more than slightly offset by weaker demand from other owner occupiers. Median house price growth slowed only marginally to 3% in 2017/18, leaving the median house price at $493,900.

New dwelling supply

Since 2014/15, completions have remained elevated and there exists a significant number of dwellings still in the pipeline. As a result, the South Australian market developed an oversupply in 2015/16 which is projected to continue to increase as new supply remains elevated. It is estimated that the oversupply is concentrated in regional South Australia, although vacancy rates in Adelaide started to edge up in June quarter 2018 to 2.3%. Further upward movement in the vacancy rate is expected in the short term as completions remain high.

Outlook

The conditions that supported the moderate price growth in Adelaide in recent years are forecast to continue, and even slightly improve. Prices remain relatively affordable and the rate of population growth is expected to improve (albeit remain modest). South Australia’s unemployment rate has improved from 7% in June 2017 to 5.6% in June 2018, with some upside coming from greater defence and infrastructure spending.

Dwelling commencements are beginning to ease and should remain suppressed for some time as the current excess of dwelling stock is progressively absorbed.

Overall, Adelaide’s median house price is forecast to grow by 12% over the forecast period to reach $555,000 by June 2021, which will be a similar rate of price growth (4% pa on average) to that seen in recent years.

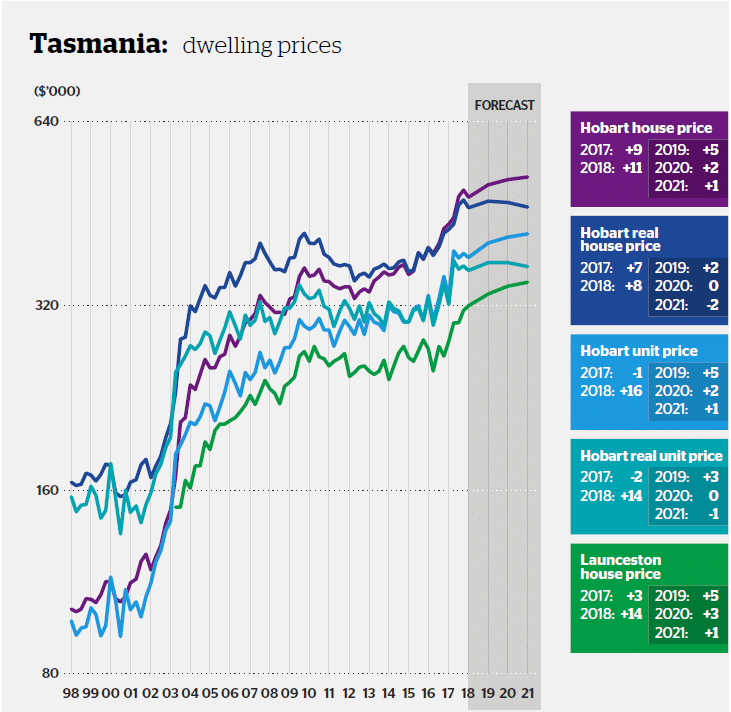

Hobart — Tasmania

Hobart house market

Hobart has witnessed the fastest growing property prices across all the capital cities in Australia, for both houses and units over the last three years.

Median house price

Median house price

House prices have increased by a third over the last three years. Even after this increase in prices, Hobart retains the lowest median house price of the state capitals. Its affordability advantage has been a key driver of interstate migration from increasingly strained affordability in Melbourne and Sydney.

Hobart’s median house price increased by 10.6% in 2017/18, bringing the median house price to $481,800 at June 2018. Price growth was strongest in Brighton (17.3% growth over the year) and Glenorchy (14.5%), while Hobart City had the weakest growth rate of all the metropolitan area regions (6.3%), suggesting that demand is spilling out to the more affordable regions.

Demand

In previous cycles, net interstate migration inflows have mainly come from ‘tree changers’ downsizing from the more expensive Melbourne and Sydney markets.

However, the current inflow is largely coming from a younger demographic, suggesting this population seeks refuge from higher prices on the mainland.

However, the current inflow is largely coming from a younger demographic, suggesting this population seeks refuge from higher prices on the mainland.

The Tasmanian economy has improved in recent years. A lower dollar has underpinned a booming tourism sector and given a boost to the agricultural sector, which competes in the niche high-value export markets.

The demand for dwellings has been relatively strong, outstripping new supply.

Vacancy rates have decreased from around 5% in the middle of 2012, to just 1.7% in the June 2018 quarter.

Outlook

Given the relatively strong rental market, alongside the recovery in the Tasmanian economy and continued population growth, house prices are expected to continue growing in the short term.

Hobart’s median house price is expected to rise by 4.8% in 2018/19, and then slow down as projects under construction are completed, which will begin to reduce the Upward pressure on prices.

By June 2021, Hobart’s median house price is expected to reach $520,000, almost 8% higher than current levels.

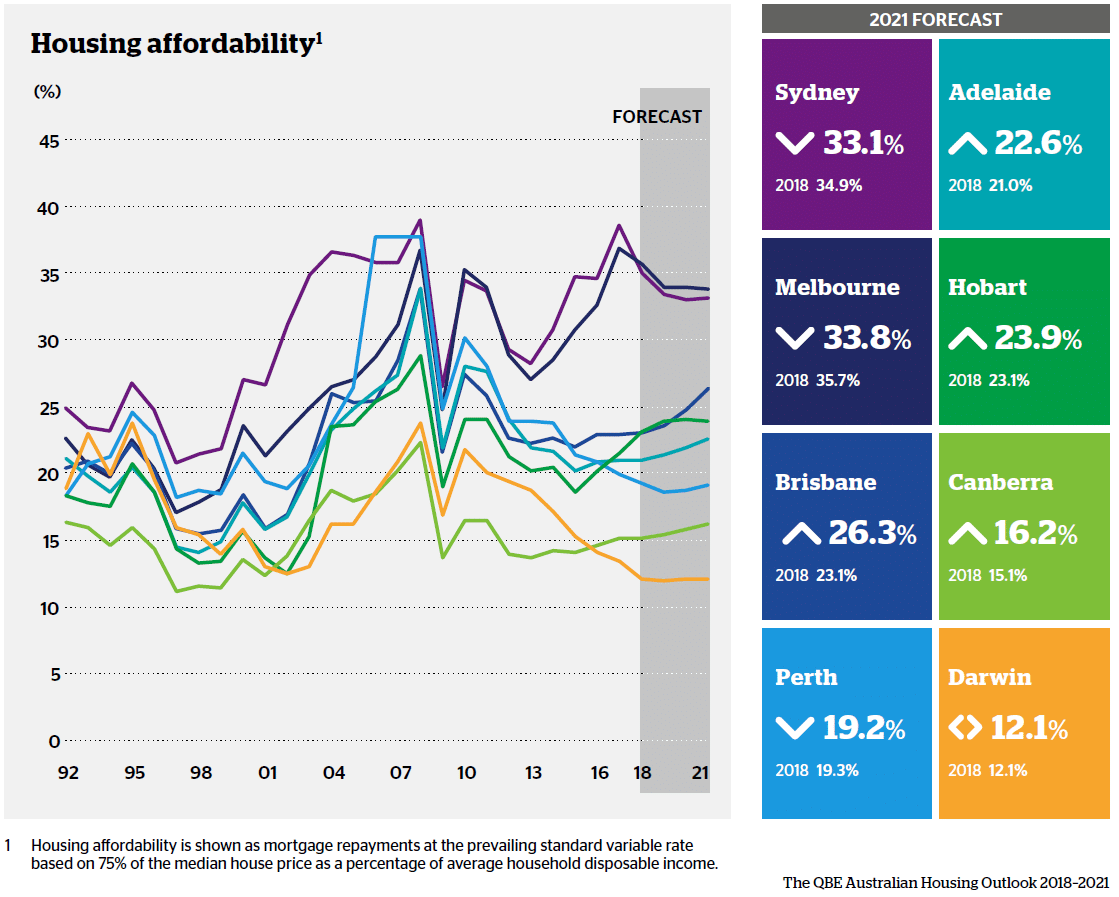

Housing affordability — What does this look like?

While demand and supply are an important influence on prices and rents, there is an upper limit on how much of a household’s income can be spent on mortgage repayments. As it becomes more difficult to service a mortgage, further property price growth becomes less possible unless incomes rise, spending habits change or interest rates reduce sufficiently to make purchasing more affordable.

While demand and supply are an important influence on prices and rents, there is an upper limit on how much of a household’s income can be spent on mortgage repayments. As it becomes more difficult to service a mortgage, further property price growth becomes less possible unless incomes rise, spending habits change or interest rates reduce sufficiently to make purchasing more affordable.

In Sydney and Melbourne, the level of affordability (as measured by the ratio of mortgage repayments to average household disposable, or after tax, income) reached its worst point in 2016/17 at a similar level to 2008, when variable interest rates were much higher at 9.6%. At this level any increase in mortgage repayments (i.e. higher interest rates, or conversion from interest only loans to principal and interest) is likely to leave some households in distress. With prices declining in 2017/18, affordability levels have improved, but remain elevated.

Affordability outside of Sydney and Melbourne is much better. Canberra has seen affordability levels deteriorate to a degree after witnessing strong price growth. Brisbane, Adelaide and Hobart affordability levels have only deteriorated slightly in recent years, while large price reductions in Perth and Darwin have made purchasing a dwelling much more affordable and affordability is at levels last seen in the early 2000s.

Outlook

Affordability over the next three years is likely to be most influenced by price movements. In Sydney and Melbourne, without major price declines or significant growth in income, affordability will not improve significantly and these markets will remain vulnerable to rises in interest rates, as the most recent purchasers may have stretched themselves to buy their dwelling.

The situation in the other capital cities, which currently have affordability ratios under 23% in 2017/18 (compared to 34–36% in Sydney and Melbourne) are expected to remain around current levels over the next three years. The exception is Brisbane, where stronger forecast price growth by 2019/20 and 2020/21 will likely lead to deteriorating affordability levels, although affordability will remain attractive relative to previous periods in the mid-late 2000’s.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.

- Common mortgage mistakes first‑home buyers still make in 2026 - January 5, 2026

- 2025 review: rate cuts, record prices and the rise of the first-time buyer - December 11, 2025

- Offset accounts and split loans: How they work and when they save you money - December 9, 2025