2019 – The best and worst of market times

No one would argue that 2019 was a year of market ups and downs.

In fact, those words probably should be the other way around, with markets in many locations less than rosy at the start of this year.

I’ll even go further and quote from Charles Dickens, because this year really has been the best of times and the worst of times!

We kicked off 2019 with property prices falling in Sydney and Melbourne, and mostly not doing much else anywhere but Hobart.

Some of the reasons why markets were clearly a bit “depressed” were a number of competing forces that were dragging them down.

Bad news aplenty

The first was the flow-on effect of tighter lending conditions, which began a year or two before.

As the screws continued to be turned on borrowers who suddenly no longer made a lender’s financial cut, markets were clearly going to soften further.

As the screws continued to be turned on borrowers who suddenly no longer made a lender’s financial cut, markets were clearly going to soften further.

This was having a major impact on the one thing (and often the biggest thing) that impacts all markets, and that’s consumer sentiment. Yes, sentimentality is a major and significant matter that affects all humans alike. If you feel good and are confident, you will borrow, purchase & buy property (amongst other things).

But conversely, if you aren’t feeling good about things, then you do the opposite and that was what was impacting our markets.

On top of that, we had the release of the Royal Commission report in February, which did nothing to inspire confidence in our major banks or the sector generally.

And to be just a little selfish for the moment, based on the findings about mortgage brokers, it certainly didn’t do anything to inspire us to make any big decisions with the uncertainty the RC created.

However, nearly a year on from the report, it’s not surprising that not much has been done about some clearly underhanded practices. Even worse, our banks have basically walked away from this unscathed… was this really the point of the exercise?

However, nearly a year on from the report, it’s not surprising that not much has been done about some clearly underhanded practices. Even worse, our banks have basically walked away from this unscathed… was this really the point of the exercise?

Indeed, each day seems to produce more unsavoury media titbits about some big lenders being caught out doing something they shouldn’t have been.

Then, we had the shemozzle that was the Federal Election, which saw Labor stick to its negative and poorly costed property polices to Australians with a singled minded approach of “take it or leave it”, which ultimately proved to be part of its undoing. Yes, thank god we won’t see any more of that vision of poor old Bill Shorten running, now that was political suicide!

Scott Morrison did an amazing job to win the unwinnable election. And this all of a sudden seemed to be the trigger, Yes, some good news was around the corner, especially for property investors where negative gearing was taken off the table.

But there has been a plethora of good financial news that saw all our property frowns turn upside down.

Good news returns

In June, the Reserve Bank cut the cash rate for the first time in nearly three years and then turned around and did it again in July.

However, with the economy sluggish and prices falling in our two biggest cities, it probably would have been more effective to have cut it by 0.5 percentage points in one hit rather than staggered over two months if you ask me. I questioned the decision makers at the time – and still do.

However, with the economy sluggish and prices falling in our two biggest cities, it probably would have been more effective to have cut it by 0.5 percentage points in one hit rather than staggered over two months if you ask me. I questioned the decision makers at the time – and still do.

By September, the Reserve pulled the rate cut trigger once again with our cash rate falling to an extraordinary low of 0.75 per cent.

The month before, the financial regulator also started to ease servicing rates for loan applications, which had been the most serious impediment on borrowers.

So all of a sudden we had home loans rates in the very low 3’s and a far accommodating servicing position and this has resulted in a mini rebound in our housing markets. And it was first home buyers that have driven this and taken advantage of these changes – they are the new force!

So, it doesn’t take Einstein to see that all of these positive levers being pulled in the same direction at the same time would kick-start markets and confidence levels.

Of course, that was the intention all along, given jobs and wages growth was non-existent so people were spending, well, not much at all.

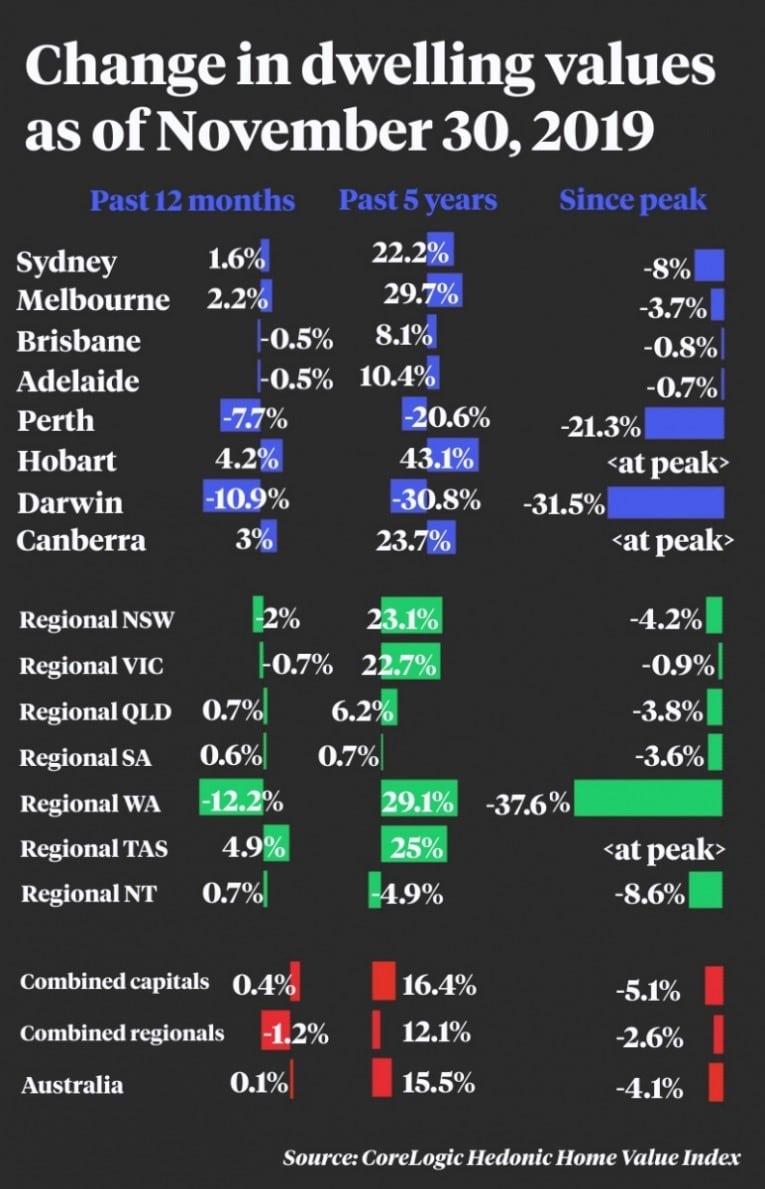

Since then, there is no doubt that Sydney and Melbourne markets have roared back into life.

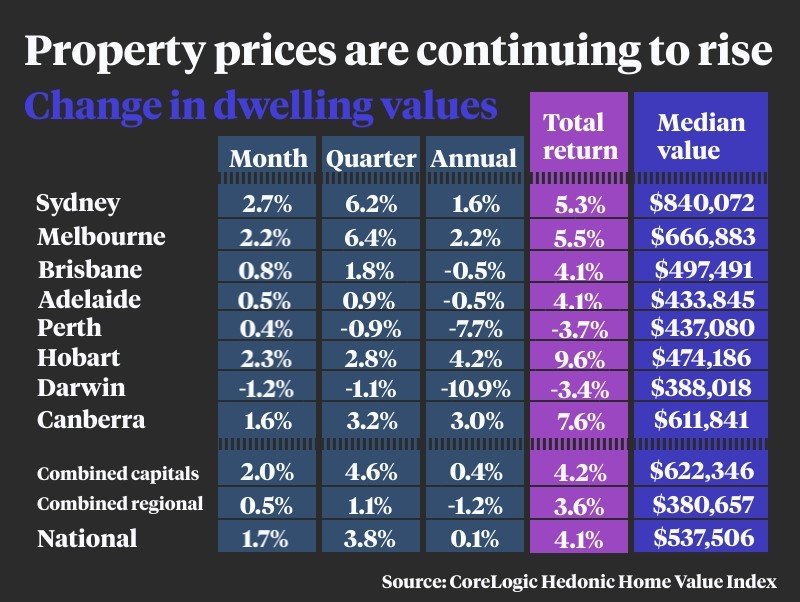

CoreLogic’s latest national Home Value Index surged 1.7 per cent higher over November to deliver the fifth consecutive monthly increase.

The data also shows it was the largest monthly gain in the national index since 2003.

The median dwelling values in Melbourne and Sydney have increased by an impressive 6.4 per cent and 6.2 per over the past quarter, with prices firming in Brisbane, Adelaide and Canberra, too.

Lending to owner occupiers and to first home buyers have surged over the past six months in particular, which is also adding to a much better property picture than what we started the year with.

Time will tell whether these results are sustainable — or perhaps the tail-end of boom conditions that were artificially halted by the handbrake actions I mentioned at the outset of this article.

One thing’s for sure, though, the lending environment and our property markets are in much better shape than they were this time last year, so, I say bring on 2020!

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.

- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026