What does comparison rate mean for home owners?

Whether you’re a first-time home owner or a seasoned investor, we all want to find the best deal for our mortgage. With an abundance of lenders and loan types paired with the complicated jargon and hidden fees involved with financial services, it is difficult to find the loan that best suits you. When you’re researching home loans, your understanding of what a ‘comparison rate’ is will be your greatest weapon.

So what is a comparison rate?

A comparison rate is a legal requirement from banks and lenders in Australia. It offers a single percentage value based on a combination of the interest rate and fees related to the loan. The lowest interest rate advertised by a lender is not necessarily the best for value which can often be misleading to consumers. This law was put in place because to help consumers steer clear of hidden costs. It helps you identify the true cost of a home loan and make an informed decision accordingly.

How is it different to an interest rate?

It is near impossible to compare home loans that offer different interest rates and fees. The interest rate is simply the percentage of your loan that you’ll be paying on top of the principal amount. The comparison rate is different because it offers a more comprehensive reflection of overall costs of the loan – providing you with the bigger picture.

When you’re comparing different loans, you should really be paying attention to the comparison rate rather than the interest rate. If you don’t you could find yourself stung with a poor and more expensive mortgage decision.

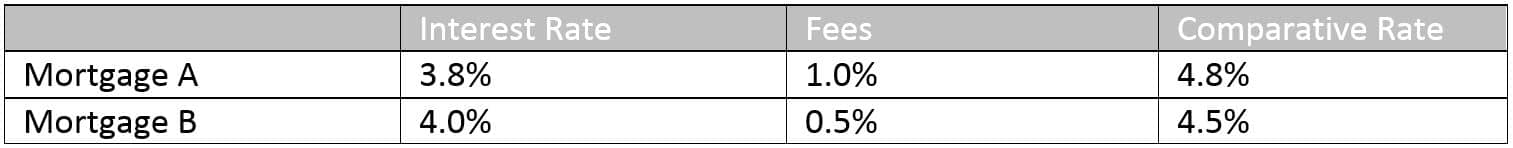

Take the example below for instance:

If we were to look at interest rates alone, Mortgage A would seem like the clear choice when in fact, you’ll be paying less overall if you go with Mortgage B.

What’s included in the comparison rate?

The comparison rate offers the value for a number of costs associated with a home loan.

These include:

- The Interest Rate – the annual percentage rate you will be charged of the amount you owe to the lender.

- Fees – Lenders can charge a monthly account fee for your mortgage

- The amount of the loan – this is a bit of an obvious one, but because the amount of interest you’ll pay depends greatly on the amount you owe, the loan amount is a necessary detail in calculating the comparison rate.

- The loan term – the longer the loan term, the more interest you will pay which of course means a higher comparison rate. If you want to lower your regular repayments, make sure your lender knows how much longer you want to extend the term of the loan so you know exactly how much extra you’ll incur.

- Repayment Frequency – the interest you’re paying changes every time you make a repayment. If you are lowering the principle amount weekly rather than monthly, you’ll incur less interest and this will affect the comparison rate.

What is not included in the comparison rate?

It is also important not to assume that every single cost associated with home-ownership will be included in comparison rates.

Comparison rates exclude the costs of:

- Stamp duty

- Conveyancing fees

- Late payment fees

- Break costs or early termination fees

- Deferred establishment fees

- Redraw fees

When you’re deciding on the right home loan, your understanding of key terminology and getting your facts straight could save you thousands of dollars in the long run. The best way to understand what’s out there and what suits you best is to chat with the experts. The award-winning team at Intuitive Finance have worked with a range of customers, from first home buyers, homeowners looking to upgrade, sophisticated investors with extensive property portfolios, Australian expatriates living and working overseas and self-employed business owners. Get in touch today to find out which loan suits you.

Further Reading

For more information on comparison rates and finding the right home loan consider the following resources:

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.

- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026