5 Great Tips for Making the Most of Lower Interest Rates

In this current climate of low interest rates, I wanted to share with you 5 great tips to maximise the impact of these low rates on the finance structures that support your portfolio.

1. Complete a full review of your current facilities:

In a low interest rate environment with the prospect of further rate reductions, people tend to be complacent. They think they’re on the best deal. Only recently, I was talking to a Medical Professional who has quite a substantial property portfolio, and he thought that his current rate of 4.8% was as good a deal as he could expect to find in the market. When I told him he was probably about half a percent out of the market and the resulting impact on his portfolio of approximately $3 million dollars meant that he was missing savings of around $15,000 a year he realised that he needed to review his facilities and consider a change.

For smaller valued portfolios the savings will obviously be less but even a saving of $100 a month could be the difference between you either starting or adding a new investment property to your portfolio so please undertake a review. The banks are actively competing for your business and now is a great time to recast your financial structures – be it for accessing investment funds or reducing your monthly exposure.

2. Gear your repayments now as if rates were higher:

The second point is, if possible, you should gear your repayments schedule at an assumed higher home loan rate. To illustrate, using today’s market rates of anything between 4.5% and 4.7%, this would mean gearing your repayments at assumed rates of 6%, 7% or even 8%. Rates aren’t going to stay this low forever and if you can afford to, higher repayments can help to either build a buffer or reduce your home loan liability and in turn build your equity.

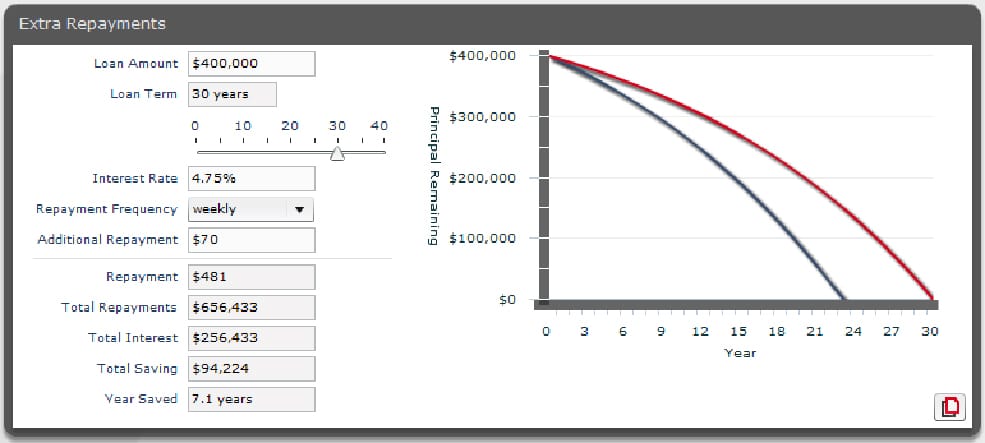

For example, if you currently have a $400,000 home loan at 4.75% you should be paying about $2,100 a month or $480 a week. If you “set” your repayments at a higher rate, such as 6% these repayments would be around $2,400 a month or $550 a week. The impact of paying this additional amount of $70 per week is significant.

3. Create an offset account

The third tip I encourage everyone to do is to set up an offset account. Offset accounts basically sit “beside” your mortgage so that any savings inside these accounts is included as a credit against your loan which in turn reduces the amount of interest you pay.

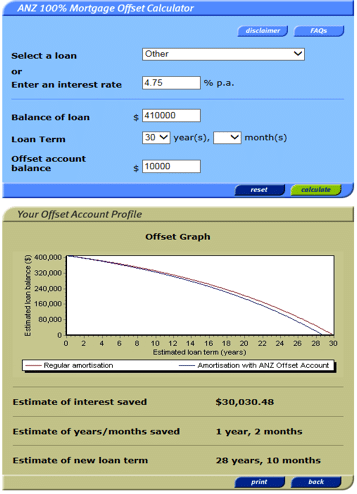

The example below shows the impact of an offset account of $10,000 sitting against a mortgage of $410,000 across the life of the loan. Paying interest only on the differential saves you over $30,00 in interest and over a year of the loan term

The bottom line is that, if you don’t have an offset account, you need to get one!

4. Don’t take on bad debt

The next tip is to try as hard as possible to avoid taking on bad debt – by that I mean debt taken on for expenditure on assets or activities that don’t generate wealth…like a new car, a boat or a lavish overseas holiday. Try and use existing cash for these – avoid taking on a personal loan, a high interest vehicle finance package or high credit card debt. In fact, if you can, take the opportunity now to remove any of these style of debts you have. With a little bit of discipline now you’ll be able to buy those things in the future by getting ahead on your home loan.

5. Fixed rate options

The final tip is to start thinking about your fixed rate options. Especially for those of you with large value loans or significant portfolios it’s important to note that, whilst rates are at an all time low, there may opportunities to fix your loans for both 3 and 5 year periods at well under 5%. Obviously there are individual circumstances to consider however everyone should be starting to at least explore their options and put a plan in place to look at establishing at least a portion of their loans at fixed rates.

Conclusion:

These are 5 great tips that will help you take advantage of today’s financial environment of low interest rates…..

- Undertake a review,

- Gear your repayments at a higher rate

- Set up an offset account

- Don’t take on bad debt and

- Start to take a look at the options of fixed rates for those of you with significant portfolios or larger value loans.

If you’d like any more information or want to talk to one of our brokers, please contact us here at Intuitive Finance via the website (intuitivefinance.com.au) or alternatively please give us a call or (03) 9598 8544. We’re more than happy to help.

About Intuitive Finance

The team at Intuitive Finance will listen to your needs, undertake a comprehensive review of your current financial position and then provide a clear, detailed and comprehensive investment strategy for you to put in place. We have written close to a billion dollars in loans and our team has access to over 500 financial products from more than 30 lenders covering a myriad of requirements – from home loans for repeat and first home buyers to first time and astute investors – and is perfectly placed to help guide you through the available options

Disclaimer:

The financial industry is a dynamic industry – continually evolving and changing. Whilst every effort has been made to ensure its accuracy, no guarantee is given that the information contained herein is currently correct. To the extent permitted by law, Intuitive Finance accepts no responsibility or liability for any loss or damage what so ever (including direct and indirect) to any person arising from the use or reliance on the information detailed here.