Stamp duty or land tax – what’s the best way forward?

The much-maligned stamp duty is facing extinction, albeit at an excruciatingly slow rate with the recent announcement from New South Wales that the state is seeking submissions on a plan to transition from stamp duty to a new property tax.

The Government has taken an opt-in approach, giving NSW property buyers a one-time chance to choose the option that best suits them and their situation.

And similarly, the Andrews Victorian government has floated this idea but not yet acted upon it.

Maybe Covid-19 has a silver lining after all that is now forcing all State Governments to look at and reform the way they earn their tax income and duties?

Like any choice of this magnitude, it is important to understand the long-term ramifications of each option and the pros and cons of each.

While specific details about the proposal(s) are yet to be provided, the discussion paper that accompanies the submission requests is comprehensive. So, let’s dive right and weigh up the options.

Long road to reform

In the 2009 Henry Tax Review, former Treasury Secretary Ken Henry identified stamp duty as a regressive tax that stymied housing turnover. His criticism of stamp duty extended to its inefficiency as a revenue generator combined with its “diabolical volatility” that prevented governments from being able to accurately forecast incomes from this tax. When housing is booming, revenue from stamp duty grows, but when housing dips, revenue slows to a trickle.

“You wouldn’t want to base a household income on the revenue generated by such a volatile system,” he said.

The case for reform is compelling. Stamp duty is a $40,000-plus line item that prevents older Australians from downsizing, leaving them in houses that are too large for their needs, while younger families remain in houses that are too small for them. It serves to discourage housing turnover when there are many benefits to encouraging turnover.

The tax punishes those who move more frequently than the average (once every 20 years) and means those who stay in one property for 20 or 30 years don’t contribute as often.

In its 2014 report on labour mobility, the Productivity Commission said stamp duty was one of the main barriers stopping people who’re considering moving.

Mr Henry told the ABC last year (2019) that changing this tax “would be a good reform for all of the states and all of the territories, it would deal with a lot of the volatility in their budgets but it would also be a productivity-enhancing reform.”

Boom slows action

However, the housing boom across Australia, particularly in the most populous states of New South Wales, Victoria and Queensland, has made it challenging for governments to seriously look at reform. There is little political will to tinker with a goose that delivers golden eggs. In 2011 the ACT received more than 25 per cent of its total tax revenue from stamp duty.

Part of the challenge has been how to reform this tax. It’s generally agreed that moving to a type of broad-based land tax would be a more equitable, more efficient way of collecting revenue.

Until now, only the ACT has been brave enough to tackle reform, in 2012 beginning a staggered, 20-year transition to a broad-based land tax.

In its latest budget, announced in November, NSW joined the ACT in the small club of jurisdictions committing to abolish stamp duty.

“Stamp duty is a tax from a bygone era,” NSW Treasurer Dominic Perrottet declared as he announced the state’s proposed new property tax regime, which would begin with an opt-in system. “This will be like the Netflix of property tax,” he added.

The proposed regime (if adopted) will be introduced gradually over decades, with buyers offered a one-off choice between stamp duty or the new smaller regular payments over time. Once a buyer has chosen the new property tax, the property will permanently be subject to the new tax.

It’s a move that should see first-home buyers enticed into the market in greater numbers, encouraged by the opportunity of avoiding stamp duty, while also encouraging older homeowners to consider downsizing.

What’s right for you?

There are four rates in the proposed new property tax with owner-occupiers paying a different rate to investors and farmers and commercial property purchases also paying different rates.

And while at first glance, the choice may seem simple – avoid a hefty bill of more than $40,000 in favour of small, regular payments over the long term, the devil is in the detail.

If you’re planning on holding the property for a long time (at least 20 years), it’s possible you might be better off choosing the stamp duty.

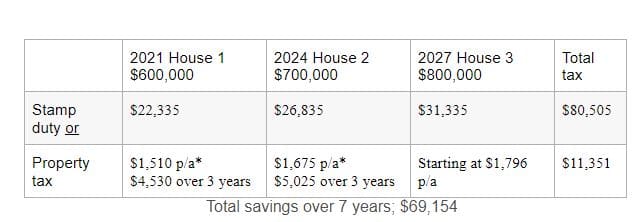

For example, according to the NSW Treasury, a property worth $700,000 will attract a stamp duty of $26,835, paid up-front. But if the purchaser opted for the long-term property tax, it’s likely they would pay more than $54,000 over the same 20-year period.

For those who move more frequently, the smaller amount attached to the property tax will provide a better financial outcome.

The NSW Government provides this example:

It’s important to understand, the choice is only available for the first time the property is transacted. Once a buyer chooses the annual property tax, all subsequent buyers will be locked into the annual property tax. This may result in rising demand for those properties that come with a choice attached and this may potentially distort the market. But over time, this will reduce.

So, to make the best choice, it’s important you understand if you’re buying for a short, medium or long-term timeframe. This will ultimately be the decider in which way you choose to pay your property tax.

And if the NSW transition is successful then it would be fair to accept that Victoria and Queensland will also soon migrate to this kind of model as well.

Sources:

- https://theconversation.com/axing-stamp-duty-is-a-great-idea-but-nsw-is-going-about-it-the-wrong-way-150629#:~:text=NSW%20is%20going%20the%20long%20way&text=That%20means%20that%20to%20be,stamp%20duty%20in%20that%20year.

- https://www.realestate.com.au/news/nsw-stamp-duty-vs-property-tax-what-are-the-proposed-changes-and-how-could-they-affect-you/

- https://www.abc.net.au/news/2020-11-18/property-tax-vs-stamp-duty-explainer/12892974

- https://www.abc.net.au/news/2019-12-23/henry-tax-review-ten-years-on/11817328

- https://www.canberratimes.com.au/story/6203608/the-act-governments-plan-for-rates-reform-and-what-comes-next-explained/

- https://www.abc.net.au/news/2019-04-03/federal-budget-queensland-billion-revenue-fall-housing-downturn/10964598

- https://www.realestatebusiness.com.au/opinion/20763-the-winners-and-losers-of-the-proposed-stamp-duty-changes-in-nsw

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.

- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026