Is APRA finally listening?

We had some long-awaited news recently which everyone in the housing and finance sectors rightly celebrated.

Now, I’m not talking about the Federal Election result – although that was good for the property market with the Coalition winning, given Labor’s stance on removing negative gearing and reducing the CGT discount.

Nor am I referencing the very strong possibility that the Reserve Bank will reduce interest rates from June – however, this will also be helpful.

What I’m talking about is the announcement that APRA is finally set to lift the boa constrictor nature of loan serviceability assessments that have been in place well past their use-by date.

As I wrote about in January of this year, I’ve long been sceptical of APRA’s willingness to see the market and be proactive in its measures.

Now, don’t get me wrong, some of the APRA introduced measures such as reducing high LVR’s and limiting interest only exposure to some borrowers has been absolutely necessary to ensure we maintained a balanced market but they went overboard on a bit of a power trip and its ground our markets to halt with their regulatory enforced credit squeeze!

So at least we are closer to the end than to beginning of the credit squeeze.

Unrealistic criteria

As I have said, in many instances, APRA did the right thing with many of its measures because some markets were a bit haywire a few years ago with investor fuelled price growth that was unrealistic to maintain – Yes Sydney I’m talking to you clearly.

Instigating measures that ensure borrowers can afford their property loans in the future helps to maintain a sustainable marketplace.

That’s why I believe reducing the number of interest-only loans as well as ones with high loan to value ratios was a good idea. I mean allowing an investor to only contribute 3% towards a purchase (with the loan at 97%) and then allowing them only pay interest only as well, just has the potential for disaster written all over it!

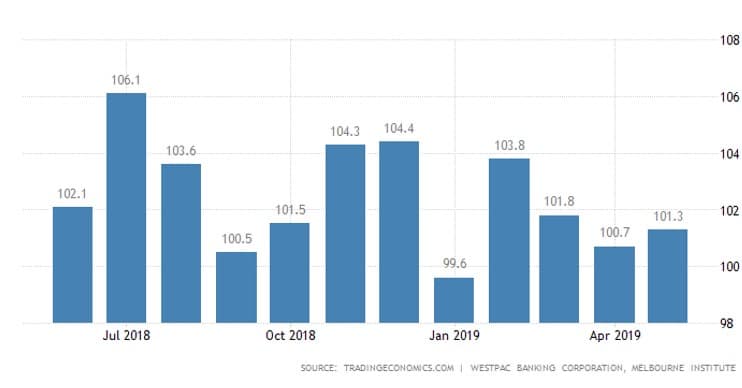

But they overshot the mark and strangled credit supply, which resulted in falling prices as well as low consumer confidence. See, as per the graph, when the number is 100, we have average consumer confidence and when it slips below 100 we have more pessimists than optimists and you can see we have just been hovering around neutral ground for some time.

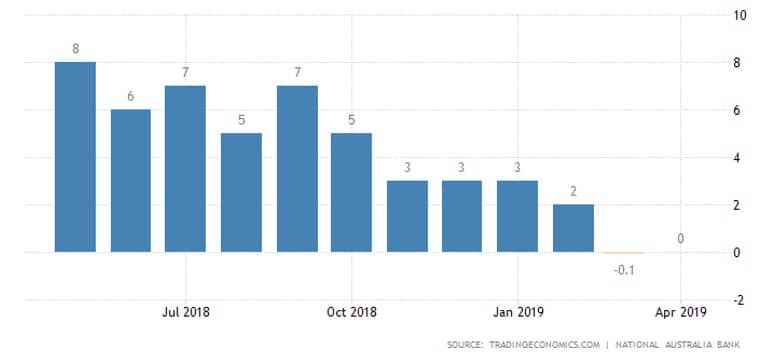

Business confidence remains vital as well as its businesses – big & small – that employ people, spend money in the markets on goods and services and meet the supplies of our nation’s requirements. And when business isn’t confident then they don’t employ and they don’t spend as a result of market conditions. And you can clearly see that our businesses confidence has been waning for the past 12 months. And this is why unemployment is starting to rise and why we have stagnant wage growth.

And, while they’re set to unwind the measures soon, it should have happened earlier to arrest the market decline and the woeful sentiment.

Instead, APRA stubbornly stuck to an interest rate serviceability calculation that had no bearing to reality.

Borrowers were being pressure tested using a rate of 7 to 7.5% when no one has been paying that rate for years, maybe a decade – and given the current low rate environment and overall economy, probably won’t for some time yet.

Reason returns

APRA has now announced, these are still yet to be passed, so maybe just keep your powder dry for now, that the major banks will soon be able to assess loan applications using a lower interest rate, which is great news for homeowners.

The rationale is that they will let the banks assess on the client’s actual home or investment loan interest rate plus a buffer of 2.5% (which equates to 10x 0.25% interest rate rises and would seem a logical assessment) for all new loan applications.

Principal and interest home loans of about four per cent (in fact as we recently wrote about in the deadly sins of interest rate creep hall home loans should start with a 3 in front of it) are common these days, so a borrower’s application would be assessed at a rate of 6.5%. And if we factor in just one of the Reserve’s aforementioned rate cuts then assessment rates for a home could reduce to around 6%, which would provide an increase in a borrowers servicing, down from the current 7.25%.

However, it will take time for the benefits to flow back to investors, because APRA won’t want a debt surge again in a low interest rate environment.

Now when I say investors in this scenario, I am meaning those who are applying for interest-only loans, which mostly remain under lock and key – for now anyway.

Why? Well your average interest only investment loan sits at around 4.75% and when add the 2.5% buffer, guess what? That equals 7.25% so no short term relief there.

However, until the purse strings are opened up again to investors more generally, it would be wise to consider strategies to secure finance sooner rather than later.

One of the easiest ways to do this is for an investor to look to a mortgage that requires principal and interest repayments.

By considering Principal & Interest repayments if your cash flow affords, this will boost your borrowing capacity the way that these are currently viewed. For example, and even before an interest rate cut, there are principal & interest investor loans available at 3.99%. If you add 2.5% to that then you’d have an assessment rate of 6.5% and an increase in an investor’s capacity right there!

While the interest rates are still slightly higher because it’s an investment loan, they’re nowhere near as high as interest-only ones, which are still tricky to secure as well.

Have we found the floor in the housing market decline?

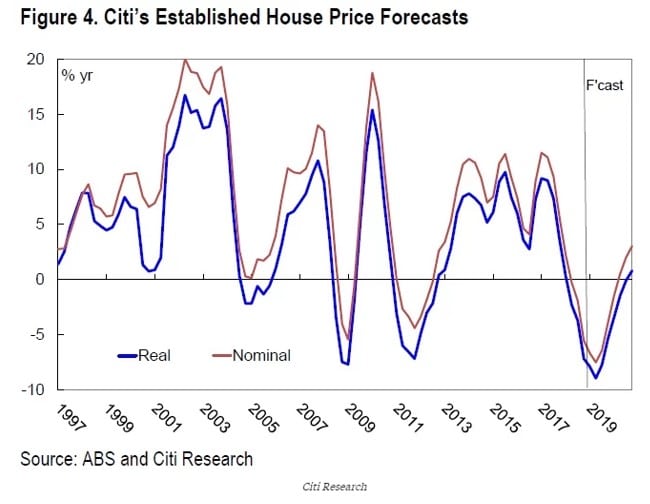

Well it would appear so if we look at this graph and forecasts from Citibank and the ABS.

It appears that the big 3 factors of the election win to the Coalition with negative gearing reforms off the table, a potential (almost guaranteed) interest rate cut and the reforms announced by APRA with lender servicing ratios (which, for the record, I believe will have the most significant impact out of all 3 of these) have now swayed most analysts to believe that we are at, or near, the bottom of the housing market declines and that’s great news for everyone.

Like so many things in the property market, the lending environment moves in cycles and that means that investors will able to refinance to interest-only loans at some point in the future.

The smartest investors are not waiting for that to become a reality because they recognise that they will likely miss out on capital growth in the meantime.

Let’s hope all the media sceptics and buffoons who have been downplaying, and almost celebrating these declines, in the recent 12 months, can now show some humility and report some positive news on our housing markets.

It would be long overdue.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026