Can I get a home or investment loan?

It’s one of the first things we always get asked, “Can I get a loan?” or “I’ve heard it’s impossible to get money from the banks” etc. etc. Well, thanks to our media outlets that falsely report and misrepresent the market in order to show their extremist or alarmist views in order to sell their newspaper or news reports, the simple answer is “Yes”.

Not just Yes, but you bet the banks are open for business and they are competing very hard to win your business with some great deals out there.

And the good news is that finally the regulators have relented somewhat in this low interest rate environment have now slightly eased some of the loan assessment criteria.

Macquarie Wealth Management recently completed a survey of 250 mortgage brokers around Australia of which I was a participant, in order to understand the current market, and they have reported some very interesting findings.

In short, the Key points were:-

- The annual mortgage survey showed improved credit availability for owner occupiers and broadly stable trends for investors.

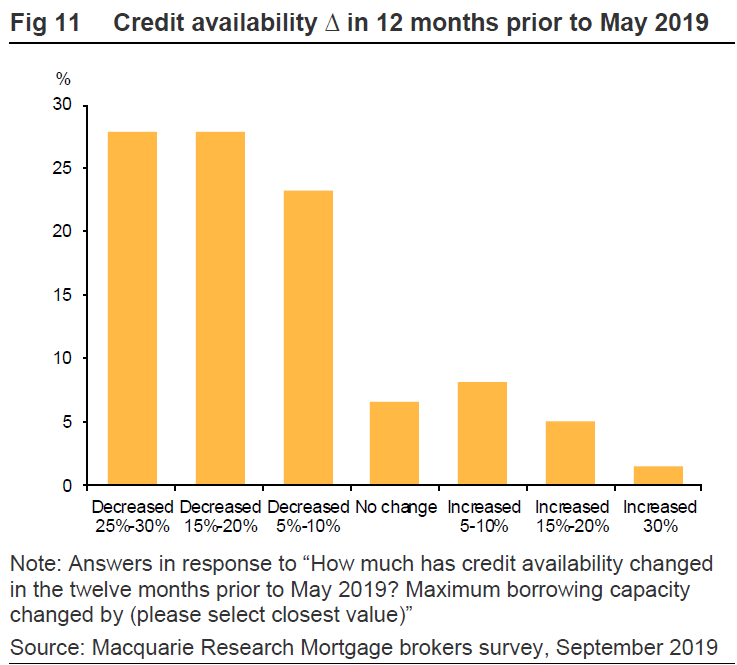

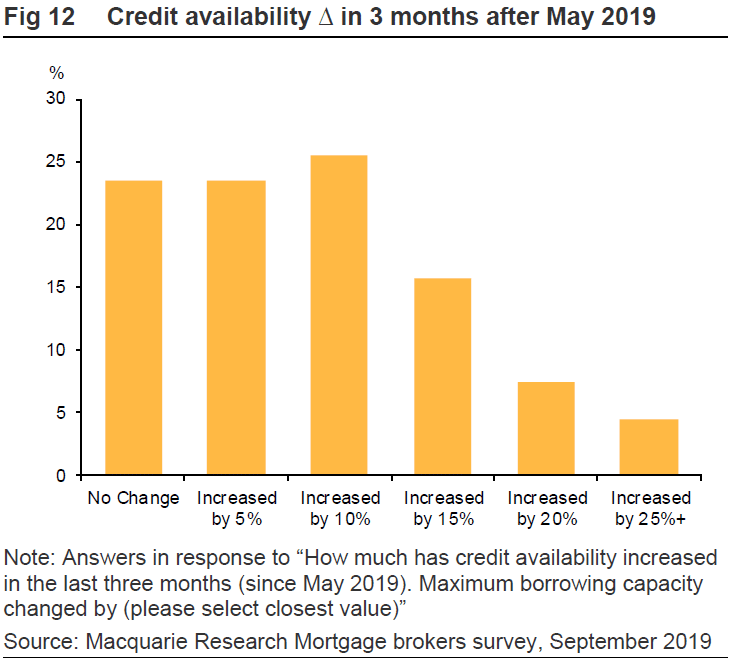

- The mortgage broker survey highlighted that credit availability continued to tighten until May 2019 and has rebounded by ~9% since then.

- The expectation is that the majors will continue to shed market share in FY20 and forecast mortgage volume growth of 2-2.5%.

The key findings from the analysis are:

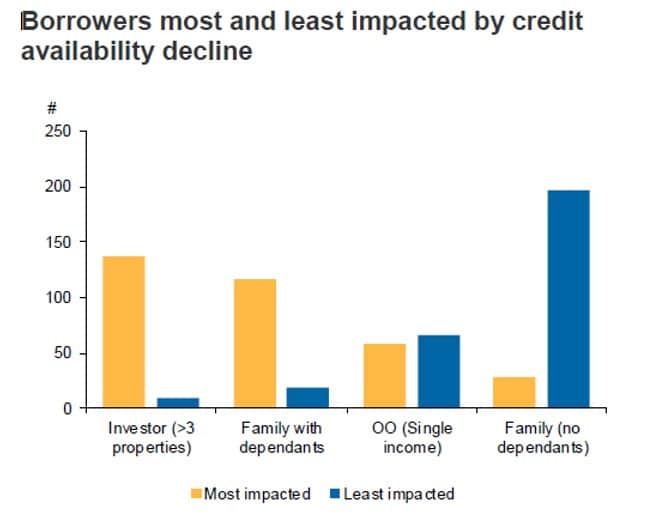

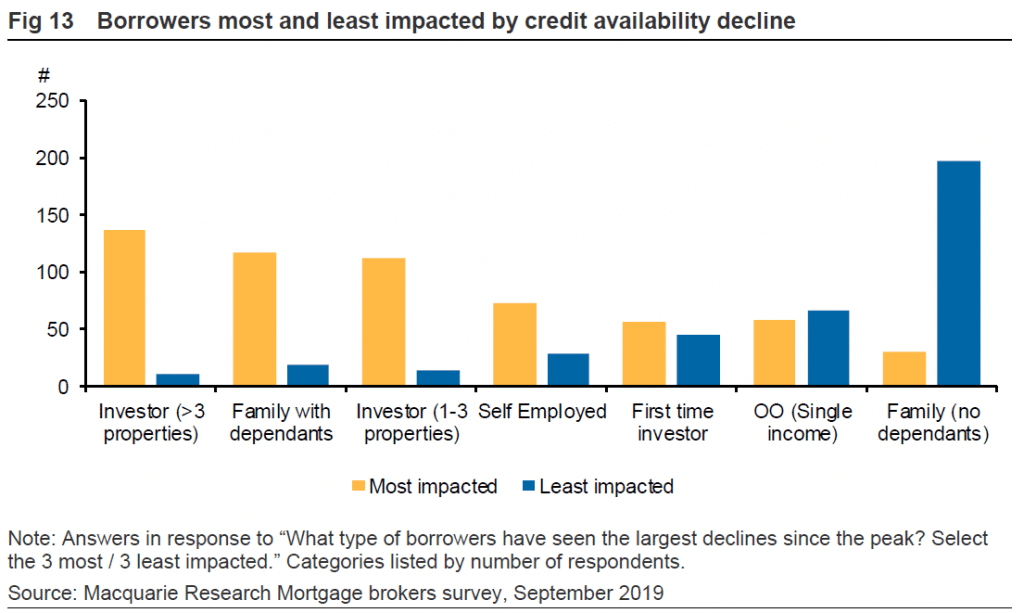

- Investors and families with dependants were most affected by tighter credit availability, while families with no dependants were least affected;

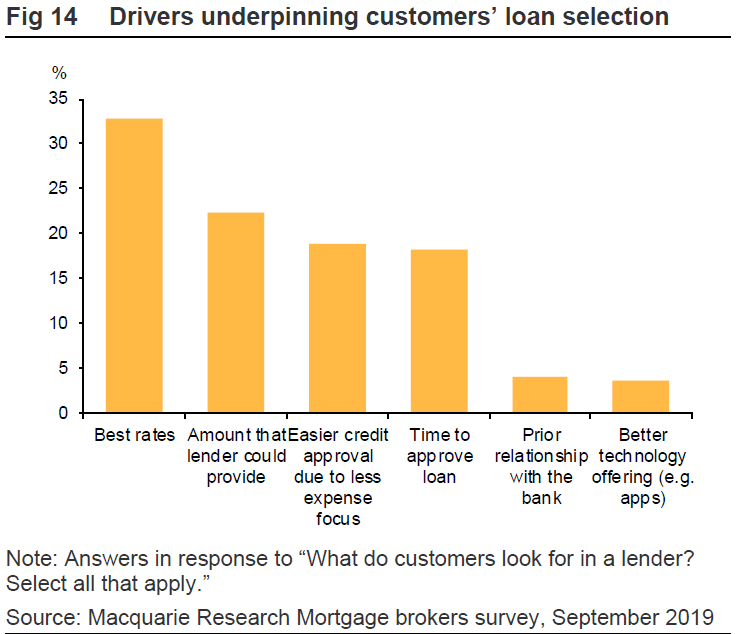

- Interest rates and borrowing capacity were perceived as key drivers for deciding on lender. The majors were generally viewed as being less competitive on price;

- Application outcomes had a negative correlation with the expense verification process; and

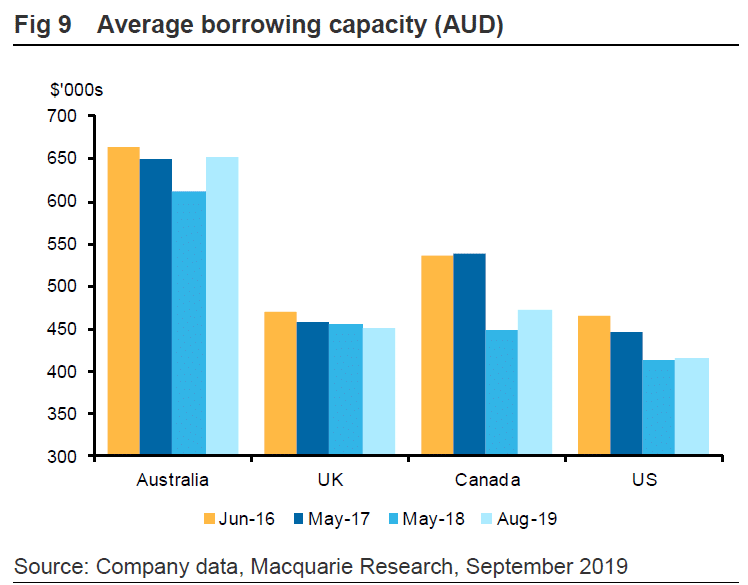

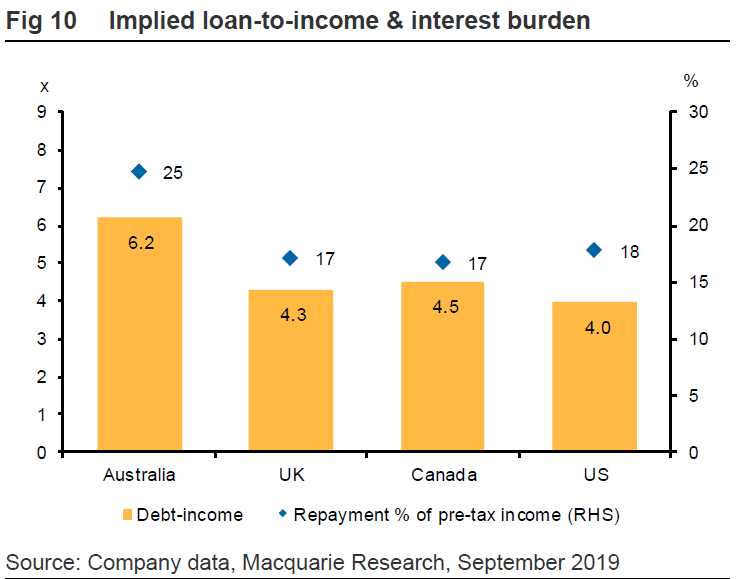

- Compared to the global peers, Australian borrowing capacity remains ~30% higher, leaving the interest burden on the Australian households above global peers (~25% vs ~17%), despite our record low variable interest rates vs. a higher prevalence of fixed rates across other markets.

Debt Bomb?

We wrote a couple of years ago about “beware the 2020 debt bomb” in which the major concern was the expiration of interest only lending terms and what this might do or impact on Australian households.

As the research shows, In comparison to global peers, Australian mortgage borrowing capacity remains higher.

We compared Australian banks’ mortgage borrowing capacity to major bank peers in the UK, Canada and the US.

In 2019, banks in these markets were prepared to lend ~30% less than the average Australian bank.

As the figure below highlights, Australian banks are prepared to lend up to ~6x gross income, compared to UK, Canadian and US peers at 4.0-4.5x gross income.

We also note that as a proportion of income, the interest burden on the Australian highly indebted households (borrowing at their maximum bowing capacity) is higher than global peers (~25% vs ~17%), despite our record low variable interest rates vs. a higher prevalence of fixed rates across other markets.

From the front line – what the Mortgage Brokers Said

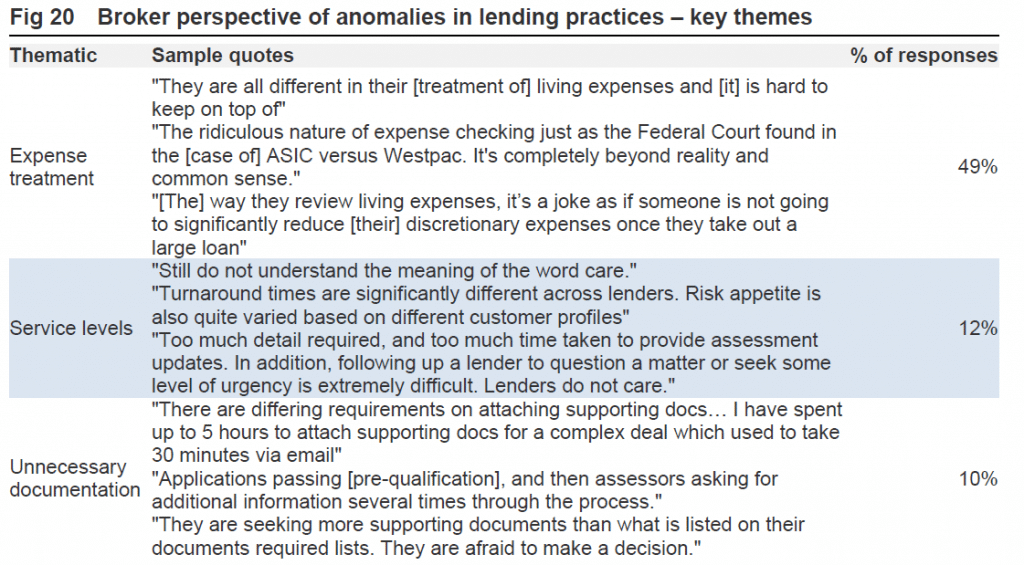

With an increased focus on expense verification, we believe it is useful to supplement our maximum borrowing exercise with a survey of mortgage brokers. The key findings from our survey were:

- Maximum credit availability has reduced by ~5% relative to twelve months ago;

- Investors and families with dependants were most affected by tighter credit availability, while owner occupiers with no dependants were least affected;

- Interest rates and borrowing capacity were perceived as key drivers for deciding on lender. The majors were generally viewed as being less competitive on price;

- Non-Banks were able to process mortgages quicker than peers, while some 2nd and 3rd tier lenders were shown to have materially longer settlement periods;

- Application outcomes had negative correlation with expense verification process (i.e. banks that were more likely to give unconditional approval were also less likely to verify expenses); and

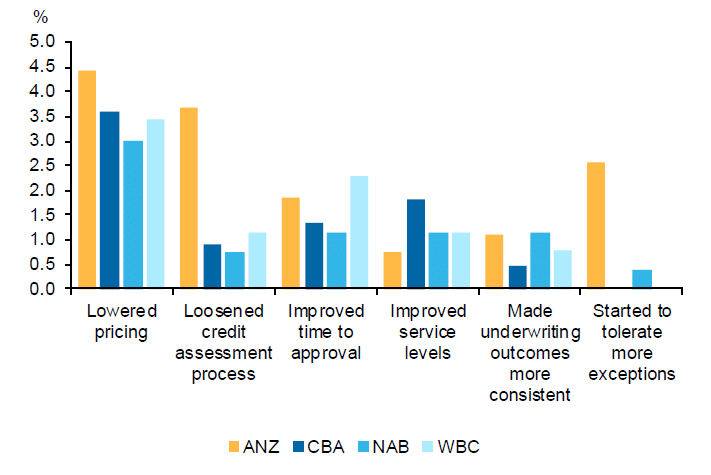

- Consistent with market share trends, brokers identified that ANZ has seen the biggest reduction in flow in the last two years. Mortgage brokers attributed it to tightening in the credit assessment process, increased time to approval, deteriorating service levels and inconsistent underwriting outcomes.

We found that the majority of brokers believed that credit availability has reduced in the 12 months before May 2019 (APRA changes) and generally improved since then. On average, mortgage brokers estimated that maximum credit capacity increased by ~9% from May 2019, but reduced by 13% in the prior twelve months. This suggests that while credit conditions have improved in recent months, the maximum borrowing capacity remains ~5% below the level it was 12 months ago.

On average, mortgage brokers estimated that maximum credit capacity increased by ~9% from May 2019, but reduced by 13% in the prior twelve months. This suggests that while credit conditions have improved in recent months, the maximum borrowing capacity remains ~5% below the level it was 12 months ago.

And then we had a federal election in which the Coalition won and we wrote about as well as some certainty around the housing markets.

Soon after, APRA announced some changes to lending assessment guidelines and the market started move again.

Who was affected?

Looking at specific types of bank customers who have been most impacted, it was unsurprising that tighter credit standards had the most significant impact on investors with multiple properties.

Also, families with dependants, investors with existing properties, and to a lesser extent self-employed borrowers’ are being impacted by tighter credit availability. On the other hand, an overwhelming majority of mortgage brokers responded that lending capacity had been least affected for families with no dependants.

What drives key consumer behaviour?

What is it that the Australian public want? Well Mortgage brokers indicated that most customers were price-sensitive when considering lenders.

No surprises really that the most sought after requirement is the cheapest price, this is normal human behaviour. Who wants to pay more than they have to?

No-one, but outcome is still equally as important as price.

Lending capacity, easier credit approval, and approval times broadly followed as secondary priorities.

Customers didn’t appear to value prior relationships with banks when choosing their mortgage provider, indicative of the continued trend of incumbent lenders losing market share.

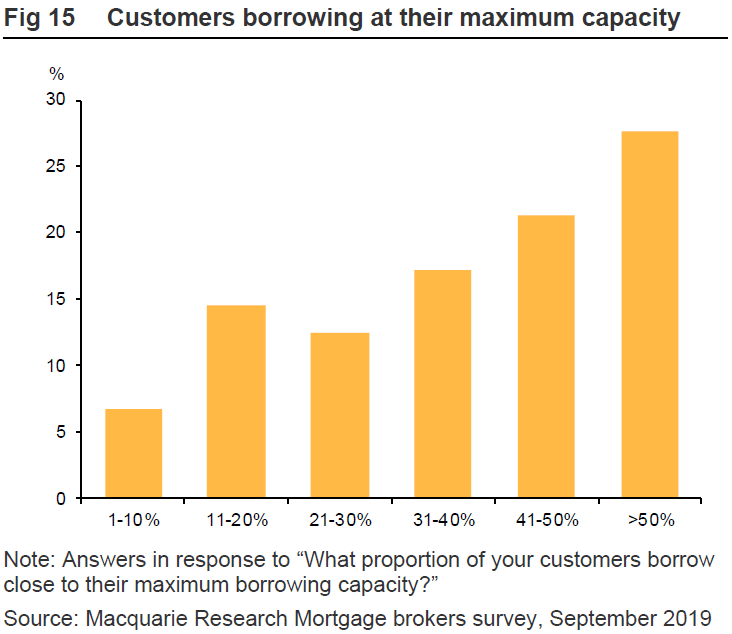

Also, contrary to the data from the Financial Stability Review October 2018, RBA, and banks’ recent disclosures which indicated that only ~13% of customers borrow at their maximum lending capacity (CBA data), mortgage brokers responded that on a weighted average basis ~35% of customers borrowed close to their maximum.

The difference may be partly explained by higher gearing levels across mortgage brokers’ customers, and impacted by varying treatment of offset accounts.

It’s not just you that are frustrated about getting asked about your living expenses

Believe me, this has become a greater inquest than the Spanish inquisition. Some lenders are analysing every expense you have down to the minute details, and we agree, it’s frustrating.

The market still hasn’t come to grips with what is needed monthly expense to maintain your lifestyle, and what is discretionary expenses that gives you choice around the lifestyle you want to live.

As I’ve just written about in why the Federal Court’s decision to throw out ASIC’s case against Westpac (although ASIC are challenging this again) the ability of lenders to analysis clients actual expenses has become a hot topic.

And as the story suggests, and Justice Nye Perram found, nothing has been proven that measure used were in fact, out of order. And nor am I yet to have proven to me that this has been a poor method or that there are thousands of Australians adversely affected by this.

No, quite the opposite, these measures have in fact, enabled ordinary everyday Australians to actually live out the “great Australian dream” and secure their desired home or owner occupier accommodation.

Here’s a great snapshot of brokers frustrations with lenders (and regulators) in what needs to be justified or substantiated on our clients’ behalf.

You can use this to your advantage!

Yes, Yes you can. As the graph here suggests.

What’s the 1st lever that banks always pull?

It’s price, they always compete on price and you can see that each of the 4 majors have reacted the most to offering bigger discounts which equate to cheaper loans for everyone, in order to win your business.

As I said from the start, banks want to lend, and need to lend to make money themselves so it’s a great time to review your mortgage rates and allow us to look at securing you the best deal – our current and future clients.

We look forward to hearing from you.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026