Use this calculator to find out how extra home loan repayments will influence your loan.

For more exact expert advice please contact us

Calculate How Extra Repayments Will Influence Your Home Loan

We all hopefully come to a point in our mortgage repayment journey where we want to make extra payments on our home loans.

Perhaps it’s one year into your home loan term or maybe it’s 10 years in – whatever the timeframe, it’s always a good idea to make extra repayments on your home loan.

That’s because by making additional repayments you can greatly reduce the amount of interest you will pay over the life of your loan, as well as pay off the mortgage much faster. Why pay more than you have to?

A good place to start if you’re considering making extra repayments is to utilise an extra repayment calculator, to understand what difference it will make to the length of your loan as well as your overall interest component.

Lucky for you we have an extra repayment calculator to help!

How to calculate extra home loan repayments

Let’s go through a couple of examples to show how extra mortgage repayments can make a big difference to the final price you pay for your home as well as how long it takes you to pay back.

First up, let’s consider Nyree and Scott, a young couple who have bought their first home for $720,000 in Melbourne with a loan amount of $600,000.

Like most first home buyers they probably don’t have a lot of extra cash, so for the first few years they pay the standard principal and interest repayments. Here’s how to calculate their initial monthly repayments using our extra repayment calculator:

- Input the loan amount of $600,000.

- Loan term is 30 years.

- Interest rate is 5.1 per cent.

- Repayment frequency is monthly.

- Extra repayment is zero.

As you can see, Nyree and Scott’s monthly repayments will be $3,258 per month. If they continued to pay the standard principal and interest repayments over 30 years, their total repayments would be $1,175,987 of which $572,771 would be interest! That’s almost as much as the original loan amount.

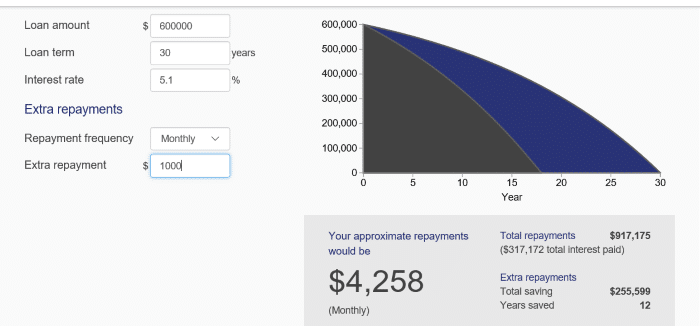

Now let’s consider a scenario where they pay an extra $1,000 repayment every month.

What difference do you think that will make to their loan? Let’s work it out to see.

- Input the loan amount of $600,000.

- Loan term is 30 years.

- Interest rate is 5.1 per cent.

- Repayment frequency is monthly.

- Extra repayment is $1,000.

As you can see, Nyree and Scott’s monthly repayments will now be $4,258 per month. If they continued to pay the standard principal and interest repayments, plus the extra repayment of $1,000 per month, their total repayments would be reduced to $917,175 of which $317,175 would be interest. That’s a saving of $255,599 over the life of the loan as well as it being paid off in 18 years instead of 30 years!

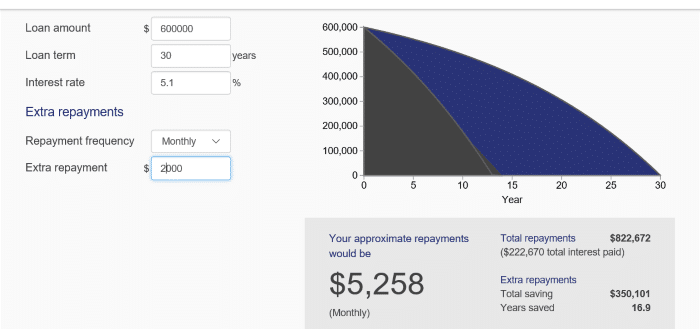

Now if Nyree and Scott could increase their extra repayments to $2,000 per month the results are better still!

- Input the loan amount of $600,000.

- Loan term is 30 years.

- Interest rate is 5.1 per cent.

- Repayment frequency is monthly.

- Extra repayment is $2,000.

Their monthly repayments will be $5,258 per month. If they continued to pay the standard principal and interest repayments, plus the extra repayment of $2,000 per month, their total repayments would be reduced to $822,672 of which $222,670 would be interest. That’s a saving of $350,101 over the life of the loan as well as the loan being repaid in about 13 years instead of 30 years!

So, as our examples show, you can save significant funds by opting to make extra repayments on your home loan. This is an especially sound strategy for home owners or investors who have moved into the consolidation phase of their investment strategy.

Nyree and Scott could potentially save hundreds of thousands of dollars if they made extra repayments every month and they could own their home in 13 years instead of 30. Who doesn’t want to be free of mortgage debt sooner rather than later?

How does this differ from a standard home loan calculator?

Our extra repayment calculator differs from a standard home loan calculator as it enables you to work out what additional repayments will mean to your total repayments as well as to the length of your loan.

A standard home loan calculator allows you to calculate what a regular repayment reschedule for a 30-year home loan would be. However, you can also input different loan terms, such as if you wanted to repay your loan in 20 years instead of 30 years or if you wanted to understand how much you’d need to repay every month to have it paid off in a decade.

With all of these types of calculators, however, it’s important to remember that your interest rate will go up or down if you have chosen a variable rate of interest, depending on rate adjustments by the RBA or your lender.

That’s why an extra repayment calculator is a great tool as it allows you to understand what repaying an extra $100 or $1,000 a month will mean to the amount you need to repay for your home loan!

Who can I talk to about my home loan repayments?

No one needs to pay more interest on their home loan they need to, so it’s always a good idea to consider extra repayments on your home loan if you can afford to do so.

The world of banking and finance can be a pretty daunting one for both novice and sophisticated investors and since our establishment in 2002 we’ve focused on providing outstanding service and business standards.

This approach was vindicated when we were named Victoria’s favourite mortgage broker at the Investors Choice Awards.

So, if you want the best advice on repaying your home loan faster, why not contact Intuitive Finance today to ensure you have the right information and expert support on your side from the very beginning.

If you’d like an expert to provide you with a better understanding of extra home loan repayments or if you have any other questions, please just contact us directly and we’ll be in touch.