Are we heading toward a ‘slow boom’ market

We are seeing signs that the housing market’s meteoric rise over the past 12 months is beginning to slow – and take note, I said, “slow”, not “plateau”.

Extended lockdowns in the nation’s two biggest housing markets – Sydney and Melbourne – are having an impact on housing turnover and prices and it’s likely we’ll see that impact amplify over the December quarter.

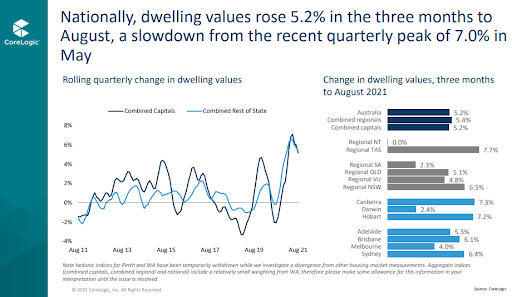

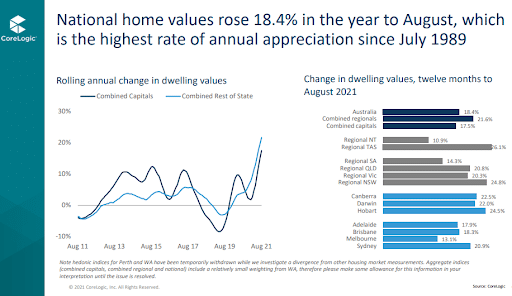

However, we are still looking at a rising market, with house price growth pushing ever higher, albeit at a much slower rate.

CoreLogic figures for the month of August have shown house values are up 1.5 per cent, which is a fractionally higher growth rate than the long-term average. The data seems to indicate that the steepest portion of the line graph was back in March when Sydney house values zoomed up 1.9 per cent to a median house price of $1,293,450 and Melbourne house price lifted 1.4 per cent to a median of $954,496.

CoreLogic Director Tim Lawless was widely reported as saying the slowdown was, “likely due to an affordability ceiling being reached rather than as a result of lockdowns that have 60 per cent of the population under strict restrictions to stop the spread of coronavirus”.

The supply shortage will be exacerbating the pressure on prices, with buyer demand increasing due to favourable credit conditions but supply failing to keep pace.

Snapshot of the three biggest markets

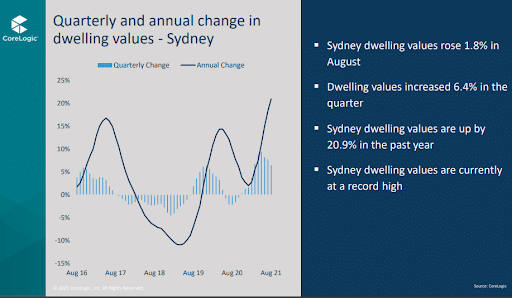

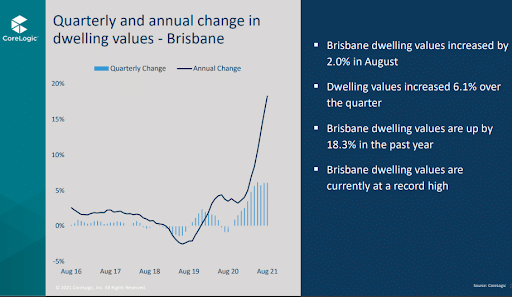

Brisbane, Sydney and Melbourne are Australia’s three biggest housing markets and, combined, they play a significant role in the national growth figures.

Sydney leads the pack with a relatively modest 1.8 per cent growth for the month, accompanied by a stunning 6.4 per cent house price growth for the quarter and rounding out with a substantial 20.9 per cent growth for the 12 months to August 30. This has delivered a median house price of $1,039,514.

Normally the bridesmaid, Brisbane has edged out Melbourne, to claim second spot, bringing home house price growth of 2.0 per cent for the month of August and a respectable 6.1 per cent for the quarter, and a notable 18.3 per cent growth for the 12 months to August 30.

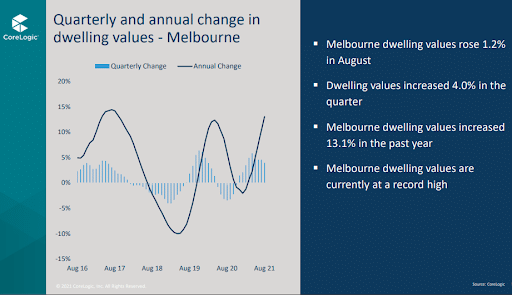

Rounding out the trio, Melbourne has brought home 1.2 per cent growth for the month, 4.0 per cent growth for the quarter and 13.1 per cent growth for the rolling 12-month average, to August 30.

Affordability bites

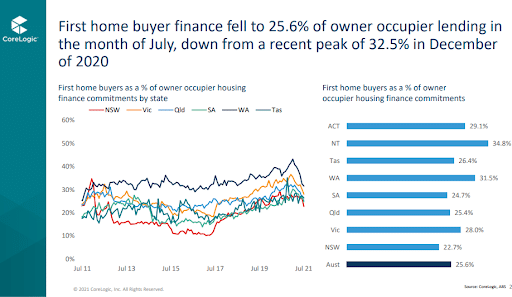

Australia’s housing affordability continues to worsen as house prices rise while wages growth fails to keep pace.

In the March quarter, when house prices surged 2.8 per cent nationally, wages grew just 0.6 per cent, according to the ABS.

Lawless said: “Housing prices have risen almost 11 times faster than wages growth over the past year, creating a more significant barrier to entry for those who don’t yet own a home.”

ABS Head of Prices Statistics, Michelle Marquardt, said, “After two quarters of minimal growth, wages rose 0.6 per cent for the second successive quarter.”

In other words, Marquardt is saying that this is a good outcome for wages growth.

These facts all add up to an affordability issue and it’s becoming ever harder to ignore. In fact, with a federal election looming, it’s going to be an issue brought front and centre for Scott Morrison, who must come up with solutions that don’t rely on support from the state governments who control zoning laws and the supply of housing.

Immutable facts

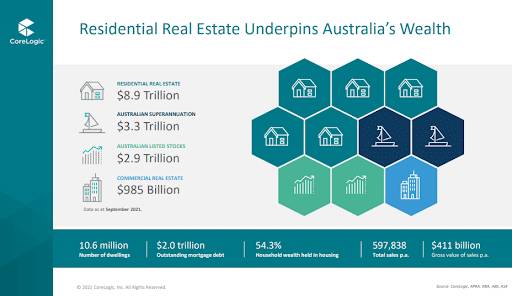

One thing is certain, property remains one of the greatest wealth-building assets available. The value of the Australian housing market – nearing a staggering $9 trillion – is more than the ASX and the superannuation industry combined. Property as a wealth-building tool wasn’t even dented by the impact of a global pandemic. In fact, it surged.

This points to some immutable facts:

- If, as a young person, you can get your foot on the property ladder by any means necessary, you are potentially creating a financially strong future for yourself that will withstand even the most ominous economy-threatening events.

- The sooner you own a property, the sooner you’ll start to experience the wonders of compound interest.

- Cash is cheap at the moment, and this represents a window of opportunity during market conditions that have been rarely see. So, try to take advantage of it!

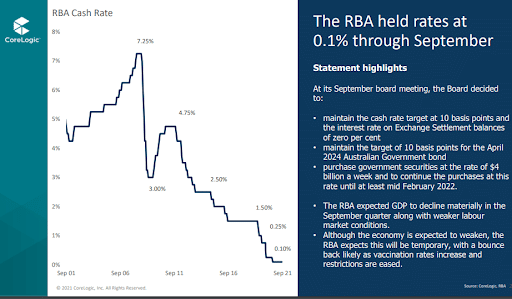

The slow boom market conditions we are witnessing are likely to continue to taper into next year. The RBA has been unequivocal in its guidance – wages and inflation must increase before interest rates move.

But, the RBA is taking a very long and close look at borrowings for housing at the moment. It is motivated to see housing price growth slow, so is maintaining a watching brief for now.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.

- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026