Get Ready For The End Of Financial Year – NOW!

But for savvy property investors, June 30 is really the most significant date on the calendar. It’s the moment where your tax affairs come to the fore and you look to make the most of financial arrangements as a real estate owner.

It’s also an excellent opportunity to take stock of your portfolio and ensure you’re maximising your deductions, while preparing to maximise outcome for next year.

Even if you don’t own property yet, but you’re in the market (or plan to be), this is the time to knuckle down and get serious about devising a strategy to turn your ambitions into reality.

The end of financial year is almost upon us. Here’s what you need to do to get ready.

Get your claims sorted

That includes (but is not limited to) the interest applied to your mortgage repayments, any required insurances, council rates, repairs, bank fees, pest control, strata levies, property management fees, and gardening, landscaping or pool servicing.

Don’t forget to claim your land tax as well. Given skyrocketing property prices over recent years, you’re no doubt paying much more than you were, especially in states like Victoria that have hiked the amount they take from investors, so be sure to add it to your list of deductions.

If your land tax bills are skyrocketing and you’re having trouble managing, speak with us about lending strategies to help combat the pain along with other suitably qualified and experienced advisors.

One big taxation perk that many investors don’t take advantage of is depreciation. In a nutshell, investors can have a depreciation schedule done for a property that can deliver a huge bump to your deductables. The schedule sets out the original value of eligible plant and equipment plant features as well as capital expenditure. It then calculates how much it depreciates in value each year based on a determined shelf life. This deprecation amount is deductable when you prepare your tax return. Even better, the cost to produce the report is also deductible.

It might include kitchen appliances, heating and cooling infrastructure, floor and window furnishings, cabinetry, bathroom fittings and more. Depending on the property type, the depreciation claimable could be several thousand dollars a year. Don’t miss out on this – get a schedule done as soon as possible after purchase.

If your record-keeping isn’t up to scratch and you’ve lost an important receipt, the ATO will usually let you make a claim with as much as a bank statement showing the purchase in question. It’s worth seeking expert advice first to make sure you’re following the rules.

Not all accountants are created equal of course. Some might be just fine at the run-of-the-mill stuff but aren’t that clued up on property investment matters. Before you engage an expert, probe their credentials and track record. You could also ask property investors for their recommendations when it comes to expert advisors.

Get ready for next year

Many are now forecasting the first interest rate deduction by the end of the year or very early next year, and there could be a few more to follow. Some lenders are already discounting their fixed rate mortgage interest rates in anticipation of an eventual reduction. This is a sign that banks too expect rates to fall soon.

Now is a good time to speak with us about the health of your current loan arrangements. If you haven’t reviewed your mortgages recently, there’s a good chance you’re paying too much. Banks are under a lot of pressure to stay competitive and there are some enticing deals on offer, from low introductory rates to fee freezes and even cash back bonuses.

It’s especially crucial to begin a conversation with us now if you’re approaching the end of the fixed rate period if you’re paying interest-only repayments. There will likely be a cost shock when those arrangements come to an end. Let’s talk about how to respond.

Review your portfolio

For each asset, list out the total income received and all of the expenses you’ve paid to determine the net rental yield. Then, see what the home is currently worth to determine the capital gains you’ve accumulated. Given how hot the market has been lately, chances are you’re sitting on a property that’s grown in value.

If you’ve got a healthy amount of equity, you’ve got some interesting options. You could unlock that value growth to invest again in bricks and mortar, or to fund renovations or major repairs that might increase the home’s value further.

Talk to us about what’s possible. You might be surprised.

Ready to buy? Here’s what you need to know

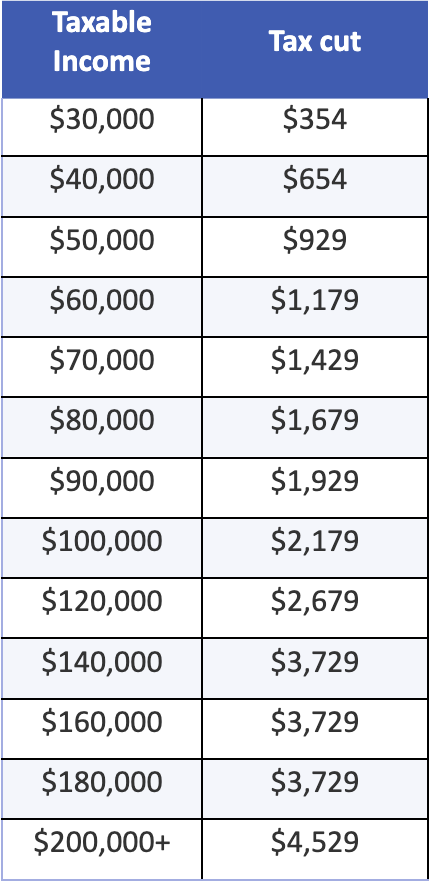

Firstly, the start of the new financial year marks a new era in personal income taxation. Stage three tax cuts take effect from July 1 and virtually everyone will immediately pay less tax. How much less depends on what you earn:

If you already own, there could be creative and impactful ways of using that extra cash to help reduce your borrowing costs. Again, talk to our team to explore your plans.

If you’re self-employed, navigating the mortgage market at the moment can be tough. The financial regulator requires banks to operate on a serviceability buffer system, which sees them take their current interest rate and apply three per cent to it, to ensure borrowers can handle any increases that might be on the horizon.

For those would-be buyers who are their own bosses, dealing with lenders is challenging enough as it is. You’ve got to jump through a whole lot of hoops to get an application across the line. The serviceability buffer just adds to the complexity. Do not go it alone. Speak with us about how we can maximise your borrowing capacity.

If you’re not sure how you might benefit, don’t stress. A great first step is preparing your financials and sending us the draft so we can assess your capacity and see where there’s room for improvement.

Possible deductions for PAYG employees

- Cars, transport and travel. …

- Tools, computers and items you use for work. …

- Clothes and items you wear at work. …

- Working from home expenses. …

- Education, training and seminars. …

- Memberships, accreditations, fees and commissions.

- Income protection insurance

Possible deductions for the Self-Employed

- Motor vehicle expenses

- Home-based business

- Business travel expenses

- Digital product expenses

- Workers’ salaries, wages and super contributions

- Repairs, maintenance and replacement expenses

- Other operating expenses such as power, phones etc.

- Depreciating assets and other capital expenses

- Rent, rates and all business address expenses

- Accountancy fees and/or legal fees

- Any interest on loans or leases

The end of financial year is a golden opportunity to reflect, assess and prepare, but trying to tackle complex financial issues can be a minefield. It’s also important that deductions don’t “cost” you the opportunity to be able to borrow again so its imperative you rely on experts in their field, like our team at Intuitive Finance.

Knowledge Hub Updates

- Common mortgage mistakes first‑home buyers still make in 2026 - January 5, 2026

- 2025 review: rate cuts, record prices and the rise of the first-time buyer - December 11, 2025

- Offset accounts and split loans: How they work and when they save you money - December 9, 2025