4 common money mistakes made by millennials

Every generation seems to think the next generation isn’t doing it right.

Every generation seems to think the next generation isn’t doing it right.

They offer well-meaning “advice” based on their own experiences, which may no longer have any relevance in our fast-changing world.

Over the past three decades, the rate of change has been enormous due to rapid technological advances.

Plus society as a whole is also evolving, with more people choosing to never marry or have children or to have children later.

Interestingly, one of the fastest growing households in Australia is the single person one.

My own observation is that while there is much change, some things stay the same.

Here’s the thing: one of the keys to financial success lies in starting early.

Setting yourself up correctly in your early life means you’ll be set in your later life.

The hard part is learning to focus on the future when you’ve just started enjoying freedom from school or university.

So, let’s consider five common money mistakes that millennials make.

1. Taking on debt and then ignoring it

Earning money from your first full-time job is a thrill for everyone, isn’t it?

You may have been studying for a number of years, and surviving on minimal funds, so when that first pay lands in your bank account, you think you’ve won the jackpot!

The problem is that often when you start earning money, you start spending it, too.

And then you get offered credit cards or perhaps think it’s time to upgrade from your old bomb of a car to a newer model.

In other words, you’re soon buying “things” with money you don’t have.

Because you’re still in the early stages of your working life, your income is probably not that high so you then only repay the minimum.

What do you think happens next?

Well, that $5,000 car loan that attracts at 12 per cent interest rate, and never goes down because you’re not repaying enough of the principal.

2. Overspending

Now, this leads me into the next mistake, which is overspending.

Now, this leads me into the next mistake, which is overspending.

Having money to spend is a great feeling.

Unfortunately, many young people think that because they now earn a salary they can spend every last cent of it.

Now I’m not saying that young people shouldn’t go out and enjoy themselves.

What I’m saying is that spending everything you earn will leave you with nothing.

There is a well-known financial theory that your expenses will always rise up to meet your income – unless you’re prudent.

Soon, while you may be earning the most you ever have, at the end of every week or month you’re still left with no savings whatsoever.

3. Not delaying gratification

The trick to overcome overspending and taking on debt you can’t afford to repay is to learn the skill of delaying gratification.

There have been a number of scientific experiments with children about this to see who had the will power to resist temptation like sweets to receive a greater reward by doing so.

As you can imagine, many couldn’t resist what was right in front of them, but some already had the discipline to delay instant gratification.

We all know that marketing is ubiquitous in our modern world.

Advertising is everywhere to help coerce us into buying things sooner rather than later.

The secret is to delay buying something like a new pair of shoes or a leather jacket until you have the cash to do so.

Then not only will you feel happy with your purchase, you’ll also be proud that you saved up the money to buy it.

4. Not investing early

I’ve said it before – one of the keys to financial independence is to invest early.

I’ve said it before – one of the keys to financial independence is to invest early.

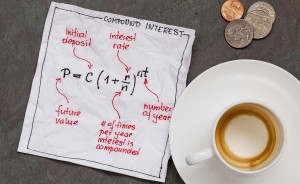

Investing early means you have more time to let the wondrous power of compounding work.

Compounding is when your money grows and grows and grows over the course of time.

Compound interest is the interest earned on the interest earned on your high growth assets, and is so effective that Albert Einstein called it the “most powerful force in the universe”.

Take this silly (but true!) story that’s often used to demonstrate how powerful compound interest is…

If you start with one cent and double it every day for 30 days, you’ll end up with $5,368,709.12.

So the more time that you that own an asset or multiple assets, the greater that growth will be, and the greater your wealth will be earlier in life.

Now don’t get me wrong…

Investing when you’re young takes discipline, education and accessing the right advice along the way.

Investing when you’re young takes discipline, education and accessing the right advice along the way.

But just because you’re not earning the same as your parents or the generation before you, doesn’t mean that you should wait until you are their age to start investing.

That would be the biggest mistake of all to make.

The world may be changing rapidly, but there is also more information about the secrets to financial success available.

Investing when you’re younger is always a smart idea if you want to be ahead of the pack when you’re older.

Wisdom can take some people a long time, but others can, and do, get a head-start.

And they get to live a wealthier life because of it.

This article originally appeared on Property Update.