Why negative interest rates would be bad for Australia

Imagine being paid by your bank to take out a mortgage for your next home purchase?

It sounds like a pretty laughable scenario – pie in the sky sort of stuff that would never eventuate. Except it has in Denmark, where Jyske Bank is offering 10-year home loans on a -0.5 per cent interest rate. Fixed.

In Australia, the two consecutive cuts to the official cash rate by the Reserve Bank sparked talks that we could be heading into negative interest rate territory in the near future.

If it leads to banks paying you to borrow money, surely it wouldn’t be so bad… right?

Wrong!

So let’s firstly explore why we are even getting more interest rate cuts?

Jobs are the key

More women and older people entering the workforce has driven Australia’s unemployment rate higher.

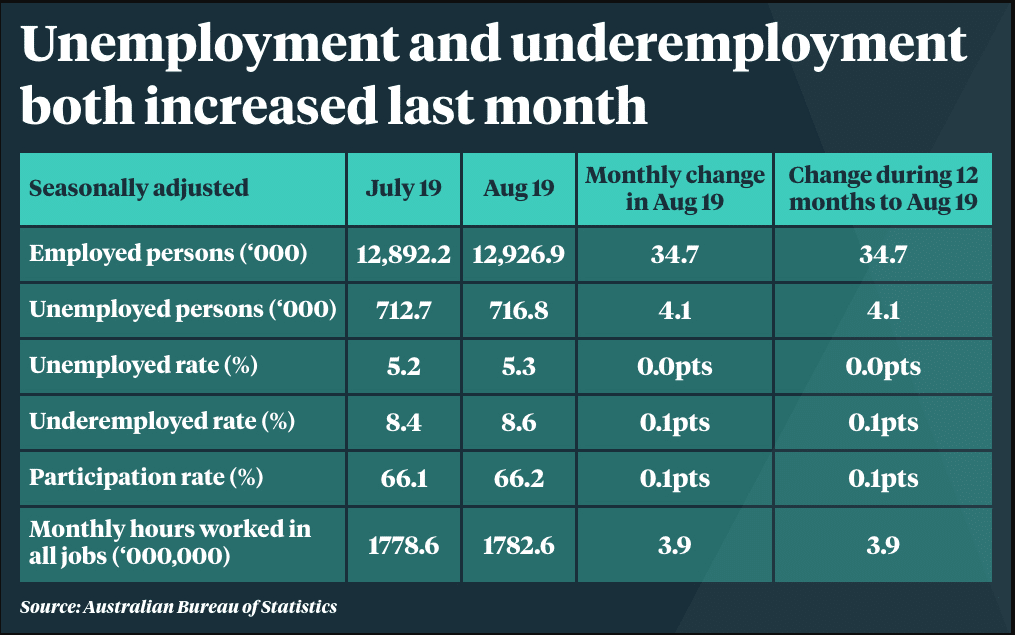

Despite the net creation of 34,700 new jobs, unemployment rose to 5.3 per cent in August, up from 5.2 per cent in July.

Economists attributed the small rise in unemployment to the growing number of Australians working or seeking jobs.

Known as the labour participation rate, this figure increased 0.1 per cent to a record high 66.2 per cent.

“The data today really just confirms more of the same from the labour market,” BIS Oxford Economics chief economist Sarah Hunter said.

“The extra jobs were matched against extra people entering the labour force and so, broadly speaking, the unemployment rate didn’t move.”

Dr Hunter said women’s labour participation rate had been trending up for decades but had “really lifted quite significantly over the last few years”.

“It’s a good thing, as it shows women are able to go back to work,” Dr Hunter said.

“And with the older workers, what we’re perhaps seeing is that now we’re all living a bit longer, people don’t feel like they need or want to retire at the same age as the generations before.”

Dr Hunter conceded financial hardship could also have had a small part to play in the growing participation rate – with falling household incomes encouraging more women to earn a second wage, and declining savings forcing older Australians to delay retirement.

“All we know is it’s definitely happening. And the key question is, how much further does the [rising participation rate] have to run?” Dr Hunter said.

“That really is so crucial to what happens to wages growth, because at the moment, if you’re a firm looking to hire and you can hire someone who isn’t currently employed, that means you don’t have to offer a wage premium to attract someone from another firm to move.

“So that’s a significant drag on wages growth.”

Underemployment – defined by the Australian Bureau of Statistics as anyone aged 15 or older who wants to work more hours and is working less than 35 hours per week – also increased, to 8.6 per cent, or 1.167 million people.

“This means the unemployment rate is too high [compared with] what it could potentially be which, according to the Reserve Bank, is 4.5 per cent in Australia,” AMP Capital senior economist Diana Mousina said.

“So we’re working below capacity. And that makes sense given that GDP data showed we only grew by 1.4 per cent over the past year.”

It’s happening elsewhere

Negative interest rates aren’t overly rare. There are a number of countries currently operating with an official rate that’s below zero.

Where interest rates have been allowed to slide into negative territory abroad, one of the key motives was to make it expensive for banks to sit on money. The idea was they’d instead be keen to lend it to people to spend.

They’d spend their loaned money on houses, driving the property market, on cars, driving manufacturing, on holidays, driving tourism and transport, and on other needs and wants, driving retail, small business and more.

Japan, Switzerland, the eurozone – they’ve all slipped below zero in a bid to boost their economies. The United States looks on the verge of it, and many pundits are even cheering on the Federal Reserve.

The idea of paying nothing, and better still, getting paid, for borrowing money is pretty enticing. The idea that economies will be kickstarted is also appealing in these uncertain times.

In all, it sounds like a good theory. Should Australia follow suit?

The huge downsides

The RBA has already hinted that it’s preparing to take “unconventional” steps to get the economy going again.

One of those very real possibilities is slashing the current official interest rate of one per cent, the lowest it’s ever been, to zero and below.

But if you look at what’s happened in the past in negative interest rate environments, it’s rarely good news.

Some of Europe’s largest economies are precariously balanced on the edge of a cliff, at risk of falling into recession. Japanese banks are at crisis point, struggling to survive.

The whole idea behind negative rates is to boost consumer spending, encourage investment and make borrowing easier. On paper, everyone seemingly wins.

But in reality, disaster seems more likely when interest rates go below zero.

Currencies weaken. People take their cash out of the bank and, both metaphorically and literally speaking, stuff it in their mattresses. Stock markets underperform. Inflation expectations rise.

The idea that banks will give out money more freely in a negative rate environment seems sound. But do we want financial institutions that are desperate to lend? Isn’t that a mindset that has gotten us into trouble before?

A banking system that’s in trouble is bad news for everybody. A banking sector that’s forced to operate in a Wild West environment is dire. On top of this, virtually forcing savers to take their cash out of banks – unless they want to lose money while it sits there – poses a serious risk to the integrity of lenders.

Another theory behind negative interest rates is that an economy will eventually become more resilient to international jitters.

In Europe, economists say years of negative rates have made households wealthier and more confident in the broader global economy. Bad economic news doesn’t seem to impact them the way it does other regions.

An era of uncertainty

When systems that have always worked in a certain way suddenly don’t and seem completely turned upside down in a strange new world, people are rightly unsettled.

It could have the opposite intended consequence, where people spend less, hoard their money, prepare for the worst and panic. Those qualities aren’t ones that encourage people to shop, take trips, upgrade the family home, start a new business or hire new workers.

Negative interest rates could drive major uncertainty across all facets of Australian society. Business. Investment markets. Property. Imports. Even politics.

Ask any economist what would happen if Australia’s official cash rate went negative and they’ll probably all tell you the same thing: they’re not entirely sure. There are lots of theories, but many of them are a “could-go-either-way” scenario.

Do we want an economy that’s essentially a flip of the coin? That sounds pretty frightening to me, yet it’s not something that I believe will happen here, so I’d rather not jump at interest rate shadows that are unlikely to materialise.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026