What is Negative Gearing?

Introduction to Negative Gearing

Negative gearing simply means borrowing money to buy an asset such as an investment property.

According to well-known property commentator and property expert, Peter Koulizos, negative gearing in relation to property means you have taken out a loan to purchase a property.

- Negative gearing means that the interest you are paying on the loan and all other associated costs with the property is more than the income/rent you earn and as a result you are making a loss.

- Neutral gearing means the interest you are paying on the loan and all other associated costs with the property is equal to the income you are receiving in rent from the property.

- Positive gearing means the interest you are paying on the loan and all other associated costs with the property is less than the income and as a result you are making a profit.

Negative Gearing and Taxes

For most investors, the largest rental expense is the interest on the loan that was used to buy the property, however, other expenses include body corporate fees, council rates, cleaning, property management fees, repairs and maintenance costs, etc.

What makes negative gearing particularly useful when it comes to personal tax is that any net loss from investment properties can be offset against other income that would otherwise be included in your assessable income.

What that means is that your taxable income bracket, and ultimately the amount of tax that you need to pay, is potentially reduced.

Meanwhile, if the investment property goes up in value, but you don’t sell it, no capital gains tax will be payable. Even if you do sell the property but it’s after 12 months, the capital gain will be discounted by 50 per cent as per current taxation policy.

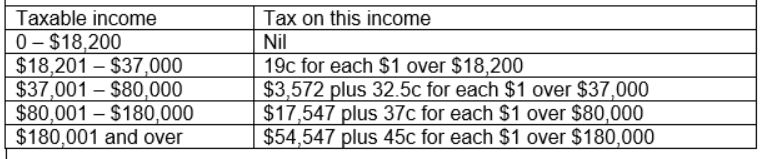

The following rates for 2015–16 apply from 1 July 2015 according to the Australian Tax Office

Please note the above rates do not include the:

- Medicare levy of 2%

- Temporary Budget Repair Levy; this levy is payable at a rate of 2% for taxable incomes over $180,000.

How does Negative Gearing work?

The deduction of negative gearing losses on property against income from other sources is permitted in several countries, including Australia and New Zealand.

A negatively-geared investment property will usually remain negatively geared for a number of years but will not generally stay that way over the long-term due to increasing rent returns.

However, when the rental income increases over time with inflation or due to rising market demand, then the investment is classed as positively geared because the rental income is greater than the interest and other costs.

Positive gearing occurs when the original amount borrowed to invest in an income-producing asset and the returns (income) from that asset exceed that initial cost of borrowing.

From that moment on, the investor must pay tax on the rental income profit until the asset is sold.

Proposed changes to Negative Gearing

In early 2016, the Australian Labor Party proposed changes to Negative Gearing policy if elected to government in the next Federal Election.

This article is not a definite guide to the pros and cons of Negative Gearing policy, however, if you are interested in better understanding the issue you can learn more from the following articles:

– Negative Gearing a blow to buyers

– Negative Gearing is for everyday battler

– Policy change a wealth killer for ordinary Aussies

How does Negative Gearing work in real life?

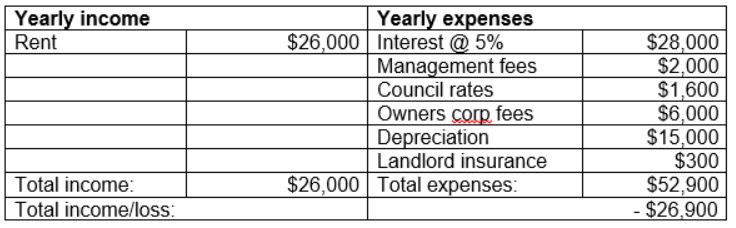

Let’s consider a possible property investment scenario to help you understand how Negative Gearing works in the real life of an investor.

Property investor “Julie” purchases a five-year-old, two-bedroom unit in St Kilda, Melbourne, for $700,000, for which she’ll receive $500 per week in rent.

Julie puts in $140,000 as the deposit so isn’t liable to pay any mortgage insurance. Therefore, the loan on the property is $560,000, with an interest-only rate of five per cent.

Let’s take a detailed look at the income and expenses in the first year of ownership, as well as allowable deductions such as depreciation given the property is relatively new. Please note these figures are approximations only.

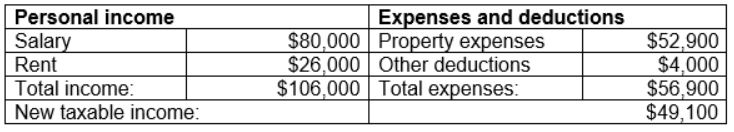

As you can see, in the first year of owning the property, Julie has recorded a taxable loss of $26,900 on the property, which she’ll be able to offset against her taxable income for the current year as outlined below.

On Julie’s original salary of $80,000 she was liable to pay about $17,500 in tax, however with the allowable expenses and deductions from her investment property her new tax payable is about $7,500, which means she’ll potentially receive a tax refund of $10,000, which she can use towards a deposit for another property.

When you consider this, there are both cash items i.e. the actual hard costs such as interest paid, rates, insurance etc. and then there is the non-cash item being depreciation that is an allowance for asset (both buildings and the fixtures) and there “wear & tear” to be maintained or replaced over time.

Depreciation can be a very powerful tool used properly with a depreciation schedule that can actually turn negatively geared properties (from a cash perspective) into neutral or positively geared from an “after tax” perspective.

What is Capital Gains Tax?

As mentioned briefly above, there is a tax, which all investors will have to pay once they sell their properties.

It’s called capital gains tax (CGT) and there’s really not much you can legally do to avoid it.

It’s a reality in today’s property investment environment and if you pay CGT it means that your portfolio has increased in value, which of course, is a good thing.

In other words, if you sold a property after achieving a capital gain of $50,000 more than 12 months after the original purchase, the applicable CGT would be calculated on a capital gain of $25,000.

The applicable rate of CGT is the same as income tax, however if you own the investment property for more than 12 months, you get a 50 per cent discount on the capital gain.

CGT is payable on any property you sell where the capital gain itself is more than $30,000, except when it’s your own home, which is CGT-exempt.

So is Negative Gearing good or bad?

It’s important to understand that Negative Gearing is a taxation policy that applies to a vast array of income-producing assets and not just property.

There are a huge number of viewpoints on the policy but it in the end it enables investors to purchase properties, which are ultimately added to the supply of rental properties across the country.

This increases the supply of rental properties, which reduces the possibility of rents rising sharply due to more demand than properties available for rent.

Advantages of negative gearing

- Negatively-geared investors support the private residential tenancy market, assisting those who can’t afford to buy and reducing demand on government public housing.

- Investor demand for property supports the building industry, creatingemployment.

- Tax benefits encourage individuals to invest and save, especially to help them become self-sufficient in retirement.

Disadvantages of negative gearing

- It encourages over investment in residential property, an essentially “unproductive” asset, which is an economic distortion.

- Investors inflate the residential property market, making it less affordable for first home buyers or other owner-occupiers.

- Tax deductions and overall benefits accrue to those who already have high incomes, which will make the rich investors even richer and the poorer population even poorer, possibly creating and prolonging a social divide between socio-economic classes.

Of course, any investment in residential property should be done from the viewpoint of your wealth creation and not for the purpose or benefit of the tax advantages you receive. The tax advantages are nice by-product as a result of your investments you make and the risks you take investing in the market.

A proper and considered investment plan based around capital growth for the long term is what all investors should be aiming to achieve.

Further reading

If you’re interesting in learning more about Negative Gearing and the tax implications of owing investment properties consider the following sources:

- What is capital gains tax?

- Negative gearing calculator

- Capital gains tax calculator

- How much can I borrow for an investment property?

Intuitive Finance – the smart choice

Navigating property lending and understanding the latest on Negative Gearing can sometimes be tricky. Having a professional team on your side could make all the difference to your success. Now more than ever, you need investor savvy people working on your financial side.

The world of banking and finance can be a pretty daunting one for both novice and sophisticated investors and since our establishment in 2002 we’ve focused on providing outstanding service and business standards.

This approach was vindicated when we were recently named Victoria’s favourite mortgage broker at the 2015 Investors Choice Awards.

For expert advice on property investment loans and guidance on Negative Gearing, contact Intuitive Finance.

- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026