Guarantor home loans provide an opportunity to purchase a property with the assistance of a guarantor, often a family member, who uses their own property as security. At Intuitive Finance, we offer expert guidance to help you navigate the complexities of guarantor home loans, ensuring you secure the best option for your financial needs.

What are Guarantor Home Loans?

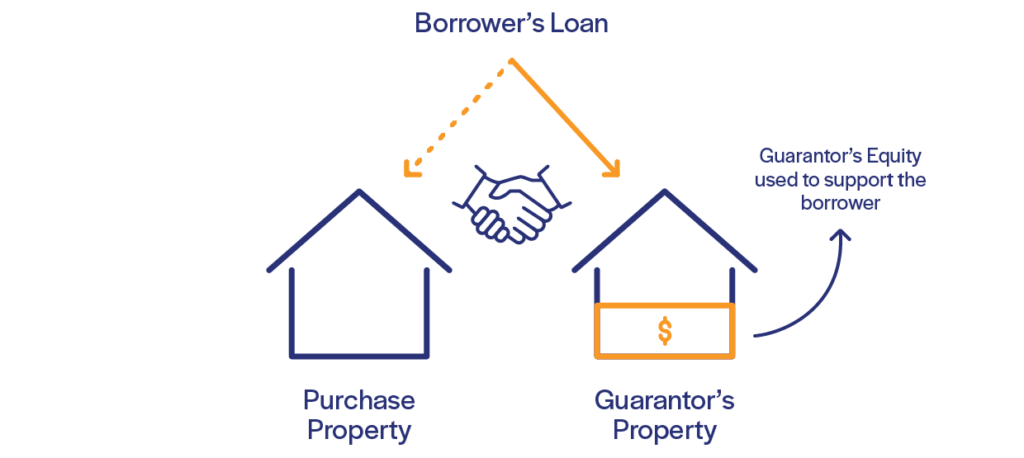

Guarantor home loans are a type of loan where another person, usually a parent or close family member, uses their own property as security for your loan. This allows you to borrow a higher percentage of the property value, or even the full purchase price. This can be a great option for first-time buyers or those who have limited savings for a deposit. The home loan guarantor’s property acts as a safety net, reducing the lender’s risk, getting you into the property market sooner, and potentially allowing you to avoid paying Lenders Mortgage Insurance (LMI).

How Do Guarantor Home

Loans Work?

Most lenders require a deposit of 20% for a home loan, and if you can’t provide that, they’ll ask you to pay LMI. All of these measures are in place to protect the lender; by proving you can keep your promise to pay the loan back.

With a guarantor loan, someone else provides the lender with reassurance that you can pay the loan back by offering up their own assets as additional security for the loan. If you only have a 10% deposit, your guarantor may offer up the other 10% in the form of their own home’s equity.

This allows you to access the loan and purchase property you wouldn’t have otherwise been able to, as your guarantor can make up for your deposit shortfall. Of course, the trade-off is that failing to make repayments allows the lender to pursue the guarantor for the loan amount, putting them at risk as well as yourself. If you’re considering a guarantor home loan, it’s important to speak to a professional.

Calculate Your Borrowing Power

Types of Guarantor Home Loans

Limited Guarantee Loans

A limited guarantee loan allows the guarantor to limit their exposure to a specific amount or portion of the loan. This provides more flexibility and reduces the risk for the guarantor while still helping you secure the necessary financing.

Family Guarantee Loans

A family guarantee loan involves a family member using the equity in their property as security for your loan. This type of loan can help you secure a higher loan amount or avoid LMI without requiring a large deposit.

ADVANTAGES

- Higher Borrowing Capacity: Borrow a larger amount or the full purchase price with a smaller deposit.

- Avoid LMI: Potentially avoid paying Lenders Mortgage Insurance.

- Family Support: Benefit from the financial support of a guarantor.

DISADVANTAGES

- Guarantor’s Risk: The guarantor’s property is at risk if you default on the loan.

- Complex Arrangements: Requires clear agreements and understanding between you and the guarantor.

- Impact on Guarantor: Limits the guarantor’s borrowing capacity and financial flexibility.

How to Obtain a Guarantor Home Loan with Intuitive Finance

Initial Meeting

A 1-hour session to establish your financial and lifestyle goals, discuss the fact-finding document, and agree on a timeline for its return.

Fact Finding Submission

We will submit the completed fact-finding document.

Strategy Submission

Within 5 days of receiving the completed fact-finding, a written strategy is submitted to you.

Document Lodgement

Within 2 days of agreeing to proceed, documents are lodged with the institution.

Conditional Approval

Expect conditional approval within 1 to 3 days of lodgement.

Unconditional Approval

Expect unconditional (full) approval within 2 to 4 days after conditional approval.

Loan Documents Arrival

Expect loan documents to arrive within 2 to 5 days after unconditional approval.

Loan Settlement

Expect loan settlement within 3 to 5 days after submitting the signed loan documents.

Who Can Be A Guarantor?

Guarantors are typically people you have a close relationship with. Your parents, partner, other close relatives, or even your adult children can all qualify as a guarantor. While having a guarantor can come with large benefits, the risks are also greater. It’s important your guarantor understands the risks and consequences before proceeding.

What happens if your guarantor is rejected?

If your guarantor is rejected, there are a few other pathways you can take to getting a loan. As mentioned, guarantor eligibility requirements can change from lender to lender, so trying a different lender may help. Otherwise, you may be able to take out a loan with Lenders Mortgage Insurance or even purchase property with a family member or friend.

Find Out if You’re Eligible for a Guarantor Loan

If you’re considering a guarantor loan, our experienced mortgage brokers will guide you through the steps. In a quick initial consultation, we’ll assess your situation, determine your eligibility, and show you the next steps to take. Book your consultation today via the button below.

Real Feedback from Real Clients

Family-Backed First Home Strategy

For many first-time home buyers, family support could be the difference between waiting and buying now. A guarantor loan enables parents or close relatives to use the equity in their property to underwrite your purchase, allowing you to get into the market faster with a lower deposit. This plan could boost your borrowing capacity, save you upfront costs, and eliminate the need for Lenders Mortgage Insurance. With the right structure and professional guidance, guarantor loans can be a smart, secure way to turn family support into long-term financial independence.

Our Commitment to the Community

With every loan we settle, you can choose to support Challenge – supporting

kids with cancer, the Movember Foundation, or the Lungitude Foundation.

We donate $20 to your chosen charity and make annual contributions. It’s our

way of giving back and helping those in need.