Is the HomeBuilder grant worth it?

Let’s take a moment to acknowledge that the political sphere has generally stepped up during 2020.

I concede that the usual argy-bargy of party politics is on display. You only have to look at the long running commentary being batted back and forth over the Victorian lockdown to see the acrimony on full display.

But in terms of the practicalities, there seems to be common aspirations to forge a path that will minimise health risks while keeping the economy as buoyant as possible.

As such, we’ve seen the introduction of a raft of assistance packages all designed to ensure jobs remain in place, the rent is paid, people are fed, and trade continues.

One of the most talked about schemes has been HomeBuilder – a program designed primarily to support the building and construction industry while easing the financial burden of some homeowners.

But has the $25,000 government handout done the job and should you be compelled to purchase, build or renovate simply because HomeBuilder is available?

Let’s take a look.

HomeBuilder rules

For those who may be unaware, HomeBuilder is $25,000 federal government grant for property owners looking to build a home or buy a new home, or carry out a home renovation, a

ll within set qualification guidelines.

The grant applies to principal places of residence only, so investors need not apply.

Criteria includes:

- Owner‐occupiers must be a natural person (not a company or trust), aged 18 years or older and be an Australian citizen,

- The grant is means tested to income caps of $125,000 per annum for an individual or $200,000 per annum for a couple based on a 2018‐19 taxable income,

- The new-build home must not have a property value in excess of $750,000,

- For those claiming for a renovation, the contracted works must cost between $150,000 and $750,000, and the value of your existing property must be below $1.5 million pre-renovation.

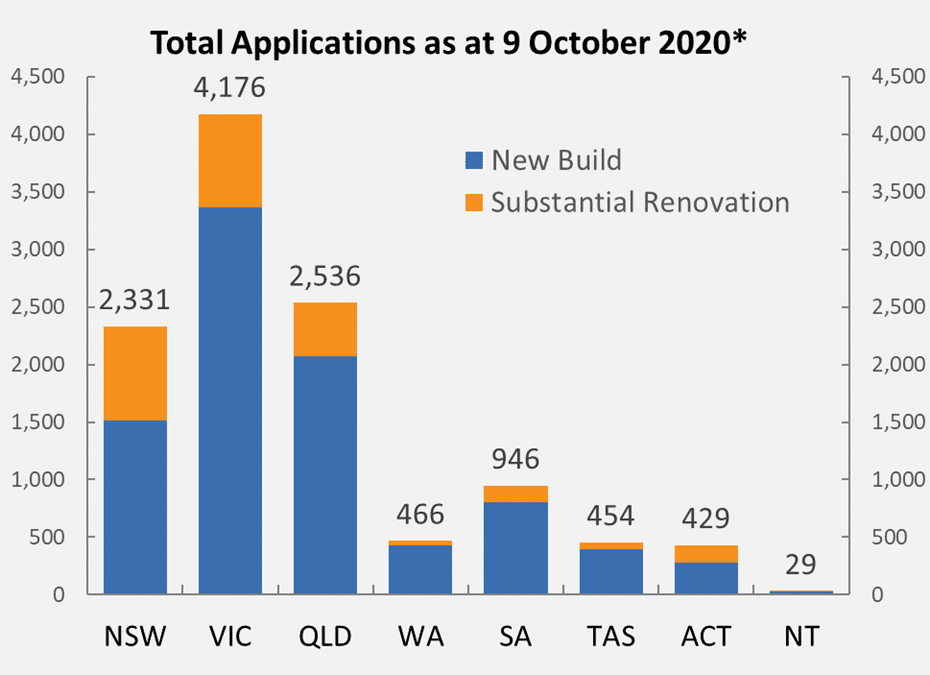

Treasury department data shows that there has been a total of 11,367 application up to the 9th October this year.

This is all well and good, but is purchasing or renovating a property because of a grant make sense?

Not in my opinion, and here’s why.

HomeBuilder faults

I have several concerns around the foundations of the scheme.

Firstly, the qualification criteria are ridiculous.

The largest population centres in Australia are Sydney and Melbourne, so the majority of Australia’s property transactions take place in these markets. If the federal government believes there’s a huge number of new-build property options with good fundamental long-term value growth priced below $750,000 within reasonable proximity of these two CBDs, they’ve got rocks in their head.

And while I have these concerns about new builds, it’s the renovation option that I think fails most of all.

It’s a nonsense those owners contemplating a renovation up to $750,000 will be spurred on to act just because a $25,000 grant is on offer. It may attract some, but not many.

And then there’s the means test. While some may consider $120,000 a year to be a substantial income, most people on this amount can’t afford to spend anything like three-quarters of a million dollars improving their home.

On the face of it, it seems idiotic to me.

And there’s 1 more thing for those Victorians amongst us. Based on the local State Government rules, you can’t even use the grant as a contribution towards the renovation that the banks will recognise, based on how it is implemented.

What do I mean by that?

I mean that you have to be able to prove to all the lenders, in Victoria, that you have the total funds to complete your renovation, without any reliance on the Homebuilder grant of $25,000 in order to undertake your renovation.

Now Dan Andrews has made a few mistakes through this pandemic, but this seems an easy fix that would enable Victorians to access the grant and get the construction industry moving again. But to date, there has been no movement and thereby hamstrung Victorians are stuck not being able to proceed – madness!

Will it work for some?

The effectiveness of HomeBuilder for individual clients is dependant of several factor.

For starters, those relying on the grant to help them scrape through with finance approval can forget it. HomeBuilder is not included as a benefit within a financier’s assessment criteria. You still need a sizable deposit to buy the new home or have access to funds that will cover some of the renovation cost.

As such anyone in this tight-finance category shouldn’t be prompted to act by HomeBuilder.

Next – HomeBuilder will stimulate overcapitalisation by some property owners. Securing an additional $25,000 in the account will see some frivolous procurements in terms of return on each dollar invested – and that doesn’t bode well for the value of an asset which is your home.

For example, spending that $25,000 upgrading your pool in an area dominated by low-cost housing could would not be smart. An end buyer is unlikely to pay extra for your property in the future just because you spent the grant without thought.

In fact, overcapitalising will assuredly negate the benefit of HomeBuilder to your project.

My years of experience tell me that HomeBuilder might look good in theory, but it’s done little in practice to be of benefit to large numbers of property owners and buyers. There are simpler ways to ensure grants of this size could be effectively utilised to create jobs AND get those who need it the most into a new home or improve their existing one.

- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026