An investor’s guide to cross collaterisation

At the start of your property investment journey, it can be confusing.

All your friends and family have well-intentioned opinions and “advice”, plus in today’s technological world there is a plethora of information available online.

But so many difference sources of intel can make start spinning until you don’t know your property pros from your property cons.

Well, thankfully we are here to help!

A term that crops in property investment, often when you’re growing your portfolio from one to two or two to three, is cross collaterisation and until that point in time you’ve probably never heard of it before.

This article will delve into what cross collateralisation is, and what it isn’t, as well as the risks associated with using this type of home loan structure.

So, what is cross collaterisation anyway?

Before we explain what cross collaterisation means in a property sense, we’ll go back a few steps to describe what is meant by the term “collateral”.

Collateral is any asset that has a value, such as a property. Generally collateral increases in value over time, which the owner can potentially tap into to use or profit from by selling.

With cross collateralisation, therefore, one asset (so a property) is used to underpin the purchase of a second asset or property. In a property context that means there would be one loan that is effectively secured by two (or more) different properties.

For example, Julie owns Property A but wants to purchase Property B without using any of her own funds. The bank can use both properties as collateral for the new home loan.

Property A is valued at $750,000 and has a mortgage of $450,000, which means Julie can use up $150,000 of the available equity – because most lenders require you maintain a loan to value ratio (LVR) of 80 per cent. In this example that means the 80/20 ratio would allow Julie to borrow funds up to $150,000 ($600,000 – $450,000 = $150,000 funds available using a 80 % LVR).

The issue is that the price of Property B is $800,000 and Julie doesn’t have a big enough deposit (using the equity from Property A) as well as the extra funds to pay costs such as stamp duty. However, if one cross collaterisation loan was created to cover both properties, Julie would be able to proceed with the transaction.

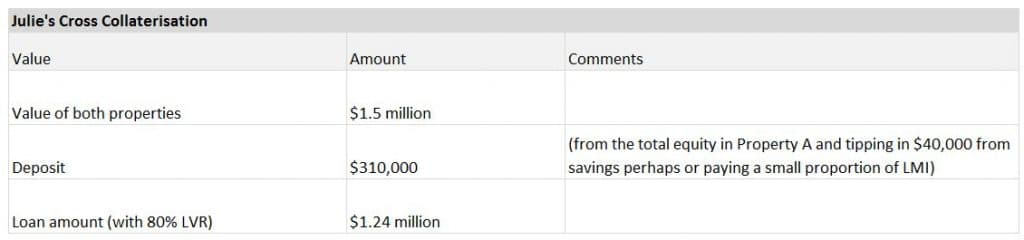

So, the cross collaterisation for Julie may look like:

It seems pretty simple doesn’t it? Well, no it’s actually not and it’s usually in an investor’s long-term interest to avoid cross collaterisation at all costs. Let’s find out why.

Cross collaterisation risks

Cross collateralisation may often seem to be an appealing option for an investor, but it puts banks in a stronger position as it provides them with greater control over your properties.

There may be a benefit initially to the investor in that he or she has not had to use their own cash to acquire the second property; however this strategy does have the potential to negatively impact future investment opportunities.

What most people don’t realise (and the banks don’t tell them) are that there are other and better ways to achieve the same results!

Loss of flexibility

With cross collaterisation there is a significant reduction in flexibility. For example, if a property is sold, the bank may require that the sale proceeds are used to reduce other loans in that portfolio so as to keep the LVR within a certain level. Therefore the excess funds you may think you’re entitled to may never end up in your bank account.

Frequent valuations

When there is one loan but a number of properties, doing anything with any of the properties can impact on them all. If you’re considering selling one of the properties, then each property within the cross collaterised loan may need to be re-valued to calculate the new LVR. Of course, valuations aren’t free and they’ll probably need to be paid out of your back pocket each and every time.

And what if 1 or more of your properties has actually decreased in value?

Limited choice

One of the things with cross collaterisation is that it’s a loan structure that usually benefits the banks over the long-term. When you “cross” properties, the cards are usually stacked in the bank’s favour because everyone knows that without a cross collaterisation loan you probably couldn’t have bought that additional property at all. What that means is there’s little room for negotiating with your lender and therefore you may not be getting the best deal.

Difficulty in changing lenders

Changing lenders has become easier over the years, but with cross collaterised loans it can be difficult given the complexity of the loan structure. Exit fees can also be higher.

Difficulty accessing equity

Different property markets do different things at different times, which means that having a diversified portfolio can be a good idea. But, if one of your properties that is cross collaterised grows in value and another falls, then any potential gains are wiped out by the corresponding fall with the end result being no extra equity. Remember, with cross collaterisation, it’s the sum of all of the property’s performance that is counted so it can take a while to grow collectively depending on individual market performances.

How do you avoid cross collaterisation?

As you can see cross collaterisation can often be more trouble that it’s worth and hands too much control to your lender, when the power should always remain with you.

So, if you’re interested in increasing your portfolio from two to three, how do you go about it without “crossing” the properties?

Actually it’s relatively simple: You can use (or leverage) the equity in your current properties and then just make sure that the new property has its own standalone home loan. Each property in your portfolio should have its own loan either with the same or different lenders.

If you don’t quite have enough money to complete the purchase, but already have two properties with quite good equity with one lender, then you could consider taking out a line of credit to supply the additional funds that you need for the transaction.

Using the same example as above: Julie has access to $150,000 from Property A but wants to buy Property B for $800,000, Ideally she would need a deposit of $160,000 plus extra funds for stamp duty and other costs, which could equal an extra $20,000 or $30,000.

So, perhaps she needs $190,000 to buy the property. An alternative strategy to use could be:

Then Julie would be able to pay down the line of credit over time while keeping both home loans separate and maintaining maximum flexibility and control.

Of course, access to lines of credit and other financial products is not a given, so Julie would need to access professional advice to understand her eligibility and mortgage options.

Intuitive Finance – the smart choice

In the property world, there are sometimes options which aren’t necessarily in your best financial interest.

The issue is that it can be quite confusing in the beginning and you don’t know what’s a property pro or a property con.

The world of banking and finance can be a pretty daunting one for both novice and sophisticated investors and since our establishment in 2002 we’ve focused on providing outstanding service and business standards.

This approach was vindicated when we were named Victoria’s favourite mortgage broker at the 2015 Investors Choice Awards.

Understanding what cross collaterisation is and why it may not be the best home loan product for you is a key part of your ongoing real estate education.

So why now contact Intuitive Finance today to ensure you have the right information and expert support on your side no matter what stage of the property ownership journey you are on?

Disclaimer:

The financial industry is a dynamic industry – continually evolving and changing. Whilst every effort has been made to ensure its accuracy, no guarantee is given that the information contained herein is currently correct. To the extent permitted by law, Intuitive Finance accepts no responsibility or liability for any loss or damage what so ever (including direct and indirect) to any person arising from the use or reliance on the information detailed here.

- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026