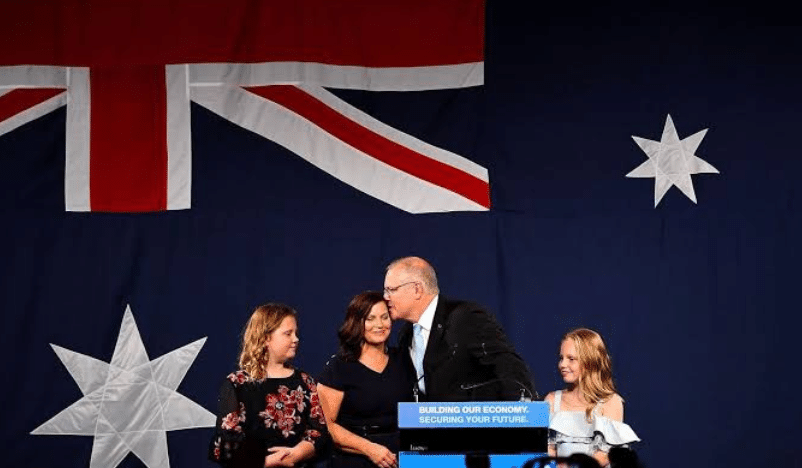

Hey ScoMo, your honeymoon’s over

Before he was the prime minister, Scott Morrison was the boss of Tourism Australia and helped coin the iconic phrase, “Where the bloody hell are you?”

Yes, that cheesy TV ad that made Lara Bingle a star was the brainchild of the then-marketing guru in his pre-politics life.

So, it’s only appropriate that many Australians are now wondering… where the bloody hell is ScoMo?

Since winning the election in May, the PM and his Treasurer Josh Frydenberg have been talking about how great things are and how promising the future is. I’d like to know what they’re looking at to get that impression.

A growing number of financial pundits expect the Reserve Bank will cut interest rates once again in November. It’s the only economic lever that’s being pulled to try to get the country out of the doldrums – and the tank is just about out of juice.

It’s time the government got to work on saving the economy. Sadly, Messrs Morrison and Frydenberg have become very adept at asking everyone else to do their job. Well Reserve bank cuts just aren’t working with business and now consumer confidence plummeting.

Yes, it seems that the Australian public have a far greater understanding of the economy than these 2 and instead of spending as they would like, they have listened to years of rhetoric about household debt being too high, and instead everyone is taking advantage of record low rates to fast-track their mortgages. Pretty smart I’d say.

Current strategy isn’t working

Since the Coalition won, there has been zero net benefit for the country. Morrison and Frydenberg don’t seem to be doing anything, except spinning political lines and parroting hopeful rhetoric not based on fact.

The constant “banging on” about their economic credentials and returning the budget to surplus as being the most important thing is sadly coming at the detriment to the rest of the country.

They’re the best government to support business? Business confidence is in the toilet and retail spending figures are hopelessly low. Consumer confidence is rock bottom. Everyone is starting to look a bit terrified.

What’s being done?

They’re the government for lower taxes? Those tax cuts weren’t spent like ScoMo hoped they would be, given the state retailers still find themselves in. And not enough of the cash went to the segment of the population that needs it.

Labour has offered a solution to bring forward the next wave of tax cuts, and the 2nd wave are far more meaningful too, but No, we need to return to surplus. What a load of bulltwang, if you can’t invest and borrow right now when the interest rates around the world are at record lows, when can you?

They’re the government for workers? Wage growth remains dead in the water. Cost of living pressures continue to soar. How can Australians be expected to help support the floundering economy when there’s no money left over each month? Or worse, when they’re in the red?

Rate cuts have done nothing. But you can’t really slag off the Reserve Bank. What alternative is there? No one else is doing anything to try to kick the economy back into gear – the government certainly isn’t.

Cutting rates and hoping for the best is all we’ve got at the moment, in place of actual policy and intervention. And with the cash rate potentially hitting 0.5 per cent next month, there aren’t many more bullets in the chamber.

Worse still, with the rate cuts we now have another “unintended consequence” of a rising housing market again – particularly in Sydney & Melbourne – buoyed by investors who are using the record low interest rates and recent regulatory easing to their advantage to re-enter the market.

Focus on wages

The government should immediately work on incentivising business to pay workers better. Throw a tax offset at the problem to put more money in people’s pockets. Yes, give business a break and incentivise them to employ.

Forget the “Small business write off” up to $30,000, if businesses aren’t confident then they won’t spend on items, but they will always look for opportunities to employ and/or incentives to pay people well. Maybe offer this same write off, up to $30k per annum, to employers who increase wages or add more hours to their staffing. This can start to work on one of the great problems we have now with underemployment.

Higher wages allow people to feel more resilient financially and they’ll spend more in the economy. They’ll shop. They’ll travel. They’ll invest. They’ll buy a car or a house. They’ll get a new TV. They’ll go out for dinner.

These are all things that many ordinary Australians increasingly feel like they should put off. Money is tight and only getting tighter. The future looks grim. Why spend money you might not have for much longer?

Higher wages also mean higher taxes, which puts money in the government’s coffers. They can either reinvest in infrastructure, which they should be doing already to support the construction sector.

You want people to spend, then give them something

What do you mean “give them something?” Didn’t Kevin07 do this? Yes, he did and the $850 handed out allowed people to go and buy those discretionary items that they wouldn’t have otherwise. It was a small reason we avoided the GFC.

Here’s what I would do:

1. Forget the surplus. What’s the point? It’s the equivalent of buying a packet of matches while your house is on fire.

- Forget the surplus. What’s the point? It’s the equivalent of buying a packet of matches while your house is on fire.

- Pour a stack of money into big infrastructure projects now. It’s nation-building, it supports construction and underpins jobs, it gives communities a vision for the future. Everybody wins. But unfortunately these take time to get to market and whilst important, we need more urgent stimulus.

- Deploy policies to increase wages immediately. Five years of zero wage growth, at a time when the cost of everyday life has skyrocketed, is outrageous.

- Help lower the cost of living by offering subsidies for energy and fuel.

And the big one…

Give every taxpayer a prepaid debit card loaded with money.

Make it between $500 and $1500, on a sliding scale based on incomes, with pensioners through to those earning up to $90K getting the most, and those beyond up to $180K getting the lower amount.

Restrict its use so it can’t be used online. You have to spend it in a store or a restaurant, or any kind of local business.

Guess what will happen? People will always spend “free money” and this then pours into local restaurants and shops, who need more staff (see income tax receipts rise) and then business turnover increases (see more GST receipts) and people will buy the items that they won’t right now due to personal pressures.

It will increase employment because of greater demand. It will boost tax income through the GST. It will help business turnover at a time when it’s seriously under pressure. It will give businesses a boost of profit. It lifts confidence. And it keeps cash in Australia.

Am I making sense yet?

We wrote about this back in May when we said “an interest rate cut would do little” And we’ve been proven right with little or nothing happening positively since.

Where the bloody hell ARE you?

ScoMo, you won. Australia probably didn’t expect you to, but the prime ministership is yours in your own right. Use it, please, for the sake of the country. The honeymoon is over. You’ve done the victory lap. It’s time to act.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026