Can I Buy a House with No Deposit?

Saving the deposit for your first property is one of the hardest parts of getting into the market. In fact, it’s always been that way.

But, with property prices in Sydney and parts of Melbourne now much higher than in years gone by, saving a big enough deposit is certainly not getting any easier.

But there are alternative pathways out there, including buying a house with no deposit.

It’s important to understand the pros and cons of this strategy, however, so you’re fully aware of the implications of buying a house with either no deposit or a low deposit. And this article has been written to help you understand just that.

How much deposit do you need?

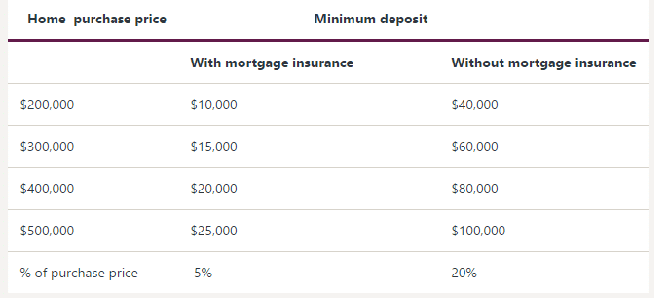

In an ideal world, all homebuyers and investors would have a 20 per cent deposit but this isn’t always possible.

Standard lending criteria is for banks to lend 80 per cent of the purchase price of a property with the borrower tipping in 20 per cent.

But if you don’t have a 20 per cent deposit you can still buy a property. However, you will have to pay Lenders Mortgage Insurance (LMI), which protects your lender in the unfortunate event of you defaulting on your home loan.

The amount of LMI you will have to pay depends on the size of your deposit, with smaller deposits, such as five per cent, attracting a higher proportion of LMI.

For example, if Julie and John want to buy a $500,000 property but only have a $25,000 deposit (or five per cent) they will be required to pay about $15,723 in LMI, which is usually capitalised on top of the loan. That is their loan will be about $490,000 instead of $475,000.

What are the options with no deposit?

Pre-GFC it was easier to buy a property with no deposit, but since that time lenders have tightened up their criteria significantly.

One thing that hasn’t changed, however, is guarantor home loans, which allow you to use the equity in another person’s property – usually a parent or close relative – as security to purchase a house of your own.

What this means is that they act as a guarantor for a 20 per cent deposit, and potentially other costs, by using their own property as security.

Over time you can have your property re-valued (once it has increased in value by more than the amount originally guaranteed) and the guarantor loan can be removed. This can take anywhere from three to five years or more, depending on the market and other factors.

For example, Sarah has saved $30,000 as a deposit but needs $70,000 to buy a one-bedroom unit for $350,000 without LMI implications. Her parents agree to come to the party as “the bank of mum and dad” and use the equity in their property to guarantee the remainder of the deposit.

It’s important that guarantors understand that they are legally responsible for paying back the entire loan if the other person cannot or will not make the repayments.

As a guarantor, however, they don’t have the right to own the property or items bought with the loan.

Removing the guarantor as soon as you can afford to should be the number one priority, which can be sped up by:

- Saving at least some money and putting it aside for unexpected fees and costs.

- Setting out a financial plan to ensure repayments can be made.

- Ensuring you have a steady and reliable source of income, such as via a secure job.

The benefit of no deposit home loans

There are opportunities to buy a house with no deposit and there are a number of benefits if you’re considering doing so.

There are opportunities to buy a house with no deposit and there are a number of benefits if you’re considering doing so.

One of the main benefits of a no deposit home loan is the ability to get into the market faster. The problem with having a save a 20 per cent deposit is that it usually takes a number of years to do so and prices can sometimes increase faster than you can save the deposit!

No deposit loans also generally benefit first home buyers, those returning to the market or investors with money tied up in other assets, who may have difficulty coming up with 20 per cent of the property price as a cash deposit.

The negatives of no deposit home loans

While there are no deposit home loans out there for homebuyers and investors, they are not without some cons, including the fact they often attract higher interest rates.

While there are no deposit home loans out there for homebuyers and investors, they are not without some cons, including the fact they often attract higher interest rates.

Therefore, if you’re considering buying a house with a no deposit, you must understand the negatives as well as the positives of these types of loans. These may include:

- Guarantors must already be well-established and risk their own assets.

- Limited lenders offer the no deposit home loan.

- Higher interest rate for the loan.

- LMI is costly.

- Higher repayment instalments.

- Not exempt from many traditional loan application fees.

Intuitive Finance – the smart choice

Today’s property market can make it more challenging for homebuyers and investors to save a big enough deposit to get into the market.

There are alternatives in the lending landscape, however, with no deposit loans offered by some lenders but you must understand all of the ins and outs. That’s why it’s vitally important to have investor-savvy people working on your financial side, who can help you understand which financial products will be the best for your situation.

The world of banking and finance can be a pretty daunting one for both novice and sophisticated investors and since our establishment in 2002 we’ve focused on providing outstanding service and business standards.

This approach was vindicated when we were recently named Victoria’s favourite mortgage broker at the 2015 Investors Choice Awards.

So, if you’re considering buying a property with no deposit, make sure you contact Intuitive Finance to ensure you have the right information and expert support on your side no matter what stage of the property journey you are on and how big your deposit is.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.

- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026