All the grants and initiatives on offer to first home buyers across Australia

Definition: The federal government, as well as each state and territory, have a range of grants and other initiatives on offer to first home buyers. They range from cash to go towards purchase costs to deposit guarantees. There are strict eligibility requirements and some rules about what you can buy and for how much.

Importance: Buying your first home is tough. Property prices are high, and continuing to rise in many parts of the country. Interest rates have risen sharply over recent years, making repayments a big pill to swallow. And then there’s the hefty deposit required by your lender. The good news is that the federal government and each state and territory has help in place via a range of grants and schemes.

Key differences: A First Home Buyer grant is an amount of money to go towards your purchase costs. Other initiatives launched in recent times are a little more complex, ranging from the government guaranteeing a big chunk of your deposit, so you don’t need as much cash up front to buy, to having them take a share of your equity to make repayments smaller and more manageable.

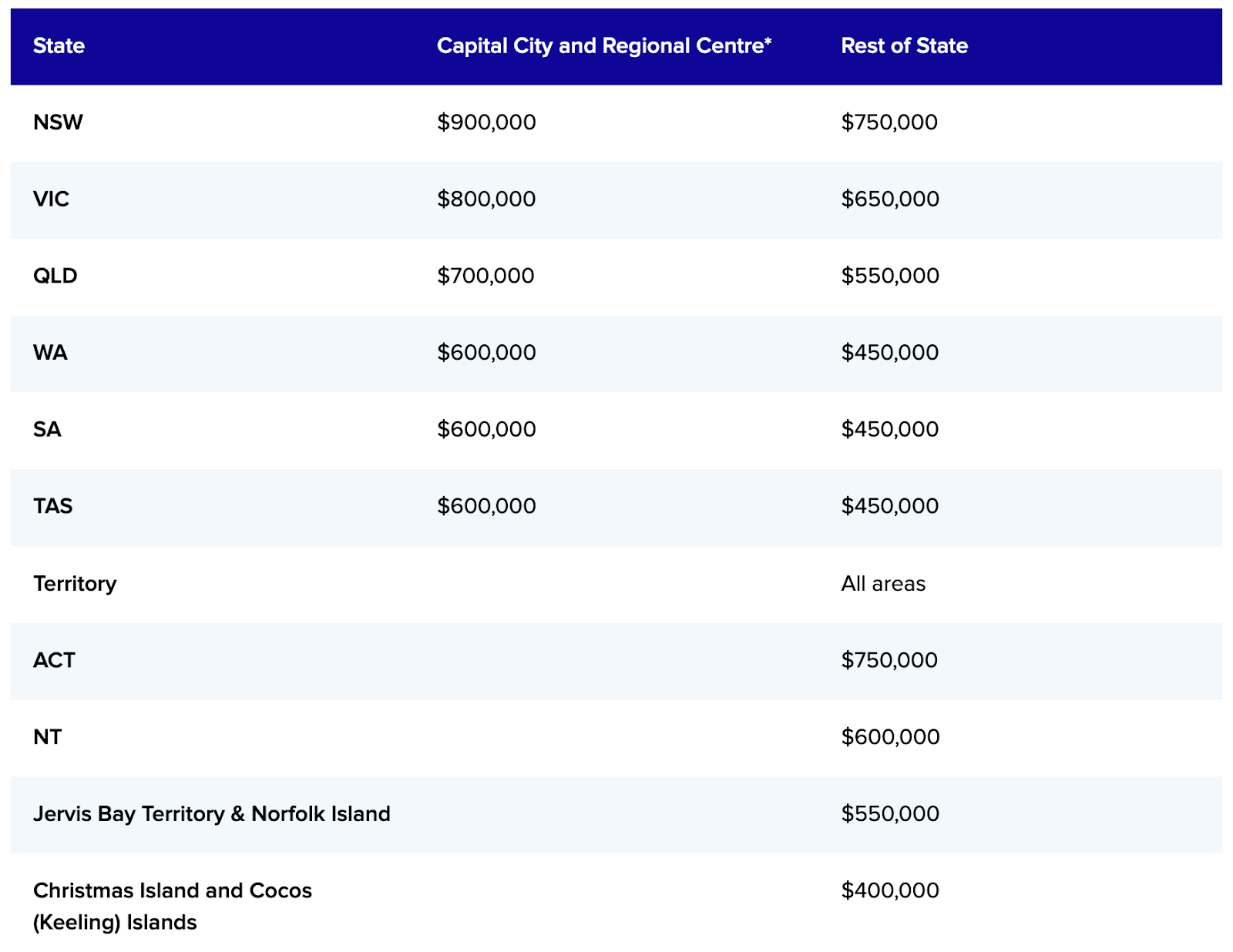

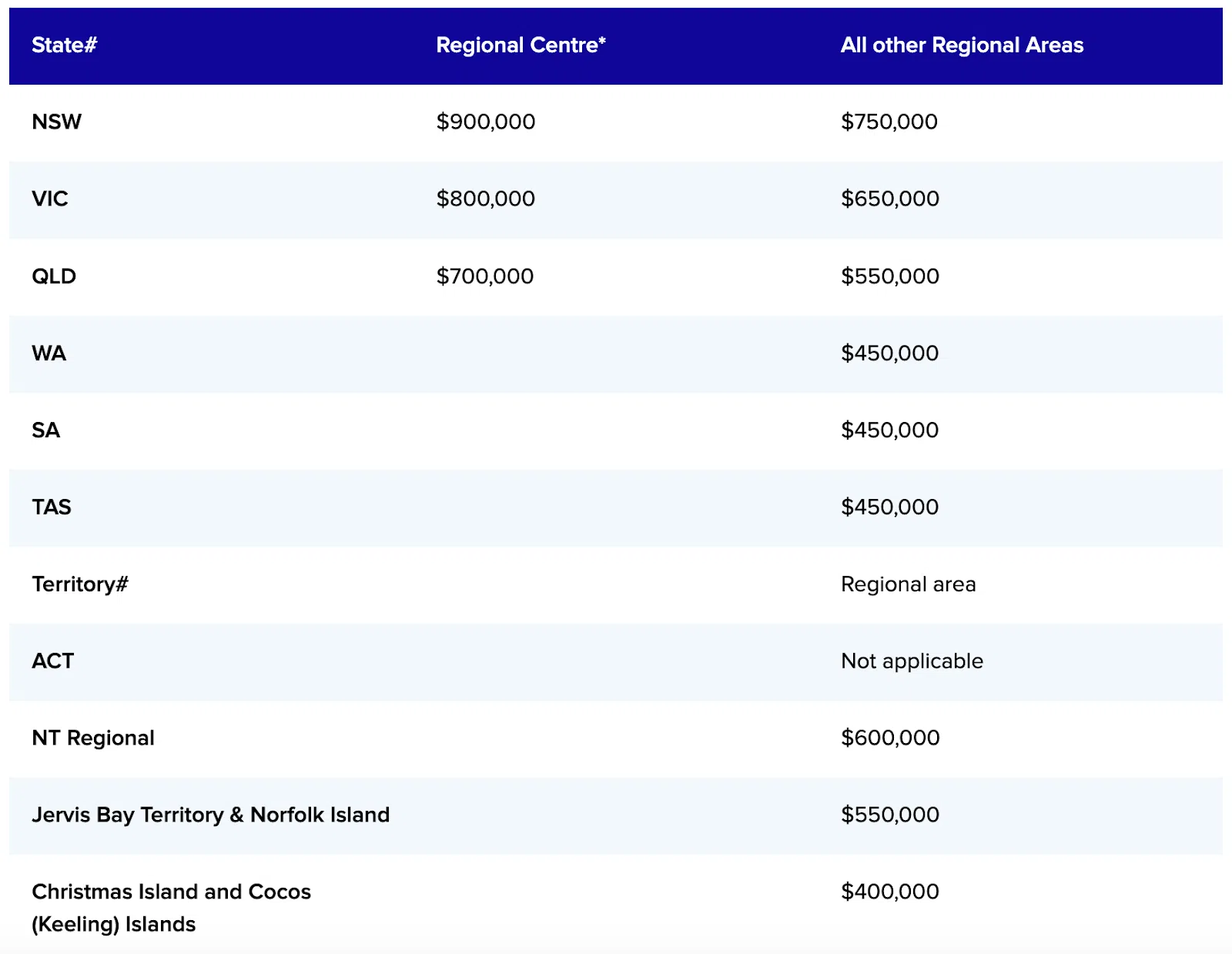

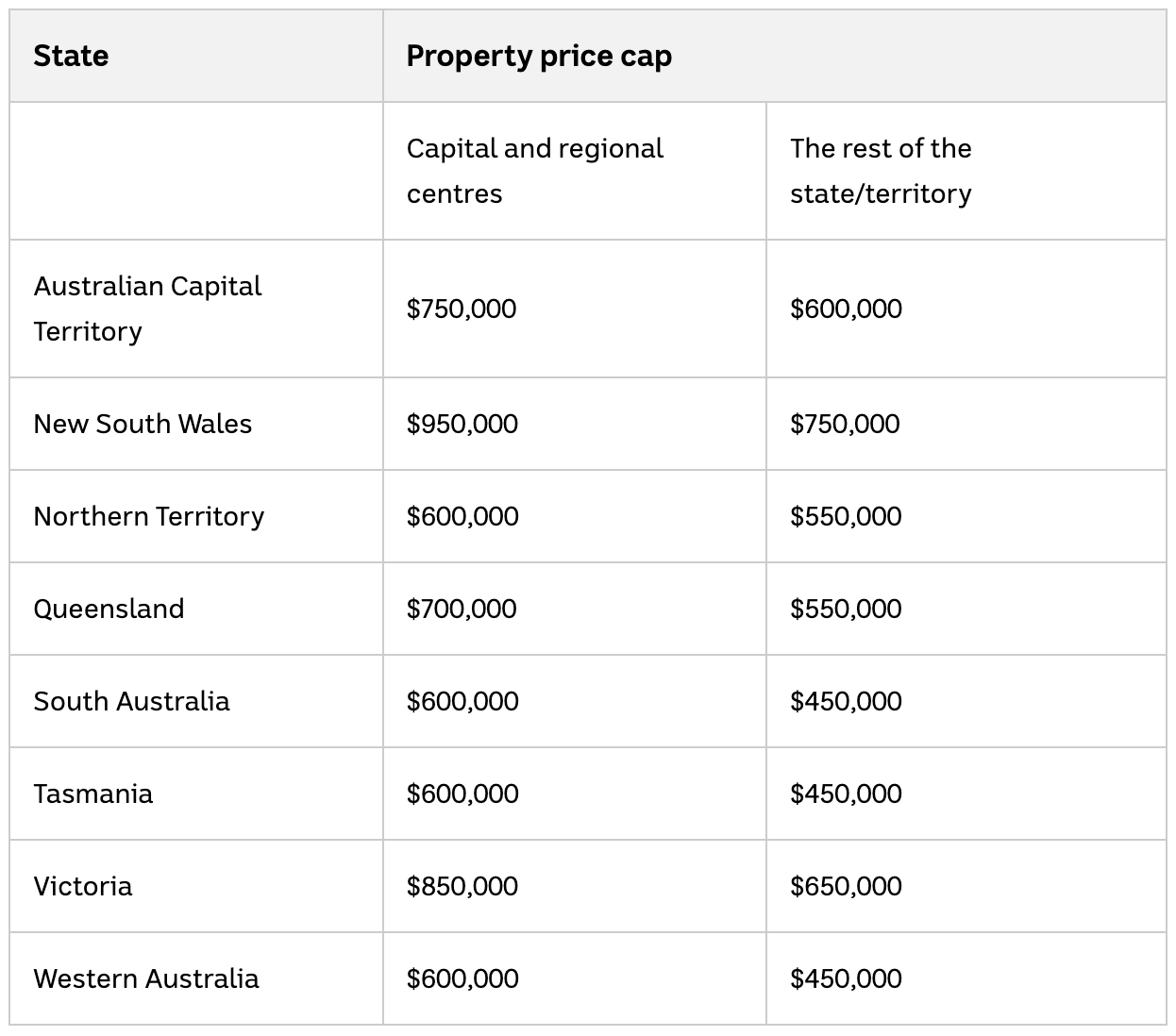

The Federal Government has made housing affordability one of its key policy focuses, rolling out new and expanded schemes to make it a little easier to buy your first home. This is a summary of what’s available. First Home Guarantee: Eligible first home buyers can purchase with just a five per cent deposit – considerably less than the standard 20 per cent contribution typically required. The Federal Government then guarantees the balance of the deposit, meaning you don’t have to pay lenders’ mortgage insurance. In the current financial year, there are 35,000 spots available. Strict eligibility requirements must be met, including: The property purchased can be an existing house, apartment or townhouse, a house-and-land package, land with a contract to build a home, or an off-the-plan apartment or townhouse. There are purchase price caps depending on where you live. Those interested can apply with an approved participating lender. Talk to us about which banks are involved, the pros and cons based on your personal circumstances, and for help applying. Regional First Home Buyer Guarantee: This scheme is very similar to the First Home Guarantee program, except it’s targeted at those living in regional and remote parts of the country. It does the same thing – eligible buyers need just a five per cent deposit and the government guarantees the rest. In the current financial year, there are 10,000 spots available. The same eligibility criteria apply. Likewise, the same property types allowed apply. And there are price caps depending on where in Australia you’re buying. The big difference is that the home you’re buying must be in a regional area, which is defined as: Greater capital city areas in each state and the Northern Territory are excluded, meaning even the furthest reaches of Sydney or Melbourne aren’t eligible. The entire Australian Capital Territory is also excluded. Those interested can apply with an approved participating lender. Talk to us about which banks are involved, the pros and cons based on your personal circumstances, and for help applying. Help to Buy: The Federal Government’s new Help to Buy scheme passed Parliament in November, 2024. It will see eligible participants able to purchase a home with as little as a two per cent deposit. On top of that, the government will take a portion of equity to make ongoing repayments smaller and more manageable. Those buying an existing home could hand over 30 per cent of the purchase price, while those purchasing a new home could forego 40 per cent. That equity share will be paid back over time, or in full when you sell. The government has indicated it will offer 10,000 places in the scheme each year. Strict eligibility requirements will apply, including: The property purchased can be an existing house, apartment or townhouse, a house-and-land package, land with a contract to build a home, or an off-the-plan apartment or townhouse. There are purchase price caps depending on where you live. The government will announce start dates for Help to Buy soon. It will also approve a list of participating lenders. Those interested in applying for a Help to Buy place can talk to us about which banks are involved, the pros and cons based on your personal circumstances, and for help applying. New South Wales: A First Home Owner Grant is on offer for eligible buyers in NSW, offering $10,000 towards the purchase price. There are strict eligibility requirements, including: First home buyers in the state could also be eligible for a partial or total discount on payable stamp duty. Those who are Australian citizens and aged at least 18 years old, buying their first home, who live in the property within a year of settlement and for at least 12 consecutive months, could be eligible. For a home purchased for up to $800,000, a full exemption from paying stamp duty is on offer. For homes valued between $800,000 and $1 million, a concessional rate is on offer. Victoria: A First Home Owner Grant is on offer for eligible buyers in Victoria, offering $10,000 towards the purchase price. There are strict eligibility requirements, including: First home buyers in the state could also be eligible for a partial or total discount on payable stamp duty. Those buying a first home, whether it’s an existing dwelling or brand-new, won’t pay stamp duty if the purchase price is less than $600,000. For homes priced between $600,000 and $750,000, a concession rate is on offer. Queensland: A First Home Owner Grant is available for eligible buyers in Queensland, offering between $15,000 and $30,000 towards the purchase price. There are strict eligibility requirements, including: Properties that have been substantially renovated could also qualify, but there are strict rules around this particular provision. If the purchase contract was signed after November 20, 2023 and before June 30, 2025, the grant amount is $30,000. For contracts signed before November 20, 2023, the grant amount is $15,000. First home buyers in the state could also be eligible for an exemption on payable stamp duty. Those buying a first home, whether it’s an existing dwelling or brand-new, won’t pay stamp duty if the purchase price is less than $800,000. South Australia: A First Home Owner Grant is available for eligible buyers in South Australia, offering $15,000 towards the purchase price. There are strict eligibility requirements, including: There is no price cap for contracts entered into after June 6, 2024. First home buyers in the state could also be eligible for a partial or total discount on payable stamp duty. All first home buyers who are Australian citizens and at least 18 years old, buying a brand-new property to live in, won’t pay any stamp duty. There is no price cap for contracts entered into after June 6, 2024. Western Australia: A First Home Owner Grant is available for eligible buyers in Western Australia, offering $10,000 towards the purchase price. There are strict eligibility requirements, including: For homes within Greater Perth, a purchase price cap of $750,000 applies. For all other parts of the state, a purchase price of $1 million applies. First home buyers in the state could also be eligible for a partial or total discount on payable stamp duty. Those purchasing a new property valued up to $450,000 won’t pay any stamp duty, while homes priced between $450,000 and $600,000 will attract a discounted rate. ACT: There is no first home buyer grant on offer in the Australian Capital Territory. However, those purchasing their first property to live in are eligible for a stamp duty exemption, called the Home Buyer Concession Scheme. There are strict eligibly requirements, including: Brand-new and established properties are eligible. There are no purchase price caps. If your household income is below $250,000, you won’t pay any stamp duty. Tasmania: A First Home Owner Grant is available for eligible buyers in Tasmania, offering $10,000 towards the purchase price. There are strict eligibility requirements, including: There are no purchase price caps. First home buyers in the state could also be eligible for a partial or total discount on payable stamp duty. Those who are Australian citizens and at least 18, purchasing a brand-new property to live in that’s valued up to $750,000 won’t pay any stamp duty. Northern Territory: A HomeGrown Territory Grant is available for eligible buyers in the NT, offering $50,000 towards the purchase price. There are strict eligibility requirements, including: Those first-timers buying an established property are eligible for $10,000 under the HomeGrown Territory Grant. The same eligibility, bar the new home requirements, apply. There are no purchase price caps on either variants of the scheme. There are no stamp duty exemptions on offer to first home buyers in the NT. Talk to us about what grants, incentives and schemes are on offer for you as a first home buyer. We can help you maximise all available opportunities, as well as apply.National initiatives for first home buyers

State and territory grants and schemes

Eligible homebuyers can access assistance in each state and territory across Australia. This is a rundown of what’s on offer.

Knowledge Hub Updates

- Mortgage Mumbo Jumbo decoded: Making Sense Of Banking Terminology - July 2, 2025

- Why winter is still a great time to sell – and buy – property - June 25, 2025

- All the grants and initiatives on offer to first home buyers across Australia - January 6, 2025