Understanding Stamp Duty

Stamp duty is one of those extra costs that is rather easy to forget when you’re buying property but can really add up to your total cost. It is tempting to dismiss it when deciding what you’re willing to pay for your next Investment property but don’t fall into a trap. Depending on the property, or asset, you could be looking at tens of thousands of dollars in stamp duty to pay in quite a small timeframe.

Our greatest recommendation is to have stamp duty in mind when setting your budget. The more you’re willing to pay for the Investment property, expect to pay more stamp duty on top of this. Knowing how much you can afford comes down to you doing your research.

What is Stamp Duty?

To put it simply, stamp duty is a tax that you’ll sometimes be required to pay on legal documents. You’ll find stamp duty applied to a number of acquisitions including real estate, cars, shares and business assets or on contracted services

such as loans, gifts and some insurance policies. Unfortunately, it’s unavoidable so make sure you consider these charges when you’re calculating the affordability of a purchase.

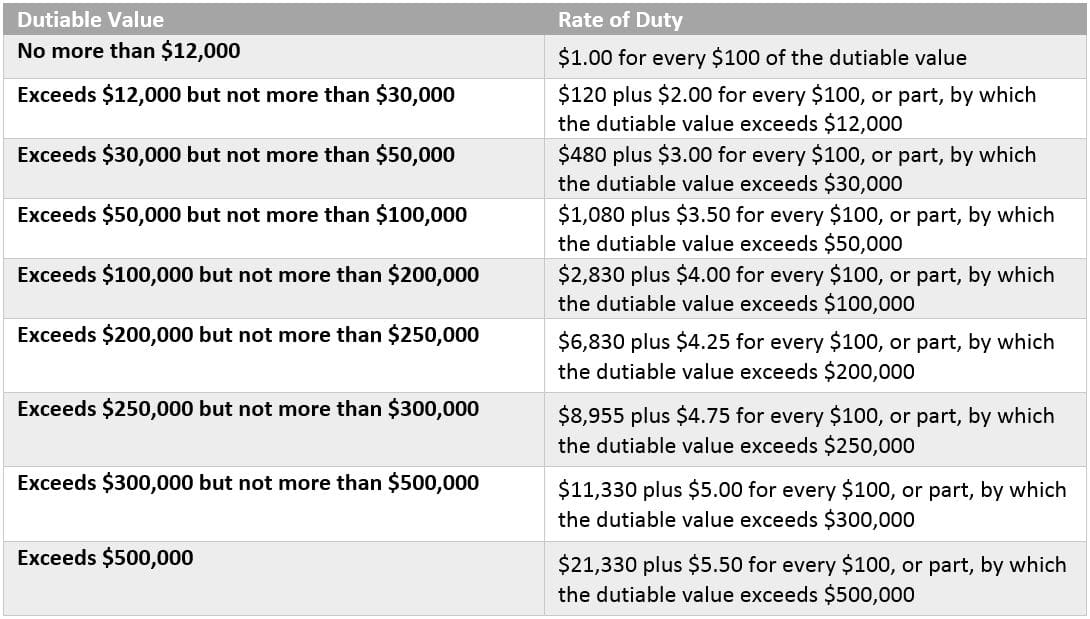

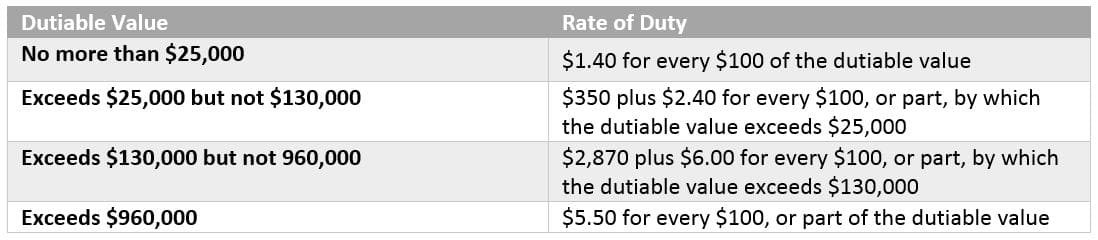

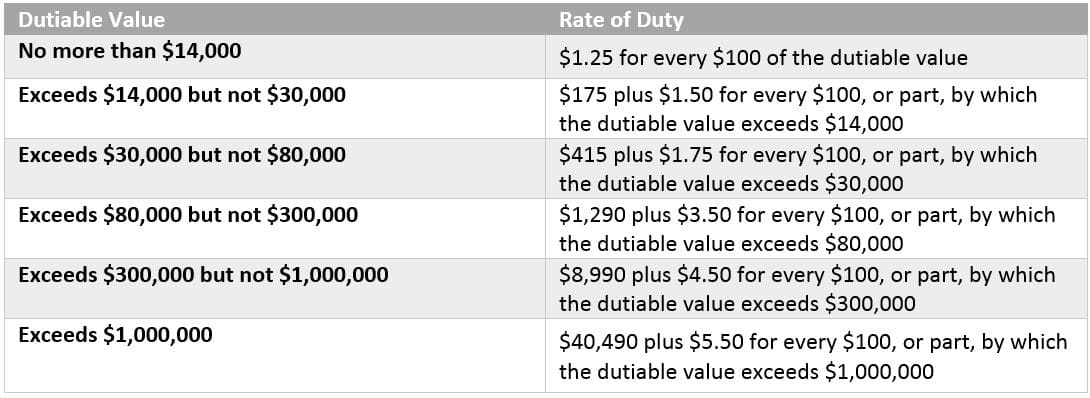

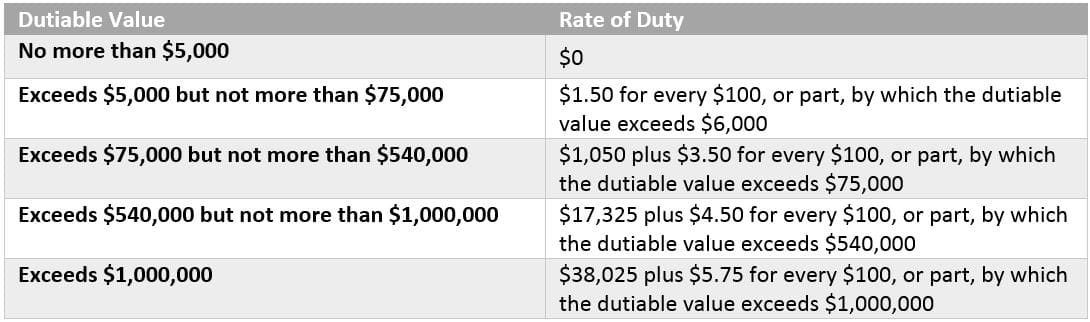

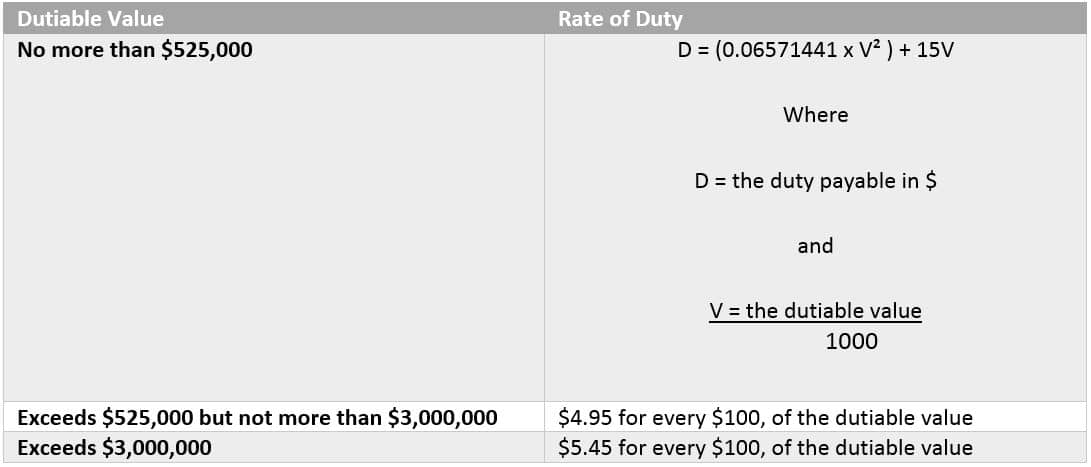

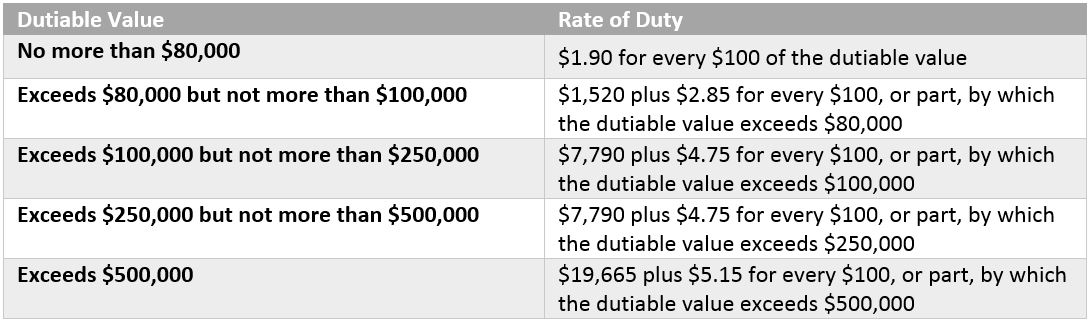

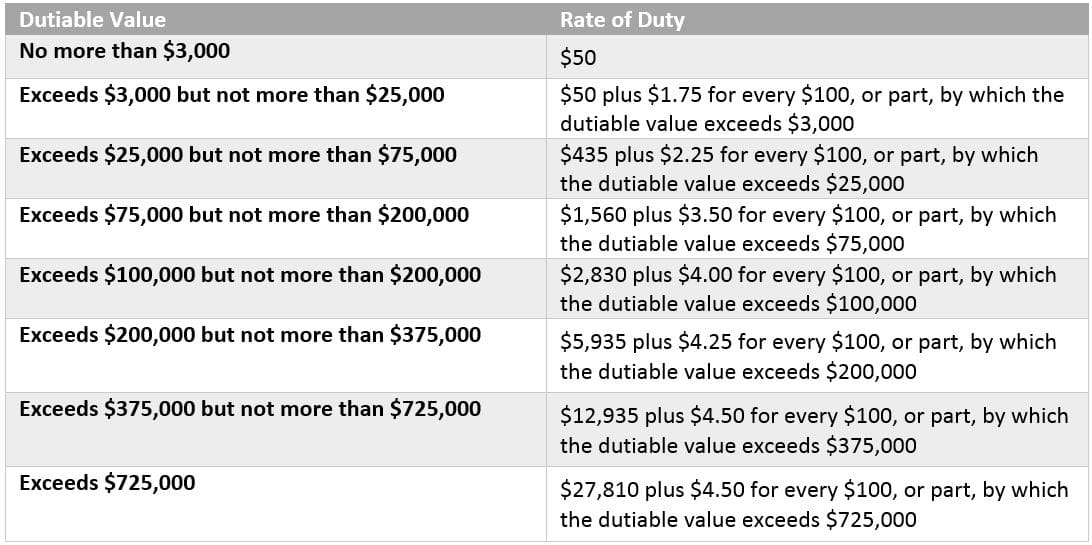

Stamp duty is a state based tax and can vary vastly from state to state depending on purchase prices and what you are purchasing. Please see the overview below for the differences between the states and how much these can vary.

Who Has to Pay It?

Depending on the transaction at hand, it may be the purchaser or the buyer who is required to pay the tax. In the case of property purchase, it is the buyer who is obligated to pay stamp duty. It is also important to remember that the stamp duty on Investment property must be paid within 30 days of the settlement or else you may incur a penalty tax or interest. If you’re working with a solicitor or conveyancer, they will pay the stamp duty on your behalf but be sure to confirm this payment and ask for a duty statement for your own reference and peace of mind.

Depending on your lender and loan type, stamp duty may be included in the amount that you borrow. Regardless of whether or not you pay the money upfront or borrow it, you’ll need to lodge relevant statutory forms with original documents, supporting information and of course payment. What you need to lodge in order to comply with stamp duty obligations is very much dependent on the relevant jurisdiction. Do your own research and talk to an industry professional to ensure you aren’t leaving anything out.

How Much Does It Cost?

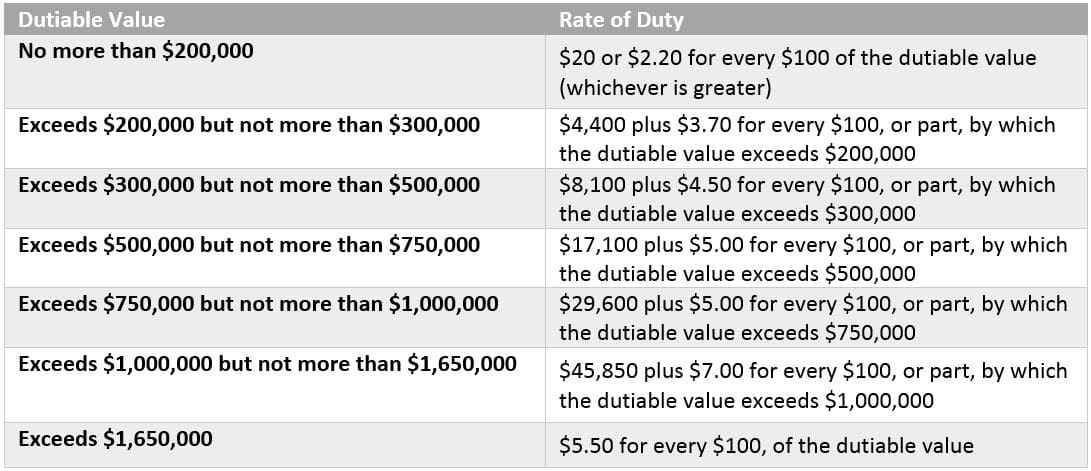

How much you pay really depends on where you live and what your circumstances are. Generally, stamp duty will be calculated from the cost of the Investment property. The more you pay for the property or the more it’s worth, whichever is higher, the more the stamp duty. Much like your taxable income, stamp duty is often determined on a sliding scale. Whichever threshold your property value falls under is the percentage you’ll pay in tax.

In Victoria for example, the amount you’ll pay on stamp duty starts at 1.4% for a $25,000 purchase all the way up to 5.5% for a purchase of $960,000 and above. Northern Territory doesn’t follow this threshold system and instead employs a formula to work out the payable stamp duty.

There are also a number of concessions that you may be eligible for depending on your circumstances. These also differ from state to state but include:

- Pensioners

- First Home Buyers

- Those handing over family farms

- Those intending to make the property their Principle Place of Residence (PPOR)

- Those purchasing off-the-plan sales

- Beneficiaries of a deceased estate

- Those who have been gifted property from his/her spouse

To find relevant concessions, have a look at your state’s eligibility criteria and rates in the links provided below.

Overview of Rates by State

Due to the diversity of the rules and regulations for stamp duty from state to state, our recommendation is to do your research. You might even find it useful to put your number in an online Stamp Duty Calculator.

Further Reading

If you are interested in reading more on stamp duty here are some useful resources.

- PWC have developed a toolkit for heaps information on stamp duty Australia-wide.

- Domain Explains Stamp Duty

Intuitive Finance – the smart choice

The world of banking and finance can be a pretty daunting one for both novice and sophisticated investors and since our establishment in 2002 we’ve focused on providing outstanding service and business standards. This approach was vindicated when we were recently named Victoria’s favourite mortgage broker at the 2015 Investors Choice Awards. For expert advice on lenders mortgage insurance, contact Intuitive Finance.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.

- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026