Should you build or buy your investment property?

You’ve decided to jump into real estate and purchase an investment property. Congratulations!

Real estate can be a great tool for long term growth and there are many pros. Property can offer the savvy investor stability, cash flow, tax benefits and an opportunity to leverage equity from your principal place of residence to build long-term personal wealth.

Of course, there are also some cons. If you need access to funds, it can take months to sell the property, tying up capital, there may be many unplanned expenses (repairs, maintenance, etc), there are high entry costs and there may be a lack of investment diversification.

However, there is a level of trust that many Australians have with property as a tool for personal wealth growth. So, for now, congratulations are in order – you’ve decided to become a property investor.

Once you’ve made the decision to invest in property, don’t think you can sit back and relax. That is just the first of hundreds, if not thousands, of decisions you need to make before you can welcome your first tenants to their new home.

The next big question to consider is whether you want to buy a dwelling or build one!

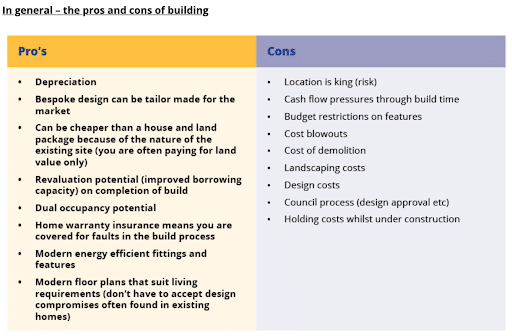

Building an investment property

If you decide to build, your next choice is between buying a well-located block of land and knocking down the building that sits on it, or, keep things simple and buy a house and land packaged together?

Let’s discuss!

A: The House and Land Package:

The pros of house and land packages:

The main benefit of buying a house and land package is that builders have created a simple process to help young, inexperienced purchasers on the road to building their first property. House and land packages have a long and illustrious history in this country as greenfield sites are colonised in the name of urban sprawl, and the process has become so streamlined and simplified that it’s become much simpler to navigate nowadays than in years past.

Many investors are concerned about building a new house because of the complexity, time and funding required. They are also concerned about making sure that what they build will have the features, amenities and services required to remain attractive to as wide a range of renters as possible.

House and land packages, where you have agreed a fixed price with the property and construction company (often one and the same) prior to commencement of the build generally means that you will have a better chance of ending up with a house that is finished and ready for rental.

A house and land package is a good option for people new to the category and who may be lacking confidence to negotiate, and fund, a more complex build that requires town planning approval, quantity surveying, architectural input and interior design – and of course, demolition.

It’s also important to note that a house and land package will generally include all of the basic finishes and fittings that could potentially add significant cost (and even time delays) if you were arranging such yourself, such as carpets, or kitchen and bathroom fit outs, and even outdoor features such as paths, lawns, driveways and perimeter fencing.

The entire house design is generally set although you will of course have the capacity to decide on colours, facades and finishes within a range. All in all, this option is an attractive one for investors who don’t have the time or inclination to take the project on themselves – you can also feel confident that the builders are well versed in offering what works – and you will end up with a property that suits the regional demographic profile and offers features that fit the lifestyle requirements of the renters. Comparatively stress-free investing!

There are other benefits to buying a house-and-land packages:

Stamp duty savings: When investing in a new house and land package, you typically only pay stamp duty on the land component, which means you could save significantly when compared to buying an existing, finished home.

Council approval: If you’ve ever built a home then you may be nodding your head in agreement when we say that the council approval process can be a long and painful one. House and land packages mean that this process is simpler and often already organised. A big plus!

New homes have higher depreciation rates: As an investor, it’s important that you consider the opportunities to reduce your assessable rental income with deductible expenses such as depreciation. Given the high starting value of the house and its fixtures and fittings, you will generally find that depreciation charges in the first years are quite high and could mean that net holding costs on the property are lower.

Customised design: The houses offered today are incredible for the range of services and amenities they can include – significantly more sophisticated than even a decade ago.

Finance offers: One of the great advantages, particularly if you are one of the development’s first purchasers, is that the project managers are often keen to do a deal – and, as a result, you may find some extremely attractive packages on offer that include finance at a significant discount. It’s always important to understand how you are placed in negotiations – never be afraid to test the market.

It’s quick! Quite often, given the efficiencies involved, your house may be ready significantly more quickly than if you were building a one-off, bespoke project.

The cons of house-and-land packages

Cheaper land: One of the challenges with house-and-land packages is that the land is often on the outskirts of regions and as a result, the land values may take some time to appreciate compared to more established suburbs.

Potential loss of quality: The fact that the construction process is more efficient (due to the volume of houses being built across the development at the one time) can mean that prices are generally kept low, however, this can often be a negative when speed is prioritised over quality.

Rising construction costs: Construction costs can change, and in the current environment, they’re rising quickly. While in most instances you will lock in a fixed price contract, this does mean the cost of the build may change dramatically between the time you start your due diligence, and when you eventually sign on. Rising costs also present some risk to builders who find their margins dwindling as projects progress. This can lead to all sorts of troubles with builders going broke mid project.

Costly add-ons: You have walked through the display home and loved everything about it. However, be aware that a display home is a selling tool and many of the features will be luxury add-ons not included in the basic level.

B: The knock-down option

Buying an established property that gets demolished to make room for a new structure is a significant undertaking.

Things to consider – pros and cons – of buying a knock-down:

Generally, you would only consider this option if the existing house was uninhabitable (or extremely unattractive to potential renters) or if the block size was such that you could subdivide and establish multiple dwellings (assuming the local council was amenable). One of the great things about this option is that you have the choice to live in one and rent out or sell the other.

Regarding sub-divisions, before you buy, check with your local council for permission. Many councils are now restricting such projects, particularly in character suburbs. Each council has its own idiosyncrasies but in general, you’ll need an adequately sized block (in Australia that’s generally a minimum of 700 square metres) and the capacity in the block to provide driveway access and off-street parking for both new dwellings. You’ll also need to understand issues such as easements, covenants and heritage overlays which will affect what you can build.

We strongly suggest you view title documents and visit the council before making any serious decisions on a property.

The choice between a standard house design (as offered by many building companies) or to engage an architect to create a design that you project manage through to build is a personal one and is generally subject to your budget and appetite for risk.

Buying an established property

Buying an established property is a simpler, more familiar process for most and will usually mean that you can be attracting tenants within days of completing your purchase.

The pros of buying an established property:

You know what you’re getting: The property is established, the layout and features are defined, and you can work with local estate agents to attract tenants.

Convenience: Often the quicker you can generate rental income the better.

Less stress: Even the most experienced property investors can find the building process incredibly stressful.

Price negotiations: There is greater scope for negotiating when buying a house from an individual, private vendor. A seller who is desperate to close the sale can be more flexible on the price. There is far less capacity for negotiation with a builder who is working on selling a group of house-and-land packages for a certain amount in order to unlock bank financing to begin construction.

Block size: Often, established properties are built on larger blocks than modern dwellings and this means capital appreciation may be stronger than newer sites.

Value adds: For anyone with some flair and imagination, it’s often possible to add value with smart and simple renovations.

The cons of buying an established property:

Cost: The cost of running the house may be higher. Older houses can be poorly wired, not airtight and have substandard plumbing. The running costs for the property can often mean that renters will look elsewhere.

Cost of renovating: Older properties can be more expensive to renovate, with materials and design elements that require specialist trade services. For some properties, heritage overlays can add additional complexities (and expense) to renovation work. In addition, materials and trades are in short supply at present. Most projects are taking much longer to complete than you might expect.

Conclusion

The choice to buy an establish

ed property or build a new house for your investment is a complex one and is based on a range of issues – from your level of experience in managing builds, your knowledge of the local market and what attracts renters to your asset, as well as your capacity for risk and any requirements for managing your financial exposure.

There’s no one right answer to the question, but guidance from trusted experts can help define your path.

Intuitive Finance – the smart choice

The world of banking and finance can be a pretty daunting one for both novice and sophisticated investors and since our establishment in 2002 we’ve focused on providing outstanding service and business standards.

This approach was vindicated when we were named Victoria’s Best Finance Broker at the 2017 Better Business Awards.

So if you’re considering investing in, or developing, property, why not contact Intuitive Finance’s mortgage brokers today to ensure you have the right information and expert support on your side no matter what stage of the property ownership journey you are on.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.

- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026