Beware the 2020 debt bomb!

Are you ready for the 2020 debt bomb?

Now before you start thinking I’ve gone all “60 Minutes” and am falsely forecasting property doom and gloom, think again!

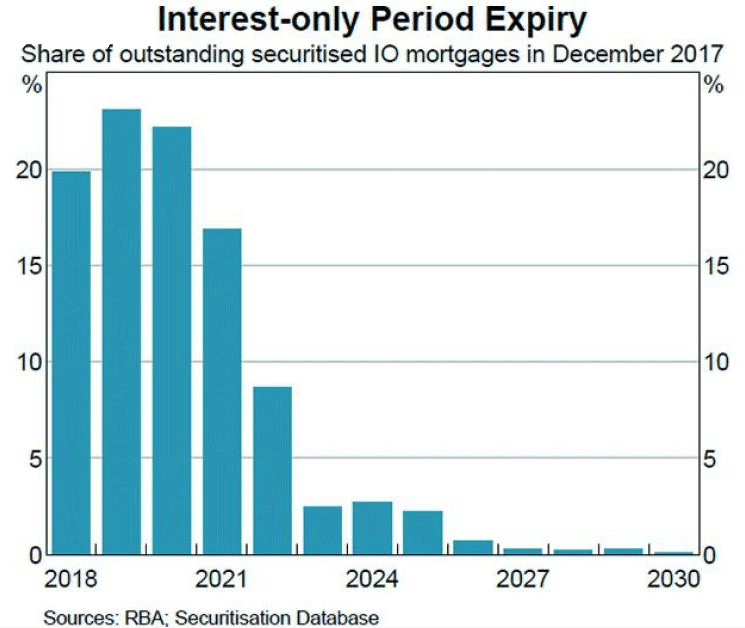

Property markets around the country are doing their thing depending on the stage of their respective cycles, but one thing that is a certainty is that there is a wave of interest-only loans due to expire in the years ahead.

In fact, according to the RBA, about 80 per cent are scheduled to flip over into principal and interest repayments by 2020 and, unfortunately, many people will find themselves up the proverbial creek without a money paddle – mostly because they probably borrowed too much to start off with.

With lending still constrained, and interest-only loans remaining hard to secure, many borrowers will have no choice but to accept principal and interest repayments and to somehow find the funds to finance them.

But fear not because there is help at hand!

Understand your loans

There was a story recently about Westpac calling in loans that the lender reportedly should never have approved in the first place.

The bank has sent a single-page letter to investors warning that it can “no longer support our commercial relationship with you”, adding it will work with the borrower to help them find a new lender with 30 days.

While there is some conjecture about the legitimacy of the letters, what it does show is that lenders can, and will, move the goalposts if they have any regulatory concerns, especially under the new tighter lending regime.

While these borrowers were likely risky to start off with, it does highlight the need to be ready for the terms of your mortgage to change, such as switching from interest-only to principal and interest repayments.

And a good place to start is to consider the following five points:

1. Can you afford to pay principal and interest?

This one is a bit of a no-brainer because every borrower hypothetically should be able to do this.

However, in the days of easy credit that some people have become naively accustomed to, many borrowers will struggle to afford principal and interest repayments because they borrowed too much at the outset.

Also, many have not considered that once their interest-only term expires, repayments are calculated on the reduced loan period.

That is, if you had interest-only for five years, your new repayments will be calculated on a 25-year timeframe, and not on a 30-year one, which naturally will be higher.

2. If not, what’s your plan?

If you’re one of the majority of people whose interest-only loans will expire by 2020, what is your plan?

It’s ridiculous to wait until “closer to the time” to consider your options, because time will not be your friend.

It’s ridiculous to wait until “closer to the time” to consider your options, because time will not be your friend.

You should be proactive and develop a plan now to save yourself from ugly financial headaches later.

That plan could include creating a financial buffer to enable you to meet the increased payments, refinancing early to secure reduced interest rates, or considering selling (only as a last resort, mind you) at a time that is the most beneficial to you.

The last thing you want is to have to sell out of desperation because you have run out of funds for the higher mortgage repayments, because you will very likely lose money on the transaction.

3. Sometimes “no” is the right answer!

Here’s the thing: sometimes the best thing to do is nothing.

Sure, market conditions are becoming more favourable to buyers, but if your finances are already maxed out, taking on more debt is just stupid.

Don’t become what I like to call a “debt pig”!

The lending environment remains tricky for even the top tier of borrowers, which means that some people are opting to wheel and deal to secure loans that they really can’t afford.

Plus, they seem to have forgotten that loans will eventually need to be repaid, and there are only two ways to do that – through sale of assets or from personal assertion income.

We are in a “no” lending cycle, but that can be a good thing because it prevents risky behaviour from borrowers who are seduced by the concept of becoming rich on someone else’s money.

Cycles and behaviour tends to repeat itself – remember the GFC anyone? That came around on the premise that “she’ll be right, property always goes up” misnomer and people got caught.

Well this cycle is being driven by regulatory controls and to try and stop people from getting in over their head and potentially suffering from financial disaster.

4. Seek advice

As I’ve been saying, now is the time to get ready.

You should seek advice from qualified professionals who are also experts in property investment sooner rather than later.

We can give you honest feedback on your current situation as well as any financial headwinds you are likely to encounter later.

Then we can help guide you to make the best decisions to protect your portfolio from any potential fallout when 2020 rolls around.

5. No one is too big to fail

Anything is possible in the world of finance.

It’s been a decade since the start of the GFC, which featured the near or actual collapse of companies that were previously deemed too big to fail.

Freddie Mac and Fanny Mae were two of the biggest mortgage providers in the US with $5 trillion in mortgage-backed securities on their loan books, but they had to resort to government bailouts to stay afloat.

Likewise, investment bank Lehman Brothers, whose downfall was the largest in US history and is considered to have triggered the start of the GFC.

And, if we go back in history a little more, we shouldn’t forget the Pyramid Building Society, which collapsed in 1990 owing some $2 billion, now, nearly 30 years on from that, $2bn at the time was a huge amount and sent many Victorian households into financial ruin.

The financial sector can implode very quickly, which can infect the entire globe almost overnight.

Now, I’m not trying to scare you.

Rather, I’m just highlighting that we seem to be at an unusual financial moment in time – both locally and internationally.

It’s not the worst credit crunch I’ve experienced in my career, but it does have the potential to trip up borrowers who would rather stick their heads in the sand.

The market is soft in most capital cities, plus there are increasing numbers of development sites being put up for sale because land-banking isn’t as sexy as it was a few short years ago.

Consumer sentiment has taken a turn for the worse – not helped by alarmist stories like the one I mentioned on 60 Minutes.

The key is not to be lethargic about your finances.

Get a grip now on what the ramifications of the impending debt bomb could be for you – or literally pay the consequences later.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.

- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026