What’s changed in our lending markets?

New research has claimed looser bank lending is the key driver of the house price rebound in Melbourne and Sydney – not the Coalition’s surprise election win.

In an article published on its blog, non-partisan think tank the Grattan Institute has used CoreLogic data to contest suggestions Scott Morrison’s election triumph led to significant house price rebounds in Australia’s two largest cities.

The research analysed daily changes in property prices – instead of monthly – and tracked them against recent political and economic events.

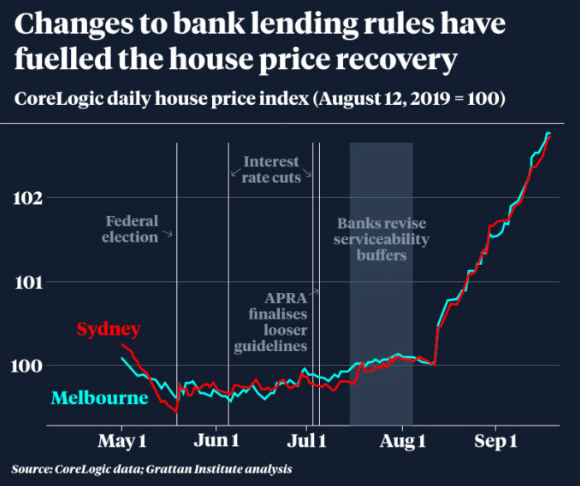

It showed house prices across the country lifted 0.14 per cent immediately after the Coalition’s election victory, before stagnating for the next three months.

House prices remained subdued even after the Reserve Bank cut interest rates in June and July.

But Grattan’s analysis shows they took off on August 12, once banks had stopped using a hypothetical interest rate of 7 per cent to assess a borrower’s ability to repay their loans, and moved instead towards a buffer of 2.5 per cent above the interest rate on the loan.

We wrote about this back in May with our article “Is APRA finally listening“

when it started to become apparent that changes were afoot.

I’ve been rather vocal on my criticism of our regulators in APRA and ASIC as they were way too late to the party in taking the heat out of the property and have now again been too slow to react before the markets grind to a halt.

We also wrote in May that an interest rate cut would do little to help.

And in my opinion, 4 key things were needed:-

- Government Stimulus

- Lending Standards Eased

- Open the purse strings

- Employers need incentives to employ and pay well

Now the Morrison government tends to have its head in the sand with this and are hell-bent on delivering the budget back to surplus instead of investing now for the benefit of our country and all its working citizens.

But at least we have had 1 of these things happen with the lending standards and changes to serviceability rates and the change has been the moist significant we’ve seen this year.

The Australian Prudential Regulation Authority (APRA) finalised the changes to mortgage serviceability rules in July and “banks began applying the new rules to loan applications over late July and early August, which means the first buyers would have received pre-approval and found a property to purchase by mid-August”, the Grattan Institute’s Brendan Coates and Matt Cowgill wrote in their blog post.

“And house prices have since rocketed in Sydney and Melbourne.”

According to CoreLogic data, house prices are now 2 per cent higher than they were at the start of August.

In Sydney and Melbourne, they are on course to increase more than 10 per cent over the next 12 months.

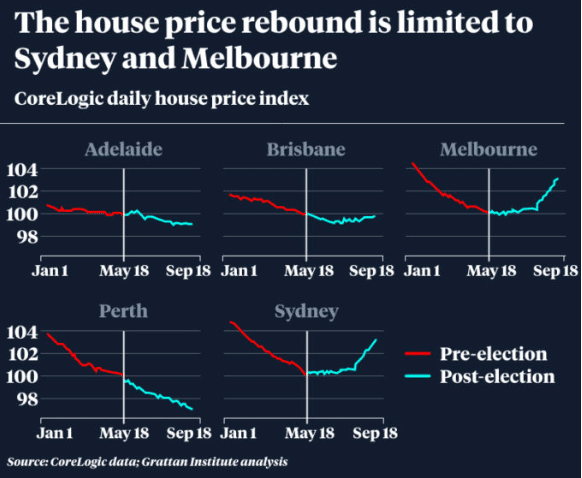

“Past tightening in borrowing capacity had the biggest impact on prices in Sydney and Melbourne, where price-to-income ratios are highest and mortgages are typically larger,” Mr Coates and Mr Cowgill added.

“So it’s no surprise that it’s in those markets that house prices are accelerating again.”

The market turnaround also coincided with Westpac’s responsible lending victory over the Australian Securities and Investments Commission (ASIC) on August 13.

The regulator argued that Westpac’s reliance on a controversial expenditure measure was irresponsible, but the Federal Court disagreed. And I agree with the Federal court as we’ve written about as ASIC has not been able to prove otherwise.

Angie Zigomanis, associate director of residential property at BIS Oxford Economics, said the Grattan Institute was right to suggest looser lending restrictions had turbocharged the house price rebound in Sydney and Melbourne.

BIS modelling estimated owner-occupiers would be able to borrow 11 per cent more money after the removal of APRA’s 7 per cent serviceability buffer, enabling them to bid up prices.

However, Mr Zigomanis argued the Coalition’s surprise election victory would have also played a big part in reversing 18 months of house price declines, by encouraging investors back into the market.

“One of the things about the election is that there were investors who might have otherwise been in the market that sat out, waiting to see who won, and what it would mean for policy on investors and negative gearing,” he said.

“So the Coalition’s election win brought them back in. But they’re not going to jump back into the market the day after the election, so you’re not necessarily going to see an instant response.”

That’s just illogical as it takes time to get a loan in the 1st place and Grattan’s analysis had underestimated the time taken for the post-election confidence boost to translate into improved sales figures and higher property prices.

It can take up to six weeks to get pre-approval, by the time you turnaround people’s sentimentality, obtain the required information to analyse and assess and then seek the loan approval.

And here we are today with more people seeking loans for properties again with a 3-6 month lag that is very normal in the housing markets.

What’s striking is that, all of a sudden, when APRA relaxes the serviceability buffer, we see an almost-immediate impact on prices, and now prices have been growing for a good six weeks.

To me, that looks like the election itself did not have that big an impact on prices but instead policy change has.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026