Happy New Year! What to expect in 2016

Our outlook for 2016 – and if your New Year’s resolution is to buy property, you MUST speak to us!

As 2015 fades into the distance (I can’t quite believe it’s already February) I just wanted to take a quick look at what might transpire over the next 11 months! The Economic outlook section of the recent RBA statement on monetary policy for February highlighted some interesting issues…

The basics for 2016

GDP

In macro terms we can expect some growth in GDP towards the end of the year:

“GDP growth is now expected to remain below trend over the course of this year and then to pick up to an above-trend pace in the latter part of the forecast period, in response to rapid growth in LNG exports and the lower exchange rate and interest rates.”

Consumer – domestic activity

At the consumer level, low interest rates, strong population growth and low fuel prices will be offset by a lower than expected income growth – the net effect however still suggests that consumption is expected to pick up over the year.

Clearly, consumer confidence is a crucial element to the overall successful growth of the domestic economy in 2016

Inflation

The RBA has reduced its headline inflation forecast.

“…spare capacity in the labour market is expected to contain labour costs, spare capacity in product markets is likely to constrain firms’ ability to expand margins….inflation expectations remain anchored.”

Assumptions

Like any crystal ball gazers however, we need to recognize some of the key factors that could impact on the year. The RBA has listed a rate of uncertainty around the following measures that could have significant impacts on the economy through the year:

- weakness in Chinese property markets (lower than expected commodity demand will have a negative impact on our GDP);

- the outlook for commodity prices and their effects on global and domestic growth (for instance, the drop in oil prices and their subsequent impact on LNG prices which could have a positive impact on GDP)

- the general assumption of no change in the exchange rate (note that movements either way will impact on exports (GDP reduction) or inflation (higher costs of imported goods));

- the extent to which households are likely to save or consume any increases in their real disposable income or wealth (the consumer confidence I spoke of earlier);

- the timing and speed of the recovery in non-mining investment domestically

What does 2016 hold for Property Investors?

So, what does an outlook of a generally sluggish 2016 mean for property investors?

I think that the general consensus was that 2015 was a fantastic year for property in Australia. The major property markets saw some significant capital gains and many property sellers made a good profit. There were also record numbers of auctions around the country – but competition was fierce and if you were looking to buy, securing the property you wanted wasn’t always easy.

The catch-cry for 2016 seems to be positive but modest growth (the RBA states that “The Bank’s forecast is for dwelling investment growth to ease gradually from the end of 2015.”) As usual, there will be significant variations across the regions and I expect that house prices in the 2 major capitals, Sydney and Melbourne will perform more strongly than the other capital cities and major rural cities/towns.

Our thoughts regarding Sydney are that we expect the market there to track back towards 2013 levels, which has been quite evident in the last quarter of 2015. Softer growth but growth nonetheless and some very interesting opportunities for investors willing to search them out.

Melbourne will continue to be strong however, as per Sydney, we expect the growth rate of returns will soften. As for the other markets, Perth and Darwin recorded negative gains for 2015 and I epxect that these markets will continue to record little or no growth through 2016.

Brisbane has long been forecast as the next big improver however this didn’t eventuate in 2015. I think this will change in 2016 as there are significant developments happening around the various “hubs” surrounding the city – the key strategy will be selecting the right areas and the right properties.

As for the style of property, we have always been a little reticent to recommend off the plan purchases and nothing in the data suggests this position should change! In fact, we believe that investors who purchased such properties may suffer short term losses with the recent APRA changes affecting some people’s ability to settle on purchases. This in turn affects everyone’s values as often forced re-sales at levels lower than the purchase price can eventuate in order to clear the liability. In turn, these reduced prices achieved are then used as the basis for ongoing valuations. People hoping for high LVR’s on these developments may well be in for a surprise.

Housing construction activity

According to the ABS, in 2015 the total value of owner occupied housing commitments excluding alterations and additions rose 1.7% in trend terms, and the seasonally adjusted series rose 2.4%.

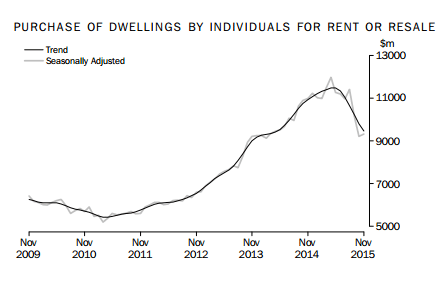

With regards to investment in property (i.e. not owner occupiers) the value of commitments for the purchase of dwellings by individuals for rent or resale fell 3.5% in November 2015 and the seasonally adjusted series rose 1.2% – clearly the APRA strategy of reducing the activity in this sector via limits on bank lending has had an impact. Having said that, we do know that a number of investors transferred their loan status to owner occupier over the last quarter of 2015.

The APRA enforced bank lending restrictions have seen investor lending in the second half of 2015 drop by 34.9%, which is significant.

Now more than ever, you need investor savvy people working on your team to assist you.

A B S • L E N D I N G FI N A N C E • 5 6 7 1. 0 • N O V 2 0 1 5

Interest Rates

With regards to interest rates, we believe the RBA will hold interest rates at 2.0% for all of 2016 with any interest rate adjustments to be on the downside. I don’t believe that there is any likelihood of an interest rate increase in 2016.

As Goldman Sachs recently reported:-

“We expect that the RBA will leave interest rates on hold in 2016 and 2017 before commencing a modest interest rate hiking cycle in early 2018. The risk to the view is that anemic domestic demand growth is sufficient to see inflation undershoot expectations and the unemployment rate to reverse recent gains. Under that scenario the RBA would likely ease interest rates further in 1H16 and interest rate rises would likely occur at an even later date. The path of the A$ will prove influential in shaping expectations for interest rates.”

Bank activity

The first month of 2016 has seen some significant maneuvering amongst the banks. Now that their investment loans are back under APRA thresholds I’d describe their appetite for lending to be “robust” with some very attractive rates on offer for borrowers with solid financial structures in place.

That means that are already seeing some significant discounting off headline rates -as we say, it always pays to use your mortgage broker to search out the best deals available!

Whilst the APRA restrictions have been quite dramatic to limit people’s ability to borrow for investments, with many (but not all) of the measures supported by us, we also believe that the banks will have some flexibility to manouvre their servicing calculators over 2016.

New Year’s Resolutions

Given the outlook for the year, we definitely see property investment as a solid segment of your portfolio. If your New Year resolution was indeed to buy a property, then here are some things you could do to help you succeed.

1. Identify a goal

It’s very easy to make a New Year resolution, but most of us do this every year and very seldom stick to it. That’s because a New Year resolution needs to be very specific if you want to achieve anything.

Having a vague resolution such as “Buy a property” isn’t going to get you over the line. You need a more specific goal like “Buy a 3 bedroom house near X before June 30″ or “secure an investment apartment in X before Y”. Adding a sense of urgency to your goal will motivate you to keep on top of what you need to do to make a successful purchase. Below we talk about some of the steps you will need to undertake to reach your goal – you may find that it will help to schedule these activities in your diary so that you don’t put them off.

2. Be ready to act

Procrastination is the enemy of success. There are often thousands of properties on the market and if you don’t know where you want to buy or what type of property you’re searching for, you’ll find yourself procrastinating about which properties to view.

The answer is to sit down, make some decisions and then do your research. If you are buying a property as your own home, you can consider which suburbs will be convenient for you in terms of work, whether you need to be near public transport, whether you need an apartment or a house. If you are looking for a property investment, you’ll need to consider properties that meet your investment strategy, have good capital growth potential and are easy to tenant.

3. Set a realistic savings budget

Good money habits are very important if you’re planning to get a home loan this year. Lenders don’t just look at how much of a deposit you have, they assess your ability to save and make repayments.

Taking on a home loan is a big financial commitment and you will also have the added expense of maintaining your property, paying rates, insurance and other expenses on top of your mortgage so you will need to demonstrate that you have your budget under control and are a good saver.

To set a monthly savings target, you could start by making a list of your expenses. It’s important that you are realistic and make a comprehensive list, so that you understand where your money is going and where you can cut back if necessary when you get a home loan.

4. Get your financing in place

We suggest you talk with us about getting pre-approval on your home loan before you start looking at properties you might like to buy. Establishing a price limit for your purchase is key.

We will help you to fully understand your financial position and help you to determine how much you can borrow and as a result, what kind of property you can afford to buy. Setting a realistic savings budget first (as mentioned in point 2 above) is an important part of this process.

It’s a good idea to make talking to us a priority, as it could make all the difference to your success. If you know exactly what you can afford, you will save yourself hours of time looking at property listings and save days making inspections on homes.

5. Get a professional team on your side

Let’s face it, buying a property isn’t easy. Having a professional team on your side could make all the difference to your success. You’ve started out by getting a professional mortgage broker (well done), but you may also need help from other professionals as well (and in many cases, we can help you by providing a referral).

Buyer’s Agent: If you are short of time, you may want to consider engaging a reputable Buyer’s Agent. They can do a lot of the leg work in locating you suitable properties to view and make a big difference when it comes time to buy.

Real Estate Agents: If you don’t want to go with a Buyer’s Agent, you may like to get in touch with reputable real estate agents in the areas you want to buy.

Solicitor or Conveyancer: When you locate the property you want to buy, it will pay to have a Conveyancer or Property Solicitor lined up so that you can move quickly.

Inspectors: When you locate a property you want to purchase, you’ll need to get building and pest inspections done before the auction date. Line up your inspectors beforehand and you’ll save yourself a lot of time and hassle in locating them when you need them. Post purchase, for investors, you also need to arrange a quantity survey so you accurately cost your depreciation on your property and its contents.

Remember, we’re here to help you keep your New Year resolution to buy a property in 2016! It won’t be easy, but we’re sure you’ll find it’s worth the effort. We’re ready to help you assess your financial position, and help you get pre-approval on your home loan so that you can start the process of locating an opportunity and making a purchase.

Give us a call today and let us help you get started.

- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026