What’s next for interest rates and our property market as we move through 2021?

Interest rates are at historic lows – the RBA cash rate remains unchanged at 0.1 per cent following its March 2021 meeting – but the hot topic that has the nation breathlessly watching every meeting is, ‘Will they go lower, or will we see a rise in the near future?’.

Just eight months ago an interest rate rise seemed unthinkable. The June quarter accounts revealed a shock seven per cent decline in the national economy (ABS data) and it seemed that a lengthy, COVID-induced recession was unavoidable. And by November 2020 the cash rate had been lowered to 0.1 per cent, the lowest in Australia’s history, in an attempt to get some money sloshing through the economy. By year’s end RBA Governor Philip Lowe was signalling that rates were not going to rise ‘anytime soon’ with key indicators suggesting 2024 might be the earliest we see a lift.

However, since then, Australia’s handling of the COVID crisis has gone from strength to strength, restoring investor confidence and consumer spending to something that resembled more normal (and that means pre-COVID) levels. The vaccine roll out has been a further shot in the arm (pun intended) to the national economy and we’re seeing some sectors roar back.

Economic recovery

Housing: The housing market is one of the most visible signs of strength, with demand sky high at the moment as buyers access cheap credit and do exactly what the RBA Board hoped – spend it.

In fact, the housing boom has been so strong and so visible, it has pundits worried. Nobody wants to say it, but the word ‘bubble’ may be an apt descriptor when assessing current market conditions. You can almost see the journos queued up and waiting, so who will be the 1st to say it?

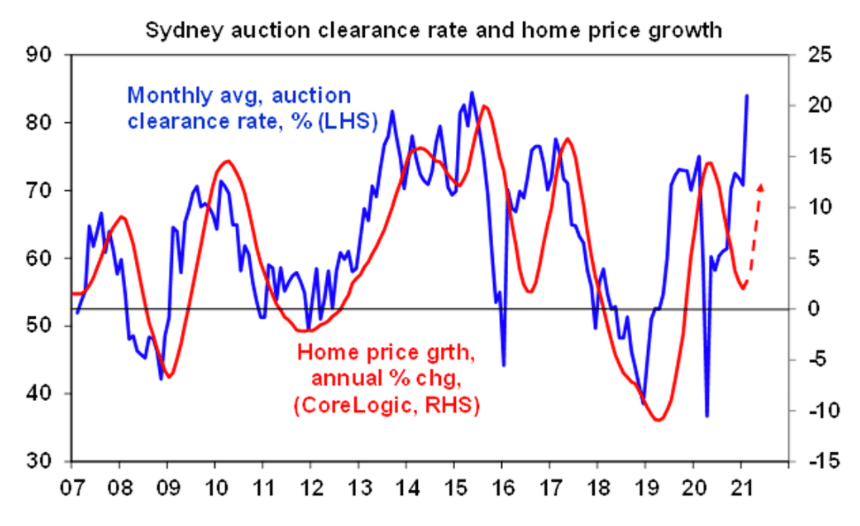

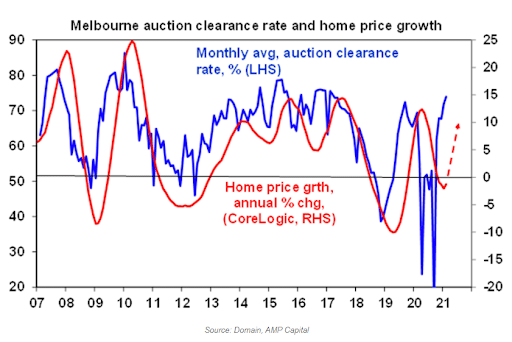

Significant demand is outstripping supply, particularly in Sydney, which experienced price growth of 2.5% in the month of February, and Melbourne, which rose 2.1% in February.

And areas such as the southeast corner of Queensland, where southerners are flocking to live with the advent of remote working.

This is pushing up prices and agents are scrambling to fill supply lines.

February 2021 resulted in the biggest increase in national house prices in 17 years, according to CoreLogic.

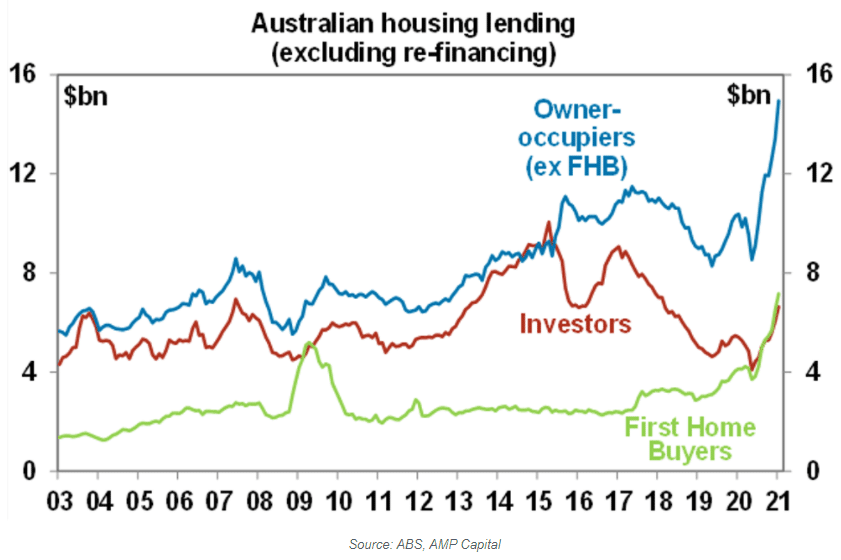

And based on lending data statistics, this is unlikely to change anytime soon with 1st home buyers, owner occupiers and even our investors rushing back to market with record numbers of applications for finance being made.

What’s driving the surge in home prices?

The combination of reopening unleashing pent up demand, government incentives, the removal of responsible lending obligations, record low mortgage rates, the desire to “escape from the city” and relatively low property listings are all helping to push prices higher with an element of FOMO (or the “fear of missing out” creeping in too. This is after bank payment holidays and Government income support measures averted a sharp fall in prices that would otherwise have followed from the pandemic recession. The combination has more than offset the impact of weak inner city rental markets and the hit to immigration and has brought forward demand from first home buyers and owner occupiers, with investors now starting to jump in too.

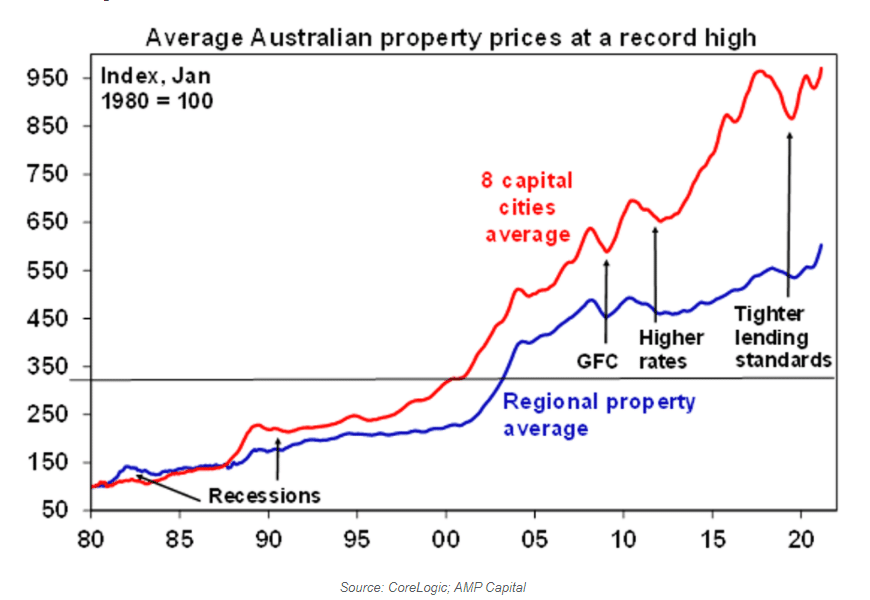

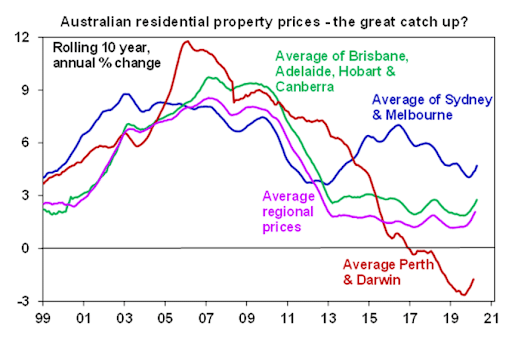

Average capital city dwelling prices have now surpassed their September 2017 high, although this masks a wide divergence with: clear record highs in Brisbane, Adelaide, Hobart and Canberra and in average regional home prices; Sydney and Melbourne still down just over 1% from their 2017 highs; and Perth and Darwin remaining well down on their 2014 highs.

Melbourne and Sydney leading the charge but all capitals are enjoying their time in the sun!

Australian capital city average dwelling prices rose 2% in February according to CoreLogic and are up 2.6% on a year ago. This is their fastest monthly gain since 2003 and they have now surpassed their September 2017 record high by 0.7%.

Sydney dwelling prices rose a very strong 2.5%, resulting in five months of gains, and are up 2.8% on a year ago.

Melbourne prices also rose 2.1%, resulting in four months of gains, but are down -1.3% on a year ago reflecting a -5.6% fall around mid-2020 through the various lockdowns.

Prices in other cities were all up strongly led by Hobart with prices up 2.5% in February and 8.7% through the year, followed by Canberra up 1.9%, Brisbane and Perth both up 1.5%, Adelaide up 0.8% and Darwin up 0.7%. Prices in Hobart, Canberra, Brisbane and Adelaide are all at record highs.

Regional dwelling prices rose 2.1% in February and 9.4% on a year ago with their relative strength reflecting lower levels of indebtedness and hence less vulnerability to the financial stresses caused by the pandemic driven economic downturn, less exposure to the slump in immigration and increased buyer interest as people seek to relocate from cities as part of a secular trend towards working from home and a greater focus on lifestyle.

Capital city house prices rose 2.3% in February and 3.6% over the last 12 months whereas unit prices lagged with a 1.1% gain in the month and a -0.1% fall on a year ago, with the relative underperformance likely reflecting an ongoing shift in lifestyle preferences towards houses as a result of more working from home and a lifestyle choice and as weak rental conditions made worse by the slump in immigration constrain the inner city unit markets in Sydney and Melbourne. Over the last 12 months unit rents fell -8.0% in Melbourne and -5.3% in Sydney, although there were further signs of stabilisation in February.

Exports: Other areas of strength include exports, driven largely by iron ore as China ramps up its steel production, sending the price above $US170 per tonne, almost double its price this time last year ($US90 per tonne). The growth has been so strong, Rio Tinto has paid out the biggest dividend – $9bn to investors – in its 148-year history, and BHP has paid out around $5.1bn to its investors.

This has resulted in the Aussie dollar pushing higher, briefly achieving US80c on February 24 before subsiding to US78c, making a gain of about five cents in the month of February – a remarkable achievement.

Unemployment: Labour force data from the ABS indicates unemployment is falling, with January’s figures down to 6.4 per cent from 6.6 per cent in December and the underemployment rate down to 8.1 per cent from 8.5 per cent in December. Current unemployment levels are still higher than a year ago, where unemployment was 5.2 per cent, however, trends are heading in the right direction.

39% of recruiting businesses are struggling to hire employees

Data from the National Skills Commission covering the four weeks to February 19 has shown that 39% of recruiting employers are having difficulties hiring employees, The Australian reported recently. 21% of businesses said they plan to increase staffing levels compared to 3% who plan to reduce them.

Rates forecast

So, what does this all mean for the RBA’s cash rate?

Late last year Governor Lowe gave strong hints that the RBA would need to see certain indicators before the Board would consider lifting rates and he expected no upward movement before 2024. Unemployment and underemployment improvements were key, but business credit and consumer spending were other indicators the Board was keeping a close eye on before they would consider pushing the rate up.

There was some recent upbeat news too. December economic growth came in at around 3.1 per cent, so it’s clear that the economy has firmly rallied. Treasurer Josh Frydenberg announced on March 3 that the national economy had recovered 85 per cent of its COVID fall, although some regions were still struggling.

With the stronger-than-expected recovery unfolding, many financial experts are saying we’ll see movement before 2024. Inflation will soon become an issue if the economy continues on its current trajectory.

In addition, the RBA has a long history of controlling the housing market with cash rate changes and with the current runaway freight train in effect, they might be prompted to move.

Things to think about

If you’re currently a renter and thinking about becoming a first-home buyer, you will need expert guidance when assessing current loan products. With a potential rate rise coming sooner than many might expect, the banks will be adjusting their products and tweaking conditions, so it pays to shop around and get help understanding the fine print.

If you’re a current homeowner looking to refinance, a mortgage broker will help you assess myriad mortgage products against your current loan and also understand what the comparison rate is, rather than the advertised rate. It may not make sense to change products, depending on the exit fees and other clauses that are written into your current home loan. And it may be wise to look at locking in part of your mortgage now before a rate rise materialises.

If you’re an investor, or thinking about becoming one, then now could be your time. The market is desperate for new rental properties, especially in areas such as southeast Queensland where vacancy rates are almost at zero in some suburbs. But getting professional advice about how to structure your loan is always wise.

Basically, whatever stage you’re at, advice from an expert is essential.

Sources:

https://www.abs.gov.au/media-centre/media-releases/economic-activity-increased-33-september-quarter

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.

- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026