COVID-19 & Your Finances

Currently we are all facing a time of uncertainty which seems to be changing daily.

Please, as a first priority, do what the government(s) are asking and either stay home or maintain your social distancing – this is a health crisis first and foremost that is creating the economic crisis.

There are, however a few up front things you can do which may prepare you for any future financial hardship:

- Contact your bank and request they reduce your repayments to the minimum amount

- Adjust your repayment dates so that they are in sync with your pay dates

- Contact us or your bank directly to request an interest rate review

- If needed, access your redraw to assist in meeting your loan repayments

- If you meet the financial hardship criteria, you may be eligible to request a payment pause

Frequently Asked Question’s

I’ve lost my job, can’t meet my loan repayments but I do have a buffer and/or savings.

Access your buffer to meet your loan repayments – that is what it is there for. The Banks are offering payment pauses, but only to those who do not currently have a buffer.

I’ve lost my job, can’t meet my loan repayments and do not have a buffer, or any savings.

If you fit the financial hardship criteria, contact us or your bank to request a payment pause. Please keep in mind that the repayments will not be waived, but merely deferred – refer below.

We can assist you to contact your respective lender or give you those details if anyone needs.

What exactly does a payment pause entail?

As mentioned above a payment pause is merely a deferral of your loan repayments for a period of time agreed upon between your bank and yourself. Your interest will continue to accrue during this period and is still expected to be repaid. At the end of your payment pause you may increase your repayments to “catch up” or extend the term of your loan.

If I take a payment pause do I keep my redraw?

No. As you will be deferring your repayments you will then lose your redraw. If you have any redraw, then take it out before applying for the payment pause.

Once I am able to resume payments will I have to catch up on the paused payments?

Yes – as stated above, the Bank will only defer payments, not waive payments completely. Your payments and the interest payable will accrue and you will be required to catch up on those payments that were paused. Some lenders will extend your term on your loan and some lenders will expect the payments to be caught up over the life of the remaining loan term.

Will taking a repayment holiday affect my credit rating?

No, these are extraordinary times and the banks and all lenders have committed to accepting this as a special exemption. So your rating will not be affected.

I was considering refinancing my loan to obtain a better interest rate, but due to COVID-19 I’m not so sure now is the right time.

Now is probably the most ideal time to consider refinancing due to the low interest rates being offered by all lenders. We recently saved a client over $8,000 per annum on his loan repayments with a simple refinance. Please call us and we would be happy to assist you.

I have a loan application in progress. Will my loan application be delayed or declined due to COVID-19?

Provided your industry is not deemed to be impacted by COVID-19, you should be ok, however the banks have begun making enquiries into clients’ areas of employment. If you believe your employment may be impacted in the near future, please get in touch with us to discuss further.

If I work in an affected industry, will my loan application be viewed differently?

Yes, you will or maybe asked more questions than normal. All lenders are going to continue to enquire into your creditworthiness and ability to repay them. Lenders would be negligent to lend people money who could not repay them.

I have signed a contract to purchase a property, will I have any issues?

As above – provided your industry is not deemed to be impacted by COVID-19, you should be ok, however the banks have begun making enquiries into clients’ areas of employment. If you believe your employment may be impacted in the near future, please get in touch with us to discuss further.

Is now a good time to purchase property?

We believe property investing is a long-term prospect, so if you are currently in stable employment with sufficient means to meet your repayments, then yes we believe now is a good time to purchase, especially considering the low rates and slight drop in the property market.

I run a small business or am self-employed, how does this affect me?

There have been many measures introduced for all small business owners and self-employed clients in terms of tax relief etc.

The ATO website https://www.ato.gov.au/ is the best resource for this or refer to your individual Accountants for more details or information on these measures.

The tenant in my residential investment property has lost their job and is unable to make the rental payments.

Work with your property agent to ensure your tenants have accessed all relevant programs in their state.

The Federal Government is yet to announce what assistance will be available to landlords and tenants, but unfortunately, we do not yet have all the answers and information is being updated daily.

There may be an option to claim on your landlord cover insurance if you have a policy in place. We would recommend contacting your insurer or insurance broker to discuss further.

Residential tenancies are managed by individual states and announcements are now being made about rent relief for both tenants and landlords.

For all State based announcements for rental as well as stay at home restrictions etc. please refer to the relevant website for your state as follows:-

ACT – https://www.act.gov.au/

NSW – https://www.nsw.gov.au/covid-19

VIC – https://www.vic.gov.au/

QLD – https://www.covid19.qld.gov.au/

WA – https://www.wa.gov.au/government/covid-19-coronavirus

TAS – https://www.coronavirus.tas.gov.au/

NT – https://coronavirus.nt.gov.au/

How are Commercial investment properties impacted by COVID-19?

Proposed tenancy code of conduct

The press release from last Friday’s announcements on the proposed response to the Covid-19 is available.

It appears that the code will prevent landlords from calling on bank guarantees and security deposits for non-payment of rent.

The text from the press release that relates to commercial landlords and tenants is below:

National Cabinet made further progress on the issue of commercial tenancies. They have agreed that a mandatory code of conduct guided by certain principles will be developed and subsequently legislated by State and Territory Governments to apply for tenancies where the tenant is eligible for the Commonwealth Government’s Job Keeper assistance and is a small- or medium-sized enterprise (less than $50 million turnover).

The principles that guide the code will be:

Where it can, rent should continue to be paid, and where there is financial distress as a result of COVID-19 (for example, the tenant is eligible for assistance through the JobKeeper program), tenants and landlords should negotiate a mutually agreed outcome

There will be a proportionality to rent reductions based on the decline in turnover to ensure that the burden is shared between landlords and tenants

There will be a prohibition on termination of leases for non-payment of rent (lockouts and eviction)

- There will be a freeze on rent increases (except for turnover leases)

- There will be a prohibition on penalties for tenants who stop trading or reduce opening hours

- There will be a prohibition on landlords passing land tax to tenants (if not already legislated)

- There will be a prohibition on landlords charging interest on unpaid rent

- There will be a prohibition on landlords from making a claim to a bank guarantee or security deposit for non-payment of rent

- Ensure that any legislative barriers or administrative hurdles to lease extensions are removed (so that a tenant and landlord could agree a rent waiver in return for a lease extension)

I’m running a small to medium business, what loan support is available to me due to the impacts on my business from COVID-19?

All the major banks have announced support for new and existing business clients with a snapshot of these being:-

COVID-19 support for SME customers – new low-rate loan up to $250,000

To support businesses in need of a quick cash flow injection to stay open and keep people in jobs, major banks have announced a new Business Support Loan.

The Business Support Loan will enable eligible businesses to apply for a loan of up to $250,000 at 4.5% p.a. from your chosen lender with no repayments required in the first six months. To be eligible, businesses must have an annual turnover of less than $50 million.

Important information

- Open to new and existing Business customers – new applications only

- Loans must be for business purposes

- Loan term up to three years

- Principal and interest repayments will apply only after an initial six-month repayment holiday

- No application or loan services fees will apply

- Loans will be available up until 30 September 2020

For more information on each of these, we suggest you go to the relative lender website as follows:-

https://www.anz.com.au/support/covid-19/

https://www.commbank.com.au/latest/coronavirus.html?ei=hp-ban-cvp-default-coronavirus

https://www.nab.com.au/personal/customer-support/covid19-help/business-support-loans

https://www.westpac.com.au/business-banking/small-business-relief/

Where we can for clients we can give some guidance but these are all being run individually by these lenders and applications are all to be lodged with them online at the above respective sites.

I received an email from my bank

Be careful, SPAM and scammers are using this pandemic to try and get to your personal information. Banks won’t email you with information unless you’ve contacted them so please don’t click on any emails or links that you aren’t sure of.

I’ve heard that I can change my loan to interest only instead of deferring repayments, is this right?

The banking regulators – APRA & ASIC – have allowed banks to convert loans to 1 year interest only instead of deferring and capitalizing your repayments. For many people this arrangement will work or suit them better.

What most banks are still doing is working through what they have to do to fulfil this request.

If this would suit you better than a repayment holiday, contact us and we’ll get details for your bank and what needs to be done.

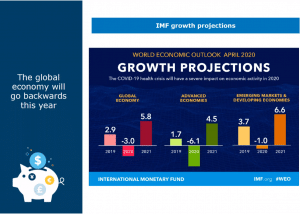

What is the economic impact of this health crisis on the world economy?

The International Monetary Fund has now forecast negative growth for 2020 of -3% for this year, with then a quick bounce back of the world economies to +5.8% growth in 2021.

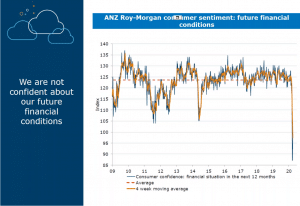

How are consumers feeling about this?

Consumers are less confident right now than the GFC. This appears to be based upon the uncertainty of the health position as well as the uncertainty of time.

I have a Commonwealth bank home loan

IMPORTANT update – if you have a Commonwealth bank home loan, as of Friday the 1st of May your home loan repayment will be adjusted back to the minimum monthly repayment.

ACTIONS:-

- If you are experiencing hardship or believe that minimum repayments will assist your position in the short term, then you don’t need to do anything.

- If you do not want to reduce your home loan repayments and wish to keep the repayments at the same as you have now, then after the 1st, you will need to adjust your repayments back to what they were or whatever figure you wish to pay. You can do this via your internet banking and it is relatively simple to do.

IF YOU HAVE ANY UNCERTAINTY about what to do, please don’t hesitate to contact us to discuss your situation in more detail.

What are lenders doing about verifying people’s identity?

Almost all lenders are trying to maintain their legal obligations to identify people whilst also recognizing the isolation and social distancing requirements. You can be assured that all loan applications are proceeding as normal with varying measurements in place to ensure a quick and smooth process.

What if a valuer can’t get access to a property to value it, what is happening there?

Again, a variety of reasons might stop a valuation from going ahead such as self-isolation, travel, fear of the valuer’s movements, tenants being unwilling to let a valuer in etc. There are now measures in place to allow virtual valuations to take place. So there is no reason that an application can’t proceed just because of a valuation concern

- Don’t buy property in a trust before reading this - February 3, 2026

- When should you refinance? Navigating RBA rate cuts and loyalty rates - January 23, 2026

- What the latest inflation data means for borrowers with the upcoming February RBA decision - January 20, 2026