Australia has experienced strong housing growth in recent years, with the country’s median house price increasing 10.6% and unit price 7.4% in the 12 months to August, according to the latest research.

Put into perspective, at this rate a house worth the current median price of $600,000 will be worth $663,500 in 12 months’ time, and a whopping $1,645,000 in a decade from now. Likewise, units will show impressive growth jumping from $509,900 now to $547,650 in 12 months’ time and more than doubling to $1,041,000 in a decade – that’s an extra $1,045,000 or $531,100 in your pocket simply for owning a house or unit, respectively.

Pretty impressive, right? Whether you’re a property owner or would-be buyer, don’t be fooled. Despite short-term higher growth rates, Australia’s overall long-term property performance is actually far more conservative, with growth rates already starting to abate as spring brings forth greater supply of property.

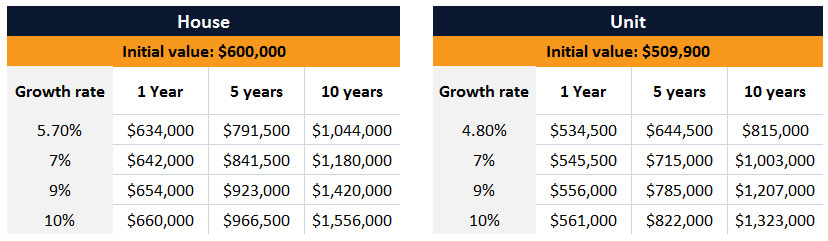

In reality, Australia’s houses have grown at 4.1% p.a. over the last five years, performing slightly better over the last decade at 5.7% p.a. True to form, units trail behind growing at 3.5% p.a. over the last five years and 4.8% p.a. over the decade.

However, that’s overall performance. We all know each city and even suburb performs differently, right? In fact, performance trends are even more specific, narrowing to a measure of an individual property.

This is where things get really interesting. Analysis reveals there are properties that consistently perform at and above Australia’s recent growth performance – at seven, eight, nine and even greater percent compounding capital growth per annum.

But, how important is a percentage or two when it comes to growth? In short, very. While an extra one or two percent compound capital growth per annum may not sound like much, it can amount to hundreds of thousands of dollars difference to the value of your property in just a few years.

The strong property growth of yesteryear underpins the wealth of Australia’s largest most well-to-do social class – baby boomers. Unfortunately, gone are the days when every property makes you wealthier. While the market comprises strong performers, it also hosts those properties that perform below the national average – well below! In fact, not only do some properties perform poorly, they actually experience negative growth costing buyers hundreds of thousands of dollars over a lifetime.

Below we analyse the future growth potential of a house and unit, respectively, each at the current national median price. The figures demonstrate a benefit of up to an estimated $26,000 for both property types after the first year alone, and up to an estimated $510,000 after a decade for well-selected properties, depending of course on their respective growth rate.

Of course, this math doesn’t just apply to investors; it’s particularly important to homebuyers too. It’s no secret a home purchase is the single biggest investment most people make in their lifetime, so why shouldn’t it be treated with the same approach taken by discerning investors?

But, how does the average pundit determine a property’s growth rate to calculate expected future return? It’s not unlike other investment due diligence really. Whether you invest in shares, art, collectables or the like, not all have the same worth and each performs at different rates subject to numerous factors including scarcity, demand, condition, location, market sentiment and more.

When it comes to property, the rules are generally pretty simple. Firstly, there’s location. We’ve all heard the old adage “location, location, location”. It’s repetitive for a reason, referring to the suburb, the street and the position in the street or the block of apartments. Each negative, or compromise, such as noise pollution, traffic congestion, privacy and security issues, not to mention low natural lighting and overshadowing are locational factors that negatively impact property performance – even between almost identical properties in the same apartment block.

Then there’s scarcity. This refers to simple supply / demand economics. The idea is to obtain a property in limited supply, but high in long-term demand. In property this often means avoiding “hot spots” or high-density developments where’s there’s sometimes hundreds of the same product. Instead select period or established property within five to 10km of a major city, particularly areas with well-supported infrastructure such as transportation, retail and lifestyle or recreational amenities.

While the above factors assist in minimising risks, the most certain way to know if you’ve selected an investment-grade asset is to analyse the property’s historical performance. This can be done in two ways – firstly, by comparing current value with previous sales history of the asset or, secondly, by comparing it with the sales of comparable adjoining or neighbouring property. This can prove a suitable measure of potential future performance that minimises your investment risk and assists you to improve your investment outcomes by achieving consistently strong growth akin to that experienced in the current market.